On April 13, 2015 Ontario's provincial government announced that it will put a price on carbon emissions by joining the cap-&-trade system that is already used by Quebec and California. Ontario takes a different path than British Columbia, which opted for a carbon tax in 2008. The Q&A below sheds light on how a cap-&-trade works, and how it is different from a carbon tax.

What is a cap-&-trade system?

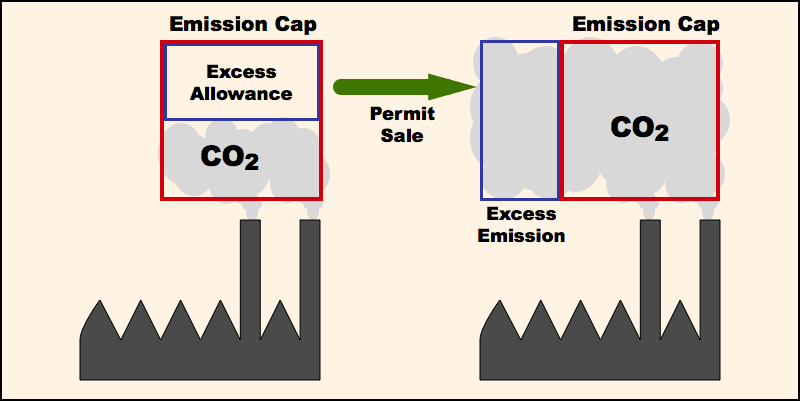

In a cap-&-trade system, the government issues permits to individual firms to emit a certain amount of carbon dioxide. In the diagram below, these "allowances" are indicated by red squares identical in size for both firms. The firm on the left is very good at preventing carbon emissions and as a result emits less than it received allowances for. The firm on the right is rather poor at preventing carbon emissions and ends up with more emissions than it has allowances for. Now the left firm can sell its excess allowance to the right firm that has excess emissions. When many firms trade emission permits, a market price emerges that matches supply and demand. More importantly, the emergin carbon price ensures that all firms lower their emissions until the cost of reducing an additional tonne of carbon emissions reaches the carbon price. Firms prefer abating emissions when this is cheaper than paying for extra permits.

How are emission permits allocated?

With an emission cap, the government decides how much carbon dioxide can be emitted in a given period in total. The tricky part is to allocate fractions of the total cap to individual firms through emission permits. There are two major ways in which this is done. One method allocates permits through an initial auction. Firms bid for permits, and the price at which demand and supply equal determines the price. The revenue from selling permits goes to the governments. The alternative is to give away the permits for free. This is called "grandfathering". Firms receive free emission permits through an allocation rule that is based on the firm's size, captured by measures such as employment, sales, or value added. Of course, firms prefer grandfathering over auctions because with a grandfathering system only high-emission firms pay for permits, while low-emission firms gain from selling excess allowances, and no revenue flows to the government.

While most permits are auctioned, some emitters receive free allocations from the Quebec government—those in NAICS industries 212 (mining), 2211 (electric utilities), 22133 (air-conditioning supply), 31–33 (manufacturing of food, beverages, textiles, wood and paper, chemicals, plastics, metal, motor vehicles, etc.). However, the number of free permits to these emitters are supposed to get reduced progressively.

What happens with the revenue from Quebec's cap-&-trade system?

Quebec and California sell permits primarily through an auction. The revenue from that auction in Quebec goes into the province's Green Fund (fonds vert) that was created in 2006. Revenue from that fund is supposed to be used to support activities directed at fighting climate change, and thus generate a double dividend. A double dividend occurs when a carbon policy reduces carbon emissions, and revenue collected through this carbon policy is used to help bring about further emission reductions.

In British Columbia, revenue from the carbon tax is used to reduce income taxes for corporate and personal income taxes. This makes B.C.'s carbon tax revenue neutral. Quebec's system is not revenue neutral, but revenue is meant to pursue a double dividend. What will happen to Ontario's revenue has not been announced yet.

How does cap-&-trade differ from a carbon tax?

A carbon cap-&-trade system and a carbon tax differ in one important way. A carbon tax provides a constant carbon price, while the exact size of the emission reduction is not entirely certain. A carbon cap-&-trade system provides certainty about the emission reduction through the "cap", but the carbon price may fluctuate. If too many permits are created, the carbon price may even drop to zero. To prevent that from happening, the Quebec trading system sets a price floor for the initial auction. Permits cannot be purchased below the minimum price. Quebec's system of cap-&-trade is therefore a hybrid approach that works like a carbon tax should the market price fall below the price floor.

Is a carbon tax better than a cap-&-trade system?

