click on image for high-resolution PDF version

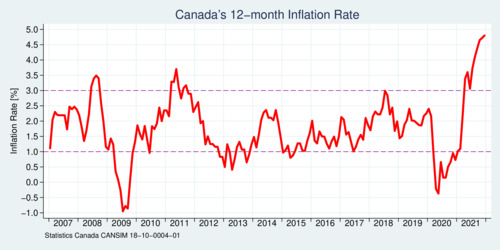

Prices are on the rise, as the above graph shows. News services report on the latest Statistics Canada data that show that Canada's inflation rate rises to new 30-year high of 4.8%. How bad is it? Are we looking at a continuation of rising prices, or are we still witnessing a pandemic-induced transitory shock?

Food and energy pries are particularly volatile, and thus they are typically removed from the analysis to focus on core inflation trends. By this measure, inflation just topped 3% and thus exceeds the 1–3% inflation target for the Bank of Canada

click on image for high-resolution PDF version

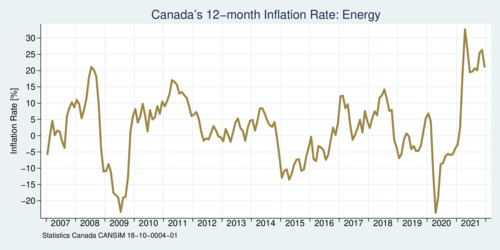

Energy is particularly volatile as shown in the next graph, with rates bouncing between minus twenty and plus thirty percent. When the pandemic started, energy prices plummeted, but have since picked up pace. The price of crude oil is only slightly higher now than it was at the start of the pandemic.

click on image for high-resolution PDF version

The cost of food is also more volatile than other goods and services, as the next graph reveals. Inflation rates vary between about minus two and plus eight percent, and in December 2021 reached five percent. However, this is only slightly higher than during previous peaks in 2011 and 2014, and less than during the 2008-09 recession. Also, at the beginning of the pandemic food prices dropped, and they are now catching up.

click on image for high-resolution PDF version

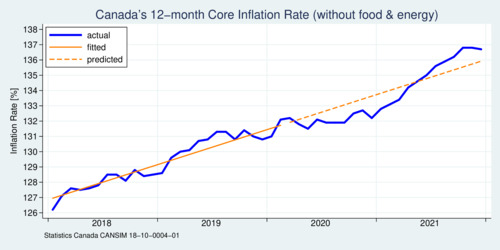

Let us focus a bit closer on the recent years. Fitting a trend line through the CPI index from 2015 to January 2020, and extrapolating, yields the orange solid and dashed line in the diagram below. The blue curve is only slightly above the trend line now, and it would be difficult to read "crisis" into this deviation.

click on image for high-resolution PDF version

Lastly, let us use another metric for inflation, the 24-month rate instead of the 12-month rate. Thus inflation is anchored relative to 2019 than 2020. The last diagram shows the all-items inflation rate (which includes volatile food and energy prices) based on this alternative metric that avoids the distortions from the pandemic. Here, inflation is well within the 1–3 percent band that the Bank of Canada targets.

click on image for high-resolution PDF version

The above analysis shows that it is perhaps too early to panic about inflation. Yes, there are worrisome signs that inflation is heating up in particular areas. I fully expect the Bank of Canada to start rising interest rates gently during 2022 in order to signal that it will act more significantly if the need arises. What we need to worry most about is that the current burst of inflation leads to a spiral of higher wage demand that in turn translate into higher consumer prices. The most important task for the Bank of Canada will be to manage expectations. If inflation expectations change, it will have significant repercussions throughout the entire economy. Even transitory inflation can cause lasting harm, as C.D. Howe Institute economist William Robson pointed out. The moment the 24-month core inflation figure crosses the 3-percent threshold, the Bank of Canada must act.

What is driving inflation is a combination of effects. First is the excess volatility from the pandemic. Prices dropped, than rose sharply. Thus for food and energy one needs to carefully compare prices with pre-pandemic levels and trends. The cost of energy, as measured by the price of crude oil, is roughly in line with 2018-2019 rates of USD 50–80/barrel. What is more worrisome is the combinaton of supply and demand conditions. Because people have been spending less money on services, which are less available since the start of the pandemic, they have been spending more on durable goods. This has driven up prices for a variety of such items including cars, appliances, and furniture. At the same time we have seen shortages in production (e.g., computer chips) and espeically transportation. The supply-demand imbalance has the predictable effect of increasing prices.

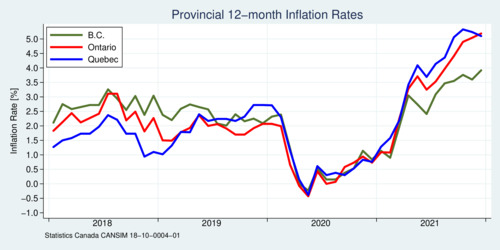

Lastly, a look at inflation trends in three Canadian provinces over the last four years: British Columbia, Ontario, and Quebec. The good news for British Columbians is that inflation is rising less rapidly here than in Central Canada. Inflation in Ontario in December 2021 was 5.2%, while only 3.9% in British Columbia.

click on image for high-resolution PDF version

Information sources:

- Statistics Canada: Consumer Price Index, December 2021

- Statistics Canada: CANSIM Table 18-10-0004-01, Consumer Price Index, monthly, not seasonally adjusted.

- Bank of Canada: Inflation Calculator (1914-2021).

- What will happen to inflation in 2022?, The Economist, November 8, 2021.

- After a shocker in 2021, where might inflation go in 2022?, The Economist, December 18, 2021.

- William Robson: `Transitory' inflation does lasting harm, Globe & Mail Op-Ed, C.D. Howe Institute.

- Paul Krugman: The Year of Inflation Infamy, The New York Times, December 16, 2021.