The province of Alberta prides itself that it has the lowest tax regime in all of Canada—something it likes to refer to as the Alberta Advantage. The sudden drop in the oil price at the end of 2014 has put this Alberta Advantage into question by reducing revenues by about $7 billion in next year's provincial budget. Alberta relies on volatile revenues from the oil and gas industry like no other province. This volatility will force Alberta to make some tough choices in the near future. Making the right choices would set Alberta on a trajectory of long-term fiscal sustainability that also secures the prosperity of future generations of Albertans. As Alberta goes to the polls on May 5, the political parties favour belt-tightening over structural reforms.

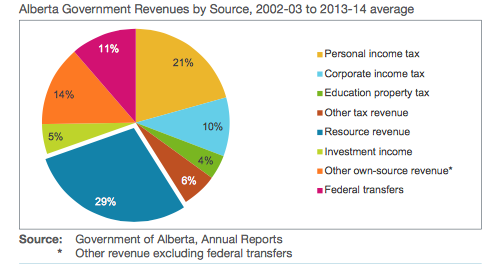

How did Alberta get into this tight spot in the first place? Below are two charts from the Alberta Treasury Board and Finance that explain the structural problem of Alberta's fiscal policy. The first chart shows a long-term average of revenue by source. Nearly 30% of Alberta's budget comes from resource revenue, about the same as from personal and corporate income taxes. Alberta does not have a sales tax like other provinces.

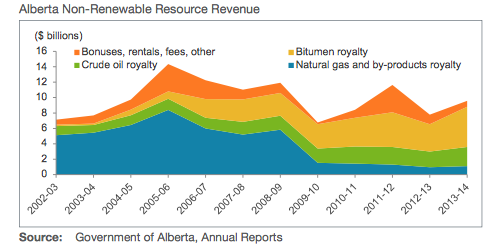

The revenue from resources moves with commodity prices, and thus the revenue is rather unstable as the next diagram reveals. It is interesting to note that the composition of the revenue is changing as well. Whereas at the beginning of the millennium, most resource revenue came from natural gas, this has shifted mostly to royalty from bitumen. Volatile revenue is the enemy of long-term planning and budgeting. Thanks to its wealth of natural resources, Alberta is an affluent province. However, by drawing on this wealth to finance its operational expenditures, Alberta's provincial budget is forcing itself into boom-bust cycles along with commodity prices.

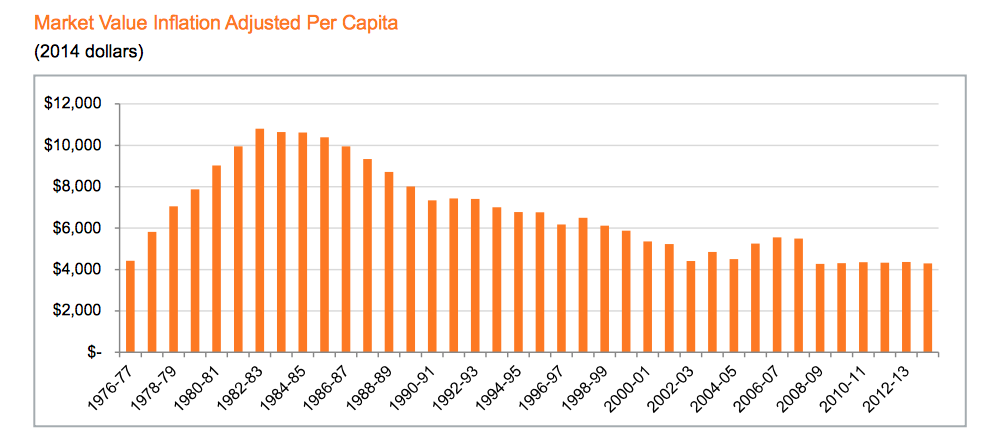

Alberta had one visionary premier: Peter Lougheed. In 1976 he created the Alberta Heritage Savings Trust Fund, or Heritage Fund fort short. It is an example of a sovereign wealth fund that sequesters revenue from non-renewable resources for the benefits of future generations. Originally conceived to receive 30% of that revenue, this contribution was first cut to 15% in 1982, and the less-than-visionary premier Don Getty stopped contributions altogether in 1987. Since then, the funds has not grown in size as governments continued to draw on the funds interest. As the chart below shows, in constant dollars the fund has been worth about $4,000 per Albertan since the beginning of the millennium. It is true that the Albertan government eliminated its accumulated provincial debt by 2005, but still there have been no further contributions to the Heritage Fund since.

How much of its non-renewable resource revenue (NRRR) should Alberta put into its wealth fund? Resource economics tells a simple story about that. It is known as Hartwick's rule. Published in the American Economic Review in 1976, Canadian economist John M. Hartwick (Queen's University) suggested:

Invest all profits or rents from exhaustible resources in reproducible capital such as machines. This injunction seems to solve the ethical problem of the current generation shortchanging future generations by "overconsuming" the current product, partly ascribable to current use of exhaustible resources.

Subsequent research expanded on this model of capital accumulation and resource depletion and demonstrated the intertemporal efficiency of this approach; see references below. The core idea is simple. Non-renewable resources belong to current and future generations. The entire(!) wealth generated from non-renewable resources (the profits) should be invested in a sovereign wealth fund, with current and future generations just drawing from the fund's income (dividends and interest). Norway's Statens pensjonsfond Utland had done just that and has reached nearly one trillion US dollars in value. Norway has just over 5 million people, about one million more than Alberta. Alberta's Heritage Fund stood at a paltry $17.2 billion at the end of 2014. The Hartwick rule is a well-established principle in resource economics today. It is a paradigm about inter-generational fairness. Jurisdictions that do not follow it are—to put it bluntly—stealing wealth from their children and grandchildren. Using resource wealth to fund consumption is near-sighted and introduces unnecessary volatility into provincial budgeting. While an argument can be made that such wealth can be used to retire public debt first and to make long-term capital investments (public infrastructure), the bulk of it should still wind up in a sovereign wealth fund. Why is it so difficult for Alberta to learn this simple lesson? Why does a conservative government not understand the meaning of the verb "to conserve"?

‘Stop squandering your grandchildren’s wealth, Albertans!’

The Fraser Institute has put together an interesting calculation, reproduced in an infographic on the Globe and Mail web site. If Alberta had followed Alaska's 25% rule, the Heritage Fund would have grown to $42 billion today. If it had followed Norway's 100% contribution rule, it would have amassed a respectable $122 billion. Put another way, Alberta has already squandered over $100 billion of its children's and grandchildren's wealth. Of course, kids and grandkids can't vote.

Jack Mintz, head of the University of Calgary's School of Public Policy, made a strong case for Alberta to adopt the federal Harmonized Sales Tax (HST), which as a value-added tax is more efficient than a conventional single-stage sales tax. The choice is easy economically but hard politically. It requires leadership and courage to convince Albertans about where their true Alberta Advantage lies. Hint: it isn't low taxes. Albertans, please stop squandering your children's and grandchildren's wealth! The oil price decline has given Alberta a window of opportunity to fix its fiscal problems. The obvious solution is for Alberta to become a little more like other provinces and institute a provincial sales tax. Instead, the budget that was announced in March calls for some cosmetic fixes: various new user fees, wage freezes for the public sector, and a very small increase in the personal income tax rate for high-earners. At the end there is still an enormous deficit, and an unwillingness to introduce reforms that lead to a path of fiscal sustainability.

The myth that Alberta's low-tax environment is the engine of prosperity seems hard-wired into the political fabric of the province. The anti-tax rhetoric that went along with it makes it difficult to change course. It is unlikely that the election on May 5 will lead to a fundamental course correction. At least there is some hope for incremental improvements. Premier Prentice promised to double the size of the Heritage Fund over the next 10 years by increasing the contribution share to 25%. What the Premier fails to acknowledge is that in order to ensure fiscal sustainability, the lost revenue from resource royalties needs to be replaced fully by less volatile direct and indirect taxation. Alberta can't have its cake and eat it too.

Further readings:

- Jack M. Mintz: Premier Prentice's next big test: The Alberta budget, Financial Post, December 23, 2014.

- Alberta Treasury Board and Finance: Backgrounder on Alberta's Fiscal Situation, January 15, 2015.

- Ted Morton: Time to politician-proof the Heritage Fund, The Globe and Mail, January 8, 2015.

- Chart: How big would the Alberta Heritage Fund be if...?

- John M. Hartwick: Intergenerational Equity and the Investing of Rents from Exhaustible Resources American Economic Review 67(5), December 1977, pp. 972-974.

- Kirk Hamilton and John Hartwick: Investing exhaustible resource reents and the path of consumption, Canadian Journal of Economics 38(2), May 2005, pp. 615-621.