On July 5,

Swedish carmaker Volvo announced that starting in 2019

all its new models will have either plug-in hybrid-electric or fully

electric engines. This is a smart move for the Swedish car

maker, which was bought from Ford in 2010 by the Chinese car manufacturer

Geely. The story made it to the headlines of all major

newspapers. The New York Times reported Volvo, Betting on Electric, Moves to Phase Out Conventional Engines and sees it

as the sign of the times that the era of gas guzzlers is coming to an end.

Yet, announcements of the death of the combustion engine may be

premature, even in Volvo's case.

On July 5,

Swedish carmaker Volvo announced that starting in 2019

all its new models will have either plug-in hybrid-electric or fully

electric engines. This is a smart move for the Swedish car

maker, which was bought from Ford in 2010 by the Chinese car manufacturer

Geely. The story made it to the headlines of all major

newspapers. The New York Times reported Volvo, Betting on Electric, Moves to Phase Out Conventional Engines and sees it

as the sign of the times that the era of gas guzzlers is coming to an end.

Yet, announcements of the death of the combustion engine may be

premature, even in Volvo's case.

Volvo will actually continue to sell vehicles with combustion engines past 2019 as many of their pre-2019 models will still be produced for many years. More importantly, however, is that the mix between plug-in hybrid-electric (PHEV) vehicles and pure battery electric vehicles (BEV) will be determined by the market. Tesla Motors bets on BEVs with a business model that was geared primarily towards the luxury segment. On the other end of the market, the Nissan Leaf targets the small-car market by making concessions to range and performance. Most other car-makers are rolling out mild-hybrid or PHEV options. In my view, there are three crucial arguments that favour PHEVs over EVs in the near future. Volvo is ahead of the curve and other car makers will probably follow.

First, PHEVs will remain a more versatile option for many motorists as EV charging stations are not ubiquitous yet and EV range remains limited due to the cost, weight, and limited capacity of the current generation of batteries. As technology advances, it is likely that eventually EVs will surpass PHEVs in cost and performance, but that point has not been reached and it may take another two decades to get there. Meanwhile, PHEVs give motorists the option to run electric whenever possible, and rely on the combustion engine as back-up and power boost.

‘Subsidies for EVs should be contingent on the availability of clean electricity.’

Second, PHEVs will remain the smarter environmental option in many jurisdictions. EVs are not necessarily zero-emission vehicles. EVs are only as clean as the electricity that they rely on. Where electricity is generated mostly from coal, EVs are not the cleaner choice when all types of pollutants are taken into consideration. As Holland et al. (American Economic Review, 2016) find, the benefit of EVs depends crucially on local factors, and as a result subsidies for EVs are not always good for the environment. Simply put, EVs make a lot of sense where electricity is relatively clean. When electricity is pollution-intensive, wide-area transmission networks can generate large interjurisdictional spillovers from local policies. In the US, it turns out, there are locations where EV subsidies make sense (strongest in dense urban areas in Western states) and there are numerous Eastern and Midwestern states where EVs should actually be taxed. Vehicle subsidies are not a first-best policy; the first-best policy taxes the negative externality (pollution) directly. In short, what helps the environment most is reducing fossil fuel use. Higher fuel taxes would be much more effective, but where subsidies for EVs are used, they should be contingent on the availability of clean electricity.

Third, PHEVs may simply be the more cost-effective choice for consumers until battery cost and technology has advanced sufficiently. The slightly higher purchase price of PHEVs will probably drop further as more car companies (including Volvo) focus their attention on this technology, and the improved fuel efficiency of PHEVs will easily amortize what remains of the higher cost. For consumers, PHEVs will remain a safer choice than EVs. The technological leap is from "mild" hybrids (which cannot be plugged in) to plug-in hybrids, which will increasingly shift the balance of use from fuelled to electric driving. As motorists become more comfortable with plugging-in vehicles, they will become more likely to switch to BEVs in the next generation of vehicles. The way to win motorists over to PHEVs and EVs is through their pocketbooks. When these technologies are cheaper (on an amortized basis) than internal combustion engine (ICE) vehicles, sales will soar.

As electricity becomes cleaner, transitioning from PHEVs to

BEVs will become more attractive. To get to a world where

EVs dominate, the cost of batteries has to fall

further a fair bit.

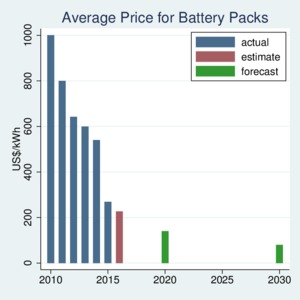

High battery cost has been the main problem that has held back

more consumers buying EVs. However, the cost of battery packs is

declining rapidly as the chart on the right shows [click on image

for high-resolution PDF version]. This steep

decline is more attributable to economic efficiencies from larger

production scale (Tesla's Gigafactory is the key example)

rather than any major technological break-through in battery technology.

Average costs in 2017

are expected to be in the US$200/kWh range, and by 2030 the cost

is expected to fall in half to below US$100/kWh. A typical EV

needs a battery pack that can store about 60 kWh. At the estimated

US$227/kWh for 2016, that 60 kWh pack costs $13,600 (about C$18,000

at the current exchange rate).

It is conceivable that a major breakthrough in battery

technology could occur in the next few years that improves energy density

and at the same time reduces battery cost.

Lithium-sulfur batteries are expected to outperform the current

lithium-ion generation, increasing specific energy from about 150-200

Wh/kg to about 500 Wh/kg at reduced cost. Even though commercialization

of this or competing next-generation technologies has not occurred yet,

the technological potential is clearly visible today already.

