Canada has a segmented oil market. In Western Canada oil is produced and exported, virtually all to the United States. In Eastern Canada oil is imported from around the world. In 2010, this included countries such as Saudi Arabia, Norway, Algeria, Angola, and Nigeria, while the United States accounted for just 5.5%. By 2014, the fracking boom in the Unitd States has changed that drastically. In that year 52.7% of imported oil came from the United States. The table below shows how import composition has changed in recent years.

Composition of Canada's Crude Oil Imports

| Country | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|

| United States | 5.5% | 6.2% | 7.8% | 18.7% | 52.7% |

| Saudi Arabia | 8.1% | 9.0% | 8.4% | 9.8% | 10.7% |

| Iraq | 8.0% | 8.5% | 13.2% | 11.9% | 7.7% |

| Norway | 9.3% | 11.2% | 10.4% | 11.4% | 5.8% |

| Algeria | 15.1% | 19.0% | 20.0% | 12.4% | 5.6% |

| Angola | 6.8% | 8.5% | 6.5% | 5.7% | 4.9% |

| Mexico | 2.9% | 2.5% | 2.7% | 3.3% | 3.1% |

| Azerbaijan | 2.3% | 1.5% | 4.1% | 1.7% | 1.9% |

| Nigeria | 6.8% | 8.3% | 6.6% | 4.2% | 1.6% |

| Côte-d'Ivoire | 1.0% | 1.5% | 0.9% | 1.2% | 1.2% |

| All Others | 34.2% | 23.8% | 19.4% | 19.6% | 4.7% |

| Total All Countries | $23.76bn | $28.91bn | $29.76bn | $27.01bn | $24.04bn |

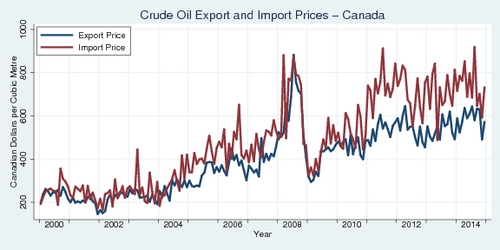

If Canada exported and imported oil at the same "world price", exporting in the west and importing in the east would simply amount to reshuffling. But that is not the case. As the next diagram illustrates, there is a subustantial gap in the price we receive for exports and the price we pay for imports. The gap between the red and the blue line is the price premium for imports. There can be a fair bit of monthly variation in these numbers, but the gap is widening. The data are from Statistics Canada time series on export and import values and volumes; prices are defined implicity.

click on image to obtain high-resolution PDF version

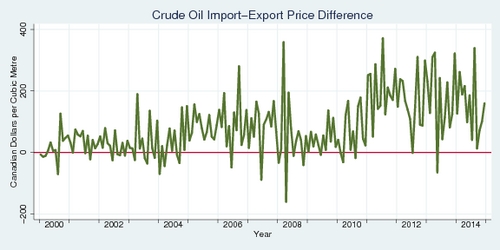

The following diagram magnifies this and only shows the price gap. In the last four years, this price gap has sometimes been in excess of $40 per barrel (1 barrel = 159 litres, or 1 cubic meter equals 6.2898 barrels). The diagram's vertical axis uses the metric measure: Canadian Dollars per cubic metre.

click on image to obtain high-resolution PDF version

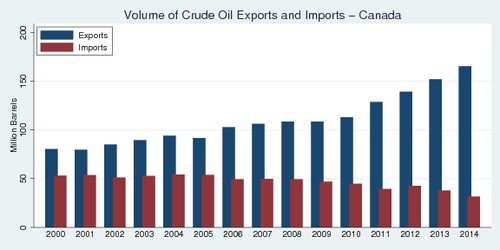

As the next diagram shows, Canadian imports of crude oil have been decreasing in volume since the beginning of the decade, while exports have been steadily increasing. As exports exceed imports, there would be plenty of potential to substitute imported oil with Canadian-produced oil. To some degree that is already happening as the value of imported oil has been falling. But more is possible.

click on image to obtain high-resolution PDF version

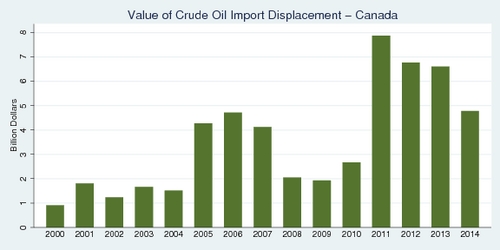

If more expensive imported oil was replaced with cheaper Canadian-produced oil, there would be a significant arbitrage benefit. This benefit is visualized in the next diagram. It is calculated as the product of the import price premium and the volume of imports, aggregated from monthly data. Between 2011 and 2014, this arbitrage benefit has been between 5-8 billion dollars annually. It only dropped a fair bit in 2014 as a result of larger import volume from our neighbour, the United States.

click on image to obtain high-resolution PDF version

So why are Eastern Canadians still paying too much for their oil? The simple answer is: there is too little transportation capacity to ship Western oil to Eastern markets. The result: 5–8 billion dollars are flowing out of Canadian pockets into the pockets of oil producers outside Canada. The economic question is therefore: would building more pipeline capacity amortize over time? But this is not the only question that needs answering.

