Overshadowed by Greece's debt problems and the euro zone crisis, the debt problems of the United States and its "fiscal cliff" have receded from public attention. Perhaps you recall that the United States had imposed a "debt ceiling", and crossing it would have triggered fiscal illiquidity even though as a nation the United States was not facing fiscal insolvency. Unlike Greece, the US economy is in good health and does not require deep structural reforms. But not all is well with U.S. fiscal policy. The US has been piling on significant amounts of debt over the last few years. How much debt is sustainable, and how much has the US still do to to get its federal budget back in order? The good news is that the US is already making progress reigning in the budget deficit. The bad news is that vested interests block the adoption of two easy fixes that would set the US budget back on track—without adverse impact on economic growth.

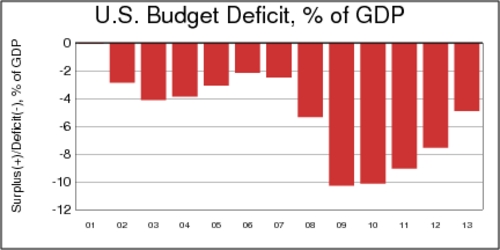

The financial and economic crisis of 2008, tiggered in part by the subprime mortgage fiasco, required the US to resort to unprecedented fiscal and monetary measures to stimulate the economy and get the country out of the recession. As is visible in the chart below, falling revenues combined with the need to increase public spending triggered hefty budget deficits that ballooned to 10% of GDP in 2009 and 2010. Since then, the deficit has been shrinking quickly, aided by a recovering economy and decreased spending.

Data from the World Bank World Development Indicators (WDI) series GC.BAL.CASH.GD.ZS.

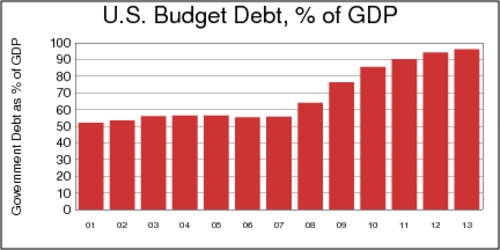

As the next chart shows, the result of the big budget deficits has been a huge increase in public debt, which went from around 50% of GDP in 2001 to nearly 100% of GDP in 2013. Retiring this enormous amount of debt will require trimming the budget deficit further, and stimulating economic growth.

Data from the World Bank World Development Indicators (WDI) series GC.DOD.TOTL.GD.ZS.

Essentially there are only two options to fix a budget deficit. One is to increase revenue, and the other is to reduce expenditures. The latter are often non-discretionary and are therefore difficult to adjust. Many expenditures are entitlements, often with strong redistributive elements that mitigate income or regional disparities. Discretionary items are mostly military spending, infrastructure spending, and subsidies. There is often more flexibility to adjust the revenue side, but that is considered politically toxic. Many senators and representatives rule out anything that might be seen as a tax increase, in an effort to whittle down the size of government, which they believe is too large. Nevertheless, it is the revenue side that provides two big and sensible opportunities for adjustment. One opportunity involves phasing out a tax deduction that amounts to a distortionary subsidy. The other opportunity involves raising a particular tax, but doing so would have many non-fiscal benefits as well.

There are two revenue measures that, in combination, would rapidly fix the US budget deficit: phasing out the $80 billion per year mortgage interest deduction, and increasing gasoline taxes to a level that is closer to what Canadians pay at the pump. That one can live with both, comfortably, is immediately apparent to all Canadians. We may grumble over the prices at the pump (not so much lately due to low crude oil prices), but we have become pretty smart about adjusting to these higher gasoline taxes. And we generally don't have mortgage interest deductions here in Canada either—although exceptions apply to those who use part of their home for business purposes. Becoming a little more Canadian would go a long way to fixing some of what is ailing the United States today on the fiscal side.

‘Mortgage interest deduction mostly benefits the wealthy.’

Mortgage interest deductions have been been a boon to many US homeowners. Most OECD nations don't allow it, so the US is rather generous in its tax code to allow taxpayers to deduct the interest paid on their residential mortgages under s.163(h) of the Internal Revenue Code. You can deduct interest for mortgages up to one million dollars. The average homeowner saves hundreds of dollars in taxes every year. However, mortgage interest deduction mostly benefits the wealthy. In 2014, households earning over $100,000 received more than 80% of the benefits, and those making over $200,000 still get 40% of the benefits and averaged over $5,000 of savings per year. The table below shows the distribution of benefits, as estimated by the US Congress Joint Committee on Taxation (JCX-97-14). Mortgage interest deductions are expensive and arguably do more harm than good. The Congressional Budget Office (CBO) noted in 2011: “Despite the favorable tax treatment that mortgage interest receives in the United States, the rate of homeownership here is similar to that in Australia, Canada, and the United Kingdom, and none of those countries currently offers a tax deduction for mortgage interest.” The deduction also distorts investment towards owner-occupied housing rather than business investments. More grievously, the mortgage interest deduction discourages taxpayers to pay down their mortgages more quickly, which in turn increases the default risk of households with insufficient equity in their homes. Arguably, the mortgage interest deduction also encourages households to take on too much debt. This translate into higher prices for homes, which makes realtors happy. Unsurprisingly, these are the most vocal opponents of reform.

Reform of mortgage interest deductions could be phased in gradually to soften the blow to homeowners. First, the benefits ought to be capped at a maximum level, perhaps first at $2,000, and then lowered successively to $1,000. Eventually, the interest deduction can be phased out completely. Such a measure would naturally be unpopular with certain groups of voters. To soften the blow, converting the mortgage interest deduction into a mortgage interest tax credit (e.g., 15%) might be a reasonable step in the right direction. Thus the benefit would only depend on the amount of the interest, but not the income and tax bracket of the taxpayer. Reducing the elgibility cap from $1 million to $500,000 at the same time would also shift more of the benefits to low-income households, and even increase it for the poorest households.

The US Energy Information Administration reports that excise taxes on retail gasoline and diesel amounted to 43 and 49 US cents per gallon, including both federal and state-level charts. Expressed in Canadian units, these tax rates amount to 14-16 Canadian cents per litre. In Canada, the federal excise tax is 10¢/L, but combined with provincial and local excise taxes and value-added taxes, the total taxes are at least 25¢/L, and in urban jurisdictions such as Vancouver they amount to over 40¢/L—equivalent to over US$1.20/gallon!

| Jurisdiction | Gasoline (US¢/gallon) |

Diesel (US¢/gallon) |

Gasoline (CA¢/L) |

Diesel (CA¢/L) |

|---|---|---|---|---|

| Federal | 18.40 | 24.40 | 6.08 | 8.06 |

| States (Avg.) | 24.12 | 24.90 | 7.96 | 8.22 |

| Total | 42.52 | 49.30 | 14.04 | 16.28 |

An exchange rate of 0.8 US Dollars per 1 Canadian Dollar was used. 1 US gallon equals 3.78541 litres.

One of the first priorities could be eliminating the differential treatment of gasoline and diesel. Curiously, the US penalizes diesel, whereas most European countries have lower taxes on diesel than gasoline. Either way, it is difficult to justify the gap in taxation on economic or environmental grounds. Closing the 6-cent per gallon gap between gasoline and diesel would amount to a sizeable windfall for the US government. In 2013, the US consumed about 135 billion gallons of gasoline, and thus the extra six cents would raise and extra $8 billion in revenue. Setting the excise tax for both types of fuel to 50 cents a gallon would generate sufficient revenue to maintain the country's transportation infrastructure, and help reduce the deficit too. The Congressional Budget Office provided some revenue forecasts for increasing excise taxes by 35 cents per gallon and indexing the tax to inflation. Such a tax increase would raise over $40 billion per year, rising to $50 billion per year by 2022.

‘Compared to other OECD nations, the U.S. hugely undertaxes fuel.’

Raising the fuel excise tax in the US would have other benefits as well. It will encourage fuel conservation, and at the same time lower emissions of local and global pollutants. This process will take time because gasoline demand is relatively price-inelastic in the short run. People will still need to get to work in the car they own today. However, in the long-run, gasoline demand is more price-elastic because consumers start to invest in more fuel-efficient vehicles. A higher price may eventually also relieve traffic congestion in cities as alternative transportation becomes more attractive. While fuel taxes are not the ideal instrument for relieving traffic congestion (road tolling is a superior instrument), it is a relatively simple measure to implement. Making transportation more expensive also reduces urban sprawl. Compared to other OECD nations, the US hugely undertaxes fuel. The chart below shows how the US tax level stacks up against its neighbours and other OECD countries. Mexico subsidizes fuel, while Germany and the United Kingdom are among the most expensive places in the OECD to buy fuel.

Bringing the US closer to the level of other OECD countries will raise significant revenue and have beneficial environmental effects. With crude oil prices low, now is the most opportune moment to raise the fuel excise tax in the United States. Will lawmakers in Washington seize this rare window of opportunity? The signs do not look promising.

Source: OECD/EEA database on instruments for environmental policy. Rates as of January 1, 2010. Taxes on gasoline and diesel for road use only. Data for the United States and Canada include average excise taxes at the state/provincial level. VAT is not included. See also the data available on US DoE Alternative Fuels Data Center. 1 US gallon equals 3.78541 litres.

The two fiscal policies described above would fix the fiscal problems of the US government. The mortgage interest deduction benefits the rich disproportionately and does little to increase home ownership. Bringing the gasoline tax up to Canadian levels, let alone common OECD levels, would have many benefits that would ultimately shift economic growth rather than impede it. The US has the ability to fix its budget problems without much economic pain. But will the US Congress have the will to overcome its partisan inflexibility?

Further readings:

- Dean Stansel and Anthony Randazzo: Unmasking the Mortgage Interest Deduction: Who Benefits and by How Much?, Reason Foundation, July 2011.

- Should Congress Limit the Mortgage-Interest Deduction, The Wall Street Journal, March 16, 2014.

- Eric Toder, Margery Austin Turner, Katherine Lim, and Liza Getsinger: Reforming the Mortgage Interest Deduction, Urban Institute, April 2010.

- James M. Bickley: The Federal Excise Tax on Gasoline and the Highway Trust Fund: A Short History, Congressional Research Service, September 2012.

- NYT Editorial Board: Raise the Gas Tax to Fix America's Roads, The New York Times, January 10, 2015.

- Taxing Energy Use: A Graphical Analysis, OECD Publishing, January 2013.