Both a carbon tax and a carbon cap-&-trade system are market-based instruments. Both offer the same level of short-term efficiency as both equate marginal abatement cost and carbon price. However, a carbon tax has one important long-term advantage: it provides a predictable price, and this in turn provides a predictable return on investment when businesses make investments into carbon abatement equipment. The carbon price in a cap-&-trade system can be quite volatile, as the E.U. Emission Trading System (EU-ETS) has demonstrated. A carbon tax provides greater dynamic efficiency over a cap-&-trade system. Nevertheless, a well-managed hybrid cap-&-trade system with a price floor and price ceiling can mimic the dynamic efficiency of a carbon tax. Wisely, the California-Quebec carbon trading is such a hybrid system.

Isn't a carbon tax more transparent to consumers than a cap-&-trade system?

A cap-&-trade system may look awfully complicated and mysterious to non-economists. A tax is much easier to understand. However, with both approaches the tax is mostly invisible to consumers, as the carbon price is embedded in the aggregate price we pay for goods and services.

Is a carbon tax cheaper to implement than a cap-&-trade system?

With a carbon tax, the tax is imposed on the carbon embodied in fossil fuels. Thus you pay a certain amount of carbon tax per litre of gasoline at the pump. It becomes a little more complicated when greenhouse gas emissions are not from burning fossil fuels but from chemical or biological processes. With a cap-&-trade system, emissions need to be either monitored, or one needs to keep track of "inputs" (that is, fossil fuels). It is also possible to have wholesalers pay for emissions associated with the eventual use of their products. Thus, oil companies can be charged with buying permits for the gasoline they sell to motorists, and utilities can be charged with buying permits for the electricity they sell to households.

Auctioning emission permits actually has one advantage over grandfathering permits—it reduces the amount of follow-up trading among companies. Many companies will buy their permits in the initial auction, and only need to engage in "fine-tuning" during the course of the year.

Does Quebec's cap-&-trade system capture carbon emissions from all sectors of the economy?

Some cap-&-trade systems (such as the EU-ETS) only put a limit on carbon emissions from industrial sources, but not households and transportation. The latter two typically account for two-thirds of emissions in industrial societies. However, it is possible to make a cap-&-trade system as comprehensive as a carbon tax. As mentioned earlier, the trick is to move the burden of obtaining permits up the supply chain to the (big) companies that can more easily manage this. It would be rather expensive and impractical to ask individual households or motorists to buy individual permits for their emissions. The transaction cost would be prohibitive.

What carbon prices have emerged in Quebec's cap-&-trade system?

Because Quebec's trading system is joint with California, the market price is determined jointly. However, each jurisdiction allocates a fixed amount of permits and receives a share of the proceeds from selling the permits. The table below shows the results from the first two rounds of auctions. In each round, "current vintage" permits (for the current year) are sold along with a smaller number of "future vintage" permits (for 3 years in the future). Because the larger part of the auction is transacted in US Dollars, the jump in the minimum (reservation) price between the two auction rounds is mostly due to the depreciation of the Canadian Dollar. At a carbon price of about 15 CAD per tonne, it is about half the level of the BC carbon tax.