There is also another problem: Western oil is "heavy" and Eastern imported oil is "light". The oil sands in Alberta produce bitumen rather than conventional crude, and bitumen requires different refining ability than is available in some of the refineries in Eastern Canada. For Eastern Canada to fully benefit from cheaper Western oil (rather than bitumen getting exported to Atlantic destinations for shipment to overseas refineries), matching refining capacity needs to be put into place. There is a price difference that reflects the different quality of crude varieties. Heavy oil (bitumen) is typically trading at a significant price discount. Therefore, some of what the above diagram shows as potential savings is the value of that price discount for quality. Nevertheless, even after taking this difference into account, there remain billions of dollars on the table.

Image licensed by Shutterstock.

The crucial first step is building a link between West and East, similar to building the Trans-Canada highway. TransCanada Corporation's Energy East Pipeline Project is a proposed 4,600-kilometer pipeline with a capacity to transport 400 million barrels of oil from Alberta and Saskatchewan to the refineries and port terminals of Quebec and New Brunswick. The project involves the conversion of an existing natural gas pipeline into an oil pipeline, with additional new pipeline capacity to link up with the converted pipeline.

Building an east-west oil connection offers significant economic advantages, as well as a higher degree of energy independence for Canada. Environmentally, there are questions about whether building this link would facilitate an expansion of oil sands production, which tends to be more carbon-intensive than conventional oil production. At current prices of oil, this expansion seems unlikely. Markets can change, however. Other than questions about the long-term carbon footprint, other environmental problems do not appear unmanageable. However, the environmental impact assessment (EIA) process is viewed with skepticism by opponents of the project because of the current government's close ties to the oil industry. Impartiality of the EIA process, along with rigorous scientific analysis, is crucial to build broad public support for the project. Of all the oil-to-tidewater pipeline projects in Canada that have been advanced in recent years—Northern Gateway, Keystone XL, TransMountain expansion, and Energy East—the east-west link offers the largest potential for benefits to Canadian consumers if it closes the price gap between east and west. While at first the project enjoyed broad political support, this support has been waning somewhat in particular in response to opposition in Quebec. NDP leader Tom Mulcair questioned whether the project had "social license" to operate in Quebec. As Canada is going to the polls on October 19, the positions of political parties range from outright rejection (Green Party), over conditional support (Liberal Party), to strong support (Conservative Party). A recent editiorial in the Globe and Mail asked: Pipelines: In Election 2015, which party has the best policy?. The editorial maintains that the Conservative Party and the Green Party have the clearest positions, but that both NDP and Liberals are aiming to refer to the outcome of an (improved) environmental impact assessment process. Both parties want to take carbon footprint into consideration, and engage in broader consultation.

The main stumbling block for an east-west pipeline is what the pipeline would carry: diluted bitumen. Support would arguably be stronger if (a) the pipeline was to carry conventional oil rather than bitumen; (b) the crude oil was more clearly destined for Canadian than international markets; and (c) the carbon footprint of oil sands production was reduced significantly. The related problem is that there are no proposals to build new refining capacity in Canada. Downstream refining is a low-margin business, less lucrative than upstream production. Experts in the oil business point to large capital investments into upgrading refineries in the United States, which has made these facilities highly competitive. Similar projects in Canada will come too late because Canada lacks the density of the distribution network to match the US competitors. The market for refined petroleum market is driven by rather different factors than the market for crude oil. There is even excess capacity for refining in Eastern Canada, which in turn makes the Energy East project attractive. The only refinery built in Canada in recent decades, the $5.7-billion Sturgeon project developed by North West Upgrading, would not have been economically viable without government assistance. It is also more of an upgrader than a conventional refinery.

Challenges for a "Canadian Energy Strategy" abound. There are compelling economic and political resaons to consider the proposed east-west pipeline. Canada needs to be able to get its oil to market efficiently and safely. The direction for consensus should be clear: a green light for more pipeline capacity in exchange for meaningful reductions of carbon emissions, and only after a scientifically rigorous and impartial environmental impact assessment (EIA) points the way towards safe operation and minimal environmental risks.

It is possible to reconcile economic benefits with sound environmental practices. But where environmental risks are too significant, the federal government needs to reject projects that are, on balance, not in the public interest. Even after a Joint Review Panel recommended approval of the Northern Gateway pipeline, there remain significant and credible concerns about oil tanker safety and the ability to respond to a major oil spill in the turbulent and hazardous waters along the Pacific North Coast around Haida Gwaii. During the EIA hearings, BC's provincial government expressed dissatisfaction with the spill response plans provided by Enbridge, and maintained that the company has not adequately considered geological and hydrological risks in its estimates of the likelihood and consequences of a spill. The panel's report is mandatory reading for anyone interested in how environmental impact assessments work and how the panel arrives at its conclusions.

References:

- Michael Bird: A look at major pipeline project proposals in Canada, The Globe and Mail, December 2, 2014.

- Kelly Cryderman: Canada's first new refinery in decades breaks ground, The Globe and Mail, September 20, 2014.

- Globe Editorial: Wanted: A plan for more pipelines, less greenhouse gases, The Globe and Mail, July 14, 2015.

- Globe Editorial: Pipelines: In Election 2015, which party has the best policy?, The Globe and Mail, August 14, 2015.