House prices in Vancouver have reached stratospheric heights. The last round of property assessments, announced in early January 2016, caught much public attention. Home owners rejoice, and prospective buyers despair. How far can prices climb before a correction will arrive? Will there be a gradual leveling off ("plateauing") or will there be a crash? My real estate economics colleagues at the Sauder School of Business have commented much on these issues, and the intricate supply-and-demand dynamics have indeed many facets to explain. Let me join the fray with some of my own musings on the issues. Looking at some of the statistics reveals interesting patterns, and perhaps a few new insights.

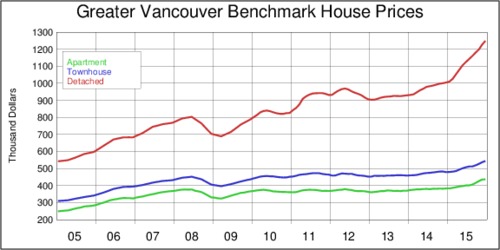

The chart everyone talks about is the dramatic increase in housing prices. Prices for detached homes in Greater Vancouver went from about $550 thousand in 2005 to $1.25 million in 2015—an increase of more than 125 percent. This increase has been accelerating rapidly. During the same period from 2005 to 2015, prices for townhouses and apartments have appreciated much less: about 75 percent.

click on image to obtain high-resolution PDF version

Data Source: Real Estate Board of Greater Vancouver

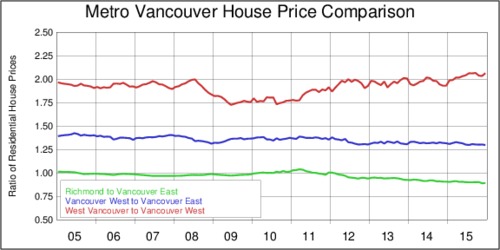

The next chart shows the widening wedge between detached homes and apartments. Between 2005 and 2009 the ratio was essentially flat and steady at about 2.1. This started to increase dramatically during 2010 and 2011, remained steady at 2.5 during 2012 and 2013, and accelerated again to over 2.8 by the end of 2015. Clearly, single detached homes are becoming a scarce commodity. With supply effectively fixed and limited in many parts of Greater Vancouver, increases in demand are driving up prices. Supply of townhouses and apartments is much more elastic, as rising prices lead to conversions of land from detached homes to multi-unit dwellings, and replacement of low-rise buildings with high-rise buildings. Essentially, the story about the Vancouver real estate market is about excess demand for single-detached homes.

click on image to obtain high-resolution PDF version

Data Source: Real Estate Board of Greater Vancouver

In all of this change, the rank ordering of desirable neighbourhoods has changed very little. I like to look at three ratios of average residential prices. The most desirable neighbourhood is the posh municipality of West Vancouver. Average house prices there are twice that for homes on the westside of (the city of) Vancouver. Another useful comparison is the ratio of Vancouver's westside and Vancouver's eastside. That ratio is also quite stable at around 1.3. Westside properties fetch about 30% more than eastside properties. Lastly, the city of Richmond can be compared quite well with Vancouver's eastside. The ratio has hovered at 1 for many years but has drifted lower in the last five years. Richmond has become relatively cheaper because housing supply appears to be more elastic there.

click on image

to obtain high-resolution PDF version

Data Source: Real Estate Board of Greater Vancouver

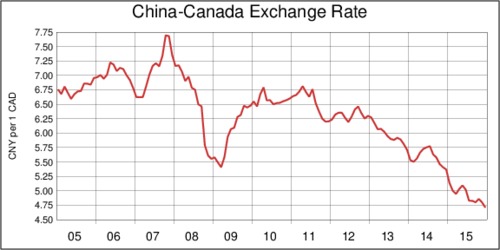

The question about what is driving Vancouver's real estate boom is the elephant in the room. The alleged key driver is an inflow of money from Asia, and mainland China in particular. While data on the national origin of real estate investment in Vancouver is scant, it is perhaps worthwhile pointing out one important fact that speaks to the question what makes Vancouver real estate particularly attractive to investors from China: the appreciation of the Chinese currency, the Yuan (or Renminbi), relative to the Canadian Dollar. The next chart shows the price of one Canadian Dollar in Yuan. Since 2010, the Yuan has appreciated by about 40 percent against the Canadian Dollar. This means that a real estate investor will be able to pay 40% more for the same property than five years ago. If investors from China play a significant role in the Vancouver real estate market, then by extension the Canada-China exchange rate will either accelerate or dampen the movements in real estate prices.

