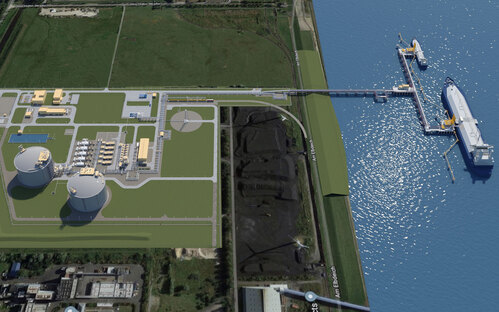

Image: German LNG Terminal GmbH

‘Germany's energy policy Energiewende has just got a massive jolt of Energieschock.’

Russia's war against Ukraine has prompted Germany's government to pivot away from Russian natural gas imports. In recent years Germany imported somewhere between 50% and 60% of its natural gas from Russia. What even last year looked like a sensible business decision has now become a severe economic and political vulnerability. How did Germany get there, and what are the posible ways forward? What role can liquefied natural gas (LNG) play, and will it be enough?

Germany's Chancellor Olaf Scholz, announced in parliament on February 27 that Germany would move expeditiously to build two LNG import terminals—regasification plants—that have been on the drawing board for a while but had been languishing because of what appeared to be a weak economic case compared to imports through Nordstream 2, and also because of a lack of clear commitment from the federal government to support these projects and see them through the permitting process. Energy security has suddenly emerged as a top priority, and that means weaning Germany off natural gas imported from Russia. In practice, energy security does not mean energy independence but energy diversification. Over the last two decades, Germany has pursued a policy called Energiewende (energy transition), which has seen the build-up of renewable energy combined with the phase-out of nuclear and coal power plants. Germany is now getting an Energieschock (an energy shock), and a big jolt of that. Despite the dire circumstances that have prompted it, it could lead to a worthwhile new direction of the energy transition: transitioning away from fossil fuels faster than planned.

The word Energieschock appears appropriate in this context, especially if Russian energy exports cease. The German word "Schock" has the same dual meaning as in English. It refers to a physical jolt as much as a psychological upheaval.

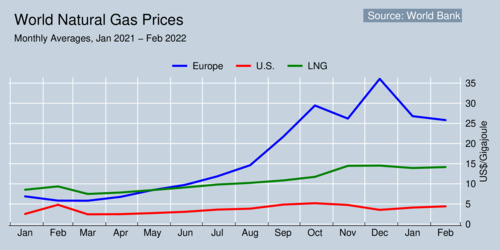

Unlike many other European countries, Germany has no import terminals for LNG terminals. The reason for this was that imported natural gas from Russia tended to be more economical—and typically traded through long-term contracts. Initially, LNG prices were less favourable and more volatile, but LNG prices in Japan are now lower than natural gas prices in Europe (see chart below).

click on image for high-resolution PDF version

‘LNG provides an opportunity for lowering exposure to geopolitical risk through import diversification.’

To unwind Germany's economy from geopolitical dependence on Russian gas, turning to LNG makes eminent sense. LNG can be supplied from a host of alternative producers, many of them friendly partners such as the United States and Australia. New LNG capacity is coming online, including in Canada. The market for LNG products is expanding. Consequently, LNG provides an opportunity for lowering exposure to geopolitical risk through import diversification

The picture at the top of the blog shows one of the proposed projects, the German LNG project, which is planned to be built near Brunsbüttel at the North Sea coast in the state of Schleswig-Holstein. The project is a joint venture between two Dutch and one German company: Gasunie and Vopak LNG Holding from the Netherlands, and Oiltanking from Germany. Under the original timeline, it was estimated to be put into service at the earliest in 2026. Whether this timeline can be accelerated will receive a fair bit of attention in the following weeks. The Brunsbüttel plant is designed for a capacity of 8 billion cubic meters per year (bcm/a) capacity, equivalent to 5.8 million tonnes per year (MTPA).

