EV-volumes.com, a Swedish consultancy that maintains a database of worldwide electric vehicles (EV) sales, provides a fresh look at the quickly-evolving market for EVs. Looking at the statistics for 2018 shows an amazingly interesting picture: EV growth is heavily dominated by China, followed by the United States as a distant second.

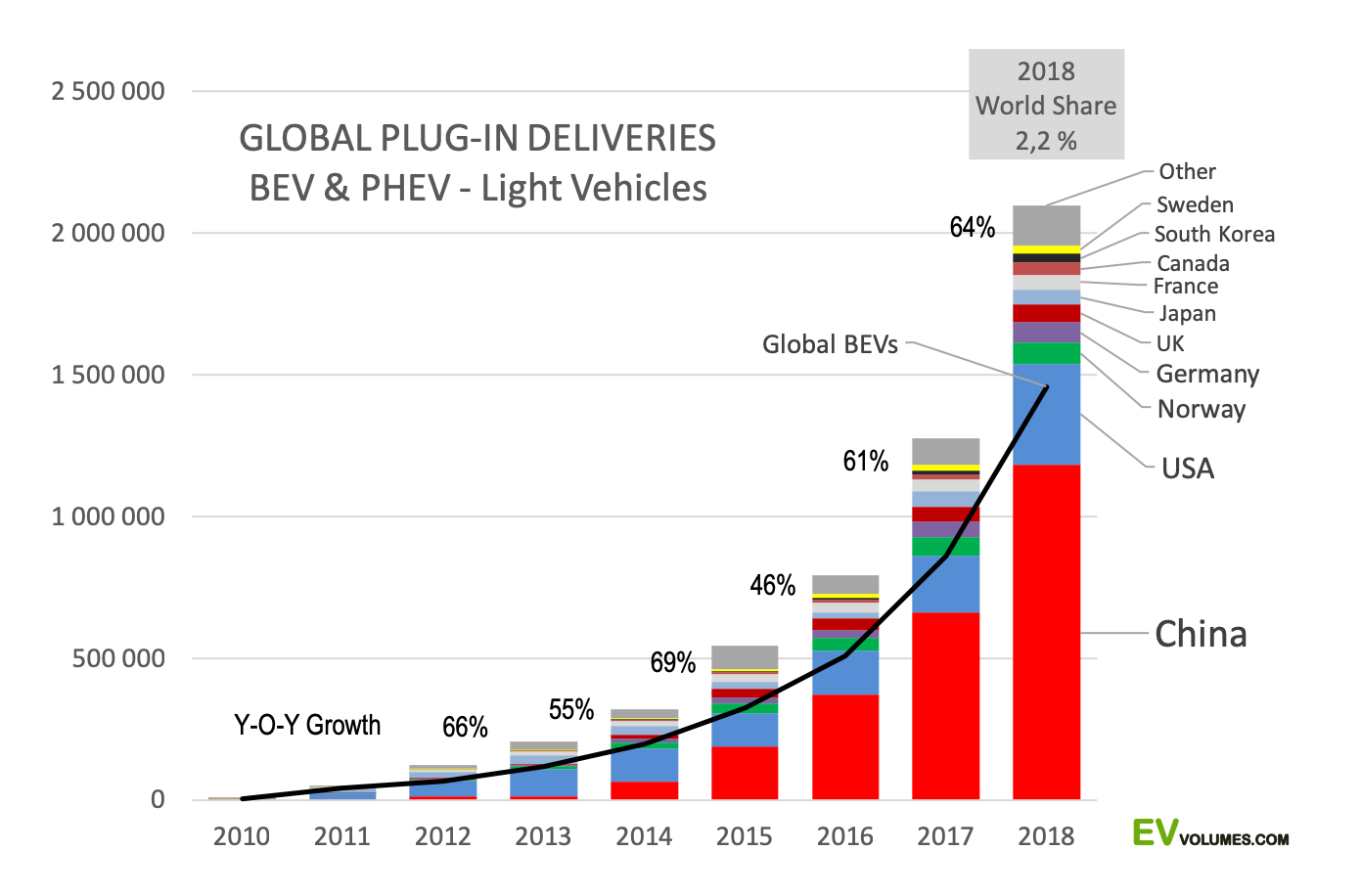

diagram courtesy of EV-volumes.com; click on image for full scale

EV-volumes.com reported that over 2.1 million EVs were sold in 2018, a 64% increase over the previous year. China accounted for more than half of the global market in 2018. When it comes to adoption rates, Norway is leading the way, where 4 in 10 new vehicles are battery-electric vehicles (BEV) or plug-in hybrid (PHEV), together referred to also as "New Energy Vehicles" (NEV).

While much media attention has been on the luxury EV segment and sales of the new Tesla Model-3, the market for EVs outside North America is focused on smaller vehicles. Technology is advancing and offering improved range. For example, the new 2019 Nissan Leaf (also known as the Leaf Plus) has become a new EV star with its new 62-kWh battery pack that replaces the previous 50-kWh pack in the same amount of space. The Leaf's range expanded from 240km to 360km.