| Auction Round | Minimum Price [C$/t] |

Market Price [C$/t] |

Total Permits [Mt] |

Quebec Permits[Mt] | Quebec's Revenue [mio. C$] |

|---|---|---|---|---|---|

| #1 – 2014 2014-11-25 |

12.82 | 13.68 | 23.071 | 1.049 | 14.35 |

| #1 – 2017 2014-11-25 |

12.82 | 13.41 | 10.787 | 1.527 | 20.48 |

| #2 – 2015 2015-02-18 |

15.01 | 15.14 | 73.611 | 11.172 | 169.14 |

| #2 – 2018 2015-02-18 |

15.01 | 15.01 | 10.432 | 1.474 | 22.12 |

| #3 – 2015 2015-05-21 |

14.78 | 15.01 | 76.932 | 13.118 | 196.91 |

| #3 – 2018 2015-05-21 |

14.78 | 14.78 | 9.812 | 1.386 | 20.49 |

| #4 – 2015 2015-08-18 |

15.84 | 16.39 | 73.429 | 11.171 | 183.09 |

| #4 – 2018 2015-08-18 |

15.84 | 16.10 | 10.431 | 1.474 | 23.73 |

| #5 – 2015 2015-11-17 |

16.16 | 17.00 | 75.113 | 11.172 | 189.92 |

| #5 – 2015 2015-11-17 |

16.16 | 16.89 | 10.431 | 1.474 | 24.90 |

| #6 – 2016 2016-02-17 |

17.64 | 19.50 | 68.026 | 11.150 | 217.43 |

| #6 – 2019 2016-02-17 |

17.64 | 18.34 | 9.361 | 1.320 | 24.21 |

| #7 – 2016 2016-05-18 |

16.40 | 16.97 | 7.260 | 1.085 | 18.41 |

| #7 – 2019 2016-05-18 |

16.40 | 18.88 | 0.914 | 0.129 | 2.44 |

| #8 – 2016 2016-08-16 |

16.45 | 18.59 | 30.021 | 3.520 | 65.44 |

| #8 – 2019 2016-08-16 |

16.45 | 17.02 | 0.769 | 0.108 | 1.84 |

Prices in Canadian Dollars (C$). Carbon emissions in million metric tonnes (Mt). The column "auction round" describes the vintage year for which the permits are issued along with the auction date. This table may be updated after the original blog has been published.

The numbers in the table above show that the market price is barely above the reservation price. This indicates that the price floor is critical. And—surprise—the cap-&-trade is actually more like a carbon tax. Without the reservation price, the market price would have likely been less. This means that businesses do not find themselves in any difficulty of meeting the carbon reduction targets. Another interesting feature of the first two joint auctions is that the future price for the 2017 and 2018 vintage auctions is lower than the spot price for the 2014 and 2015 vintage auctions. This means that businesses do not expect the carbon price to rise significantly over time.

How will the carbon cap progress over time?

California's cap in 2013 was set at about 2 percent below the emission level forecast for 2012, declines about 2 percent in 2014, and is scheduled to decline about 3 percent annually from 2015 to 2020. Overall, California's Bill 32 targets a reduction of 15% of greenhouse gas emissions by 2020 compared to the "business-as-usual" scenario.

The cap-&-trade system in Quebec was launched in 2013 and was linked to California's in 2014. Quebec aims to reduce greenhouse gas emissions by 20% below 1990 levels in 2020. The program is proceeding in two phases. The first phase (2013-14) includes only large industrial emitters (>25 kt CO2 per year) and electric utilities. The second phase (2015-20) expands the program to distributors of fossil fuels, and the 2015 cap will reach about 85 percent of Quebec's total emissions. Quebec's emission caps for the forthcoming years are shown in the table below.

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|

| Cap (Mt) | 23.20 | 23.20 | 65.30 | 63.19 | 61.08 | 58.96 | 56.85 | 54.74 |

Note: [Mt] is million metric tonnes of carbon dioxide equivalent CO2(e) emissions.

Will other provinces join the system?

Momentum is building for the California-Ontario-Quebec trading system. In Canada, the trading system in Ontario and Quebec covers more than half of our country's population. The liquidity of that market makes it attractive for other provinces to join. Similarly, California's environmental leadership role in the United States makes it likely that other states in the US will adopt the California program rather than design their own systems or adopt a different policy instrument.

The simplicity of a carbon tax—and in particular the political attractiveness a a revenue-neutral carbon dividend, discussed in my July 31, 2014 blog—may yet convince some jurisdictions to take another route. What matters at the end of the day is that the carbon prices in different jurisdictions are not too far apart. Large differences in carbon prices across jurisdictions create economic distortions.

Where is the federal government in all of this?

The federal government is notably absent from any initiatives to mitigate climate change. While provinces have unquestionably jurisdiction over environmental matters and can pursue their own environmental policies, the federal government also has the power to initiate carbon policies. Curiously, the current federal government that prides itself about being market-oriented has only introduced command-and-control regulations that are known to be less efficient than market instruments. As a result of federal inaction, provincial governments will continue to take the lead on climate change in Canada.

The Ecofiscal commission, chaired by my economist colleague Chris Ragan of McGill University, has made four sensible recommendations for implementing carbon pricing in Canada:

- All provincial governments should move forward by implementing carbon-pricing policies.

- Provincial carbon-pricing policies—existing and new—should increase in stringency over time.

- Provincial carbon-pricing policies should be designed to broaden coverage to the extent practically possible.

- Provinces should customize details of policy design based on their unique economic contexts and priorities; they should also plan for longer-term coordination.

The last point in particular points to the need for cooperation among the provinces and with US states. A key question will always remain about the form of revenue recycling, and here different provinces may choose different routes.

References:

- Government of Quebec: Quebec Carbon Marekt

- California Environmental Protection Agency, Air Resources Board: Cap-and-Trade Program

- Jane Taber and Adrian Morrow: Ontario unveils cap-and-trade plans as provinces take lead on climate change, Globe and Mail, April 13, 2015.

- Chris Ragan et al.: The Way Forward: A Practical Approach to Reducing Canada's Greenhouse Gas Emissions, Report by Canada's Ecofiscal Commission, April 2015.