click on image

to obtain high-resolution PDF version

Data Source: Pacific Exchange Rate Service

Forecasting where housing prices in Vancouver will go remains a little bit like reading tea leaves: it's more an art than a science. We can only hope for a "soft landing", a leveling off of prices rather than sudden drops. Events in China could turn things around rapidly. China's economy is slowing, but it is still far from recession territory. China is caught in an epic struggle of "reform against control", and this struggle often amounts to two steps forth and one step back. The political class in China is still wedded more to control than to reform, and stock price volatility is triggering the desire to intervene in the markets rather than let market forces play out on their own. China's volatile stock market will probably remain volatile, and this will likely prompt affluent people in China to seek safe havens elsewhere in the world. Canada will remain an attractive destination if volatility and uncertainty persist in China. The risk is that the Chinese government will try to clamp down on capital outflows by re-introducing stricter capital controls. Such measures would certainly have an affect on Vancouver's real estate market as well. There is an old saying: what goes up must come down. That must be true for real estate prices in Vancouver. But how long the boom will last before an inevitable correction arrives is anyone's guess.

Even if foreign investors are to blame for Vancouver's red-hot real estate prices, there are two sides to the story. The money coming into the city enriches present homeowners who sell to new arrivals. This money from home sales is likely to trickle into the economy through higher spending on other goods and services, along with super-charging BC's construction industry. The wealth that is arriving is, for the most part, staying in British Columbia. The economic risk associated with high real estate prices is whether people can afford to live in Vancouver in order to work in Vancouver. If employers find it difficult to attract employees, the economy would suffer. For that reason it is crucial that the real estate market does not turn into a drag on economic growth. Various measures have been proposed to deal with this. Some have called for a speculator tax, such as Vancouver Mayor Gregor Robertson. I doubt that such measures will yield the desired effect. Perhaps such measures can take some of the froth off the bubbly market, but they do not solve the fundamental problem that is ailing Vancouver's real estate market.

‘Metro Vancouver's overheated real estate market requires densification and better transportation, focusing on availability instead of affordability.’

Ultimately, the underlying problem about Vancouver's real estate market is population growth—and whether this is propelled by immigration (or instead by internal migration) is a less important question than many commentators have made it out to be. With a growing population, what really matters is the supply of housing. The real problem is availability, not affordability. Affordability will happen when availability improves.

Our current obsession with real estate prices at the upper end of the housing market misses the bigger picture. More people are moving to Vancouver. British Columbia population projections for 2015-2041 suggest that BC's populatoin will rise from 4.6 milion in 2013 to 6.1 million in 2041—roughly 1 percent per year. Most of the new arrivals will settle in the Lower Mainland. But where will they live? Some cities, such as Calgary, can sprawl. But urban sprawl is no solution in Vancouver where geography imposes strict limits. In Vancouver much land is still taken up by low-density single detached homes. This is unsustainable. Vancouver requires significantly more densification: more townhouses and apartment buildings. This goes hand in hand with better transportation, in particular the much-needed expansion of our subway and skytrain system. Densification requires rezoning, in particular close to proposed and existing rapid transit lines. Densification around the Cambie corridor of the Canada Line is already visible. Many bungalows along Cambie are making way for multi-storey buildings and high-rises near the Marine Drive station. New developments are proposed for Langara Gardens at West 57th Street and the Oakridge Centre at West 41th Street. Similar densification needs to happen around the Broadway corridor along with the construction of the proposed new subway. The corridor along 41st Street between Cambie and Kingsway could be another key area for densification, perhaps even connecting the Canada Line with the Joyce-Collingwood skytrain station through a new rapid transit link.