Not along ago, China claimed the mantle of global leadership on deployment of solar panels and solar power. China's solar panel makers have dominated export markets in recent years as well. Even though China's "531 policy" (pulling the plug on various subsidies) has slowed down growth, this has not reduced China's pre-eminence in solar power deployment, led by JinkoSolar. Chinese-Canadian company Canadian Solar is one of the few North American contenders in this market. As the BBC's Chris Baraniuk reports, we can see how China's giant solar farms are transforming wold energy. The push towards clean electricity is matched by China's ambition to become a global player in electric vehicle production.

‘Car makers don't want to suffer a "Kodak moment"—losing a market to competitors because of rapid technological change.’

Western car makers appeared to have moved only cautiously into EV development during this last decade, but a turning point has been reached. As I discussed in July 2017, car makers are waking up to the realization that the 2020s will become the decade of electric vehicles—because once battery cost are down sufficiently, they will be the cheaper, better, cleaner choice for motorists. None of the big car makers wants to suffer a "Kodak moment": not the type the company advertised in their marketing campaigns, but the collapse of Kodak when customer preferences changed from film to digital, and eventually from conventional cameras to smartphones, too fast for the film maker to realize that the market had shifted below its feet. By the end of 2010, Kodak had dropped out of the S&P500 index. Today the company is a shadow of its former self. Just like Kodak in the early 2000s, today's car makers must evolve into the electric age or face losing relevance. It is true that upstart Tesla and Rivian are still struggling, but this does not change the underlying emerging trend. Eventually, these upstarts may well become acquisition targets by the big car makers. Ford has already invested $500mio. in Rivian.

Car makers such as Ford and Volkswagen are joining forces in a strategic alliance to further EV development. BMW and Mercedes are discussing EV cooperation to share platforms and technologies. Car manufacturers, with the exception of Tesla, are not plunging into a single technology choice for sourcing batteries. For example, Nissan sources its batteries from LG Chem. Volkswagen is spreading its risk and is said to invest over €50billion into battery makers Northvolt (Sweden), SKI, LG Chem and Samsung (all three in South Korea) and CATL (in China).

In 2017, a McKinsey report summarizes the trend for production cost of batteries as follows:

From 2010 to 2016, battery pack prices fell roughly 80% from about $1,000/kWh to about $227/kWh. Despite that drop, battery costs continue to make EVs more costly than comparable ICE-powered variants. Current projections put EV battery pack prices below $190/kWh by the end of the decade, and suggest the potential for pack prices to fall below $100/kWh by 2030.

The $100/kWh mark is often considered a significant threshold for mass adoption of EVs. Perhaps we are getting there faster than even a few years ago was thought realistic. More recent reports put industry cost of EV battery packs are thought to be around $190/kWh, and Envision Energy Says EV Battery Cell Costs Will Fall Below $50/kWh By 2025. We could cross the $100/kWh mark already by the end of 2020, although other experts are more cautious, but still predict a below-$100/kWh cost by 2025.

China is an excellent position to become a key player in the EV market. As Julia Pyper argued in China Poised to Dominate EV Battery Manufacturing, Chinese battery manufacturers such as BYD Co. and Contemporary Amperex Technology Co. (CATL) are all planning on scaling up production significantly and eventually surpass the scale of the Tesla/Panasonic gigafactory; see also This Chinese battery maker will soon surpass Tesla in capacity.

China's role in the EV market is a welcome stimulant for innovation. The big automakers are all shaken up and don't want to miss the boat. Volkswagen (VW) will soon start building the new ID.3 model, which the company hopes will become in the next decade what the Beetle and the Golf have been in previous decades. The mid-level 58-kWh model is said to offer a range of 410km, while the 77-kWh high-end trim will offer a 540km range. The ID.3 will be based on its new modular MEB (Modularer E-Antriebs Baukasten) platform. With Volkswagen's ambitious commitment to electromobility, the company emerges strongly from the dark shadows of the emission scandal. VW and other manufactures are clearly understanding that EVs are not a fad, but the future of mobility. Volkswagen, for example, is keeping a keen eye on the Chinese market. Alongside production of electric drives in its plant in Kassel, Germany, the company will also produce electric drives at tis Tianjin plant in China. Jointly, they are expected to produce 1.4 million electric drives per year from 2023 on. A recent report from Reuters indicates that VW is retooling 16 factories to build electric vehicles and plans to start producing 33 different electric cars under the Skoda, Audi, VW and Seat brands by mid-2023.

‘To realize the full environmental potential of EVs, our electricity grids need to become cleaner as well. ’

The future of mobility is electric. This future will be cleaner as electric grids are increasingly turning to renewable sources. To succeed, the expansion of EV use must go hand in hand with phasing out coal from the electric grid. In my January 2019 blog Coal's retreat is good news for climate change, for some countries the path is still long. Many countries, including China, the United States, and Germany, still have too much coal in their electricity mix to make EVs the clean choice everywhere. Before you buy an EV, check whether your electricity is clean. If you happen to live in British Columbia or California, the answer is "yes". To make EVs live up to their full potential of lower emissions, massive investments into a cleaner electricity grid are needed as well.

Further readings and sources:

- International Energy Agency: Global EV Outlook 2019, 2019.

- Patrick Hertzke, Nicolai Müller, Stephanie Schenk, Ting Wu: , McKinsey & Company, April 2018.

- New market. New entrants. New challenges. Battery Electric Vehicles, Deloitte LLP, 2019.