High battery cost has been the main problem that has held back

more consumers buying EVs. However, the cost of battery packs is

declining rapidly as the chart on the right shows [click on image

for high-resolution PDF version]. This steep

decline is more attributable to economic efficiencies from larger

production scale (Tesla's Gigafactory is the key example)

rather than any major technological break-through in battery technology.

Average costs in 2017

are expected to be in the US$200/kWh range, and by 2030 the cost

is expected to fall in half to below US$100/kWh. A typical EV

needs a battery pack that can store about 60 kWh. At the estimated

US$227/kWh for 2016, that 60 kWh pack costs $13,600 (about C$18,000

at the current exchange rate).

It is conceivable that a major breakthrough in battery

technology could occur in the next few years that improves energy density

and at the same time reduces battery cost.

Lithium-sulfur batteries are expected to outperform the current

lithium-ion generation, increasing specific energy from about 150-200

Wh/kg to about 500 Wh/kg at reduced cost. Even though commercialization

of this or competing next-generation technologies has not occurred yet,

the technological potential is clearly visible today already.

‘The sweet spot where BEVs reach cost parity with ICE vehicles will require battery costs near or below the US$100/kWh mark.’

The point at which EVs make economic sense is reached where the lower per-kilometre cost offsets the higher cost of batteries. A few simple calculatons illustrate where this point can be found. Let's say the lifetime vehicle use is 120,000 km, and the fuel cost difference is about 10 cents/km (15 cents/km for gasoline minus 5 cents/km for electricity, all in Canadian Dollars). So the present-discounted value of these savings over a 12-year period with a 6% interest rate is about $8,400. Hence, the 60 kWh battery pack would have to come down in cost by a little more than half. At current trends that point could be reached in about five years, in the early or mid 2020s. The sweet spot where BEVs reach cost parity with ICE vehicles will require battery costs near or below the US$100/kWh mark.

The McKinsey report Electrifying insights: How automakers can drive electrified vehicle sales and profitability from January 2017 suggests that consumer demand is starting to shift in favour of electrified vehicles. However, interest in EVs is not translating into sales into EVs yet despite large subsidies in some jurisdictions. It is interesting to note that more EVs are sold in China than the United States. Buyers in China opt for smaller EVs, a country where EVs are exempted from high excise taxes for vehicle purchases and receive favourable lane access in congested cities. In particulr, low-speed (up to 70 km/h) EVs are becoming popular . EVs are only one in four major trends in the automotive industry. McKinsey identifies four automotive "megatrends":

- Autonomous Driving that makes vehicles safer, facilitates vehicle sharing, and is easier to implement in EVs than in gasoline-powered vehicles.

- Vehicle Sharing that diminishes individual owernship but also offers motorists more choices for individual trips.

- Connectedness that provides safety and improved mobility.

- Electrification due to lower battery costs.

All

four of these trends may intersect in some way to create

new markets for automobiles. These trends generate new entrants

(Tesla Motors) but also entices established carmakers (Daimler)

to seek out new business models (car2go). Information Technology

will play an increasing role, which has already drawn in

Alphabet (i.e., Google) to develop autonomous vehicle. Waymo, Google's car unit, is considered years ahead of established carmakers

for developing self-driving cars. It's test vehicle is pictured here.

All

four of these trends may intersect in some way to create

new markets for automobiles. These trends generate new entrants

(Tesla Motors) but also entices established carmakers (Daimler)

to seek out new business models (car2go). Information Technology

will play an increasing role, which has already drawn in

Alphabet (i.e., Google) to develop autonomous vehicle. Waymo, Google's car unit, is considered years ahead of established carmakers

for developing self-driving cars. It's test vehicle is pictured here.

Until recently, traditional carmakers have focused entirely on optimizing the internal combustion engine (e.g., turbocharging), mild hybridization, transmission improvements such as dual-clutch systems and more speeds, better aerodynamics, and lighter materials in order to gain better fuel efficiency. This strategy faces diminishing returns, and smaller carmakers such as Volvo face a tough decision: continue to pursue these incremental improvements at great cost, or pursue the next-generation of engine technology. With limited resources, Volvo has opted for the latter. Its Chinese owner may be able to provide crucial complementarities; Geely started selling the Emgrand EV sedan in 2015 and sold 12,000 units in 2016. Volvo developed a new Compact Modular Architecture (CMA) platform for its future models that Geely is expected to use as well.

As for Volvo, a maker of premium vehicles, the business strategy to shift to hybrid-electric and pure-electric vehicles is sound. The engine performance of PHEVs will be acceptable to current Volvo drivers, and the enhanced fuel efficiency will be appealing financially if, as expected, PHEV technology will come at little increased purchase cost. Volvo, as a historic frontrunner in safety, can claim the mantle of sustainability frontrunner as well. As Aarian Marshall put it in Wired Magazine, Volvo's electric car plan isn't as bold or crazy as it seems. Going PHEV is not risky any more, and to what extent consumers will choose between PHEVs and EVs Volvo is hedging on. Volvo's business strategy is also in line with the aspiriations and affluence of its customer base. Other European and Asian carmakers are not far behind Volvo, while in the United States low fuel taxes will continue to favour combustion engines for some time. Tesla Motors has carved out a niche at the premium end of the market, but whether the company's new Model 3 (the first model rolled off the assembly line on July 6) will inspire cost-conscious buyers will remain to be seen. Tesla's competition is not sleeping, and neither is Volvo's.