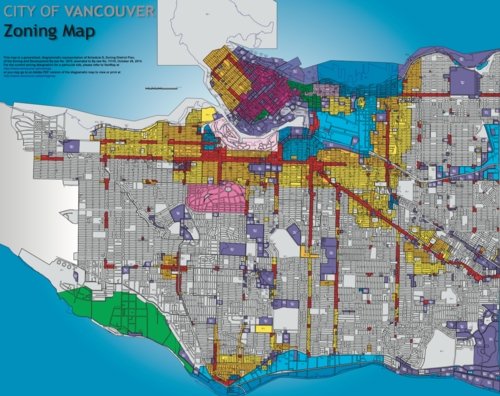

Vancouver has too much land devoted to single detached housing stock. As population grows, this stock needs to decline. Metro Vancouver's overheated real estate market requires densification and better transportation, focusing on availability instead of affordability. Look at the zoning map of Vancouver below. Grey identifies the large part of town reserved for one-family dwellings. Yellow indicates two-family dwelling districts, and orange identifies multipe-dwelling districts. Red areas show commerical (and mixed-use) districts. What we need is a lot more orange and red than grey on the map.

click on image for full-resolution PDF version with legend

Densification is not popular politically. Those who own single detached homes do not like the character of their neighbourhoods changing. Unsurprisingly, there is a fair bit of opposition to rezoning. However, if Vancouver wants to solve its affordability problem, it cannot eschew rezoning and solving the availability problem. On each of its 115 square kilometres of land, Vancouver accommodates about 5,250 people according to the 2011 census. Compare this to Paris (France), where the average density is about 21,500 people per square kilometre. Vancouver's downtown core manages a population density of about 11,500 people per square kilometre. Even if we don't want all of Vancouver to look like downtown Vancouver, there is ample room for densification.

Densification will also continue to increase the price gap between detached homes and apartments. As the stock of detached homes needs to decrease in order to make room for more townhouses and apartments, the increased scarcity of detached homes will result in the remaining units commanding an ever higher premium. I expect the price ratio in the graph above to break through the 3.0 barrier in 2016. Between 2001 and 2011, the number of single detached homes decreased from 327,655 to 301,140 in Metro Vancouver. During the same period, the number of apartments increased from 281,450 to 357,840, and townhouses and semi-detached homes increased from 149,610 to 232,360 units. This trend will continue, and this trend needs to continue to accommodate Vancouver's growing population.

Densification is a long-term solution, but what about the short term? One problem in Vancouver's housing market is the number of homes that have been bought as investment objects but are sitting empty. This limits availability. There is a solution to that. As Frances Bula reported in the Globe and Mail on January 18, B.C. professors call for property surtax on vacant Vancouver housing. Concretely, the proposal calls for a new 1.5% property tax surchage on residential real estate, with revenues distributed as lump-sum payments to all Canadian tax filers in any area included. The ten professors who signed the proposal suggest that "the tax targets owners of vacant properties and those with limited economic and social ties to Canada," while all other home owners would be exempt. This proposal takes direct aim at housing availability; it is also in line with the theme of my blog: focusing on availability rather than affordability. It was reported that the provincial government considers other measures. The CBC reported on February 19 that the premier suggested that the B.C. property transfer tax could be cut. This tax generates nearly one billion dollar in revenue. Raising the exemption threshold for first-time buyers will only help a very small group of people. It doesn't help people who prefer to rent, for example. Changes to the property transfer tax will do little good economically. The surtax proposal provides much better aim at the target. It will make it more expensive to let real estate sit idle.

Both short-term and long-term measures are needed to address the housing availability crisis in Metro Vancouver. Hand wringing about affordability misses the more fundamental problem: housing stock availability. If Vancouver is to prosper and grow, we need more and denser housing stock and better urban transportation.

- Metro Vancouver Housing Data Book, 2015

- Real Estate Board of Greater Vancouver: MLS Home Price Index

- Vancouver Zoning Map

- Frances Bula: B.C. professors call for property surtax on vacant Vancouver housing, The Globe and Mail, January 18, 2016.

- Mike Lloyd: Local economists propose plan for a surtax targeting foreign investors, January 18, 2016.

- BC Housing Affordability Fund

- Gary Mason: It's time for Canada to take action on its offshor real estate problem, The Globe and Mail, January 18, 2016.