Another terminal is planned to be built in Stade (Lower Saxony) near Hamburg, with an even larger capacity of 11.8 bcm/a (8.5 MTPA). This terminal is pursued by Hanseatic Energy Hub GmbH. However, this plan is not one of the two that has been mentioned in the address to parliament by Germany's chancellor.

The second proposed LNG import terminal would be located near Wilhelmshaven, a deep sea port. According to reports, the German government has already asked the energy company Uniper to resume its plans to build the LNG plant. Energy company Uniper emerged in 2016 as a spin-off from electric utility E.ON and is focusing on conventional fossil fuel assets. Uniper had recently abandoned plans to build this LNG terminal and instead pursuit alternative plans to build it as a hydrogen plant.

As reported by the US Energy Information Administration, Europe (EU-27 plus UK) has increased imports of LNG since 2019, when the US has become a major provider. Three countries provided almost 70% of liquefied natural gas received in Europe in 2021: the US (26%), Qatar (24%), and Russia (20%).

Building LNG terminals had been criticized for locking in fossil fuel supplies rather than transitioning away from them. However, these terminals do not need to become "stranded assets" in the future. They can be converted to import green hydrogen in the future. For now, LNG import capacity is what Germany needs urgently.

How did Germany end up in this malaise about natural gas?

Simply put, Germany gambled on Russia becoming a reliable partner commercially and politically. It turned out that the second part was a strategic miscalculation. Under a leadership different than Putin this "trade and dialogue" policy (in German known as Wandel durch Handel—transformation through trade) may have succeeded, but Russia has had the misfortune of handing reign to an autocrat who has increasingly suppressed freedom of expression and who has cemented his power ruthlessly, even changing the constitution so that he could remain in office indefinitely. The signs were there: Russia's 2014 occupation of Crimea was the warning sign that we in the West collectively refused to see for what it was: prelude to something much more sinister.

‘The European Union put out an economic and political welcome mat for Russia. Vladimir Putin poured gasoline on it and put it on fire.’

The European Union has long pursued a policy of welcoming new members. For aspiring new members, EU membership has become a route towards fostering democratic stability and economic prosperity. After the post-communist transformation of Eastern Europe, German businesses were eager to build new commercial bridges to the former communist countries. With economic integration comes political interdependence that helps countries negotiate amicable solutions to bilateral conflicts. In principle, this economic and political rationale is solid. Many of the post-communist Eastern European countries joined the European Union, as well as NATO. Europe welcomed Russia too, economically and politically. A welcome mat was put out for Russia as well. However, Vladimir Putin decided to pour gasoline on that mat and put it on fire. Germany's gamble has failed. Now comes the reckoning, at great economic cost. On February 28, Ukraine's president Volodymyr Zelensky signed the formal application for his country's membership in the European Union. The people of Ukraine deserve a path towards E.U. membership, a path towards peace, prosperity, and democracy.

Which scenarios could play out in the next months and years?

The first scenario is the business-as-usual scenario, unlikely as it may be. Russia continues to deliver natural gas according to its contractual obligations, and Germany continues to pay for it through the remaining payment channels. In the long term, Germany diversifies its import sources through LNG and weans itself off Russian gas gradually. Yet, it is hard to imagine that this benign scenario will play out. While gas is still flowing today, there is no guarantee that it will tomorrow as the war in Ukraine continues. Eventually, something will give. Russia will be tempted to retaliate against economic sanctions by cutting off supplies.

In scenario #1, Germany and other European countries would expire the long-term contracts they have with Russia, and not renew them afterwards. This will dicontinue the minimum take-or-pay levels.

Scenario #2 is one where the Transgas pipeline through Ukraine becomes inoperable as a consequence of the war, either because it is damaged, or gas flows are stopped purposefully. This would cut off the bulk of natural gas supply from Russia and would leave the Nordstream-1 and Jamal lines, for a total of 88 bcm/a capacity. Germany would have to scramble resupplying natural gas from other sources, and implement demand-side management (DSM) policies to prioritize household heating during the winter. Natural gas prices would soar and encourage conservation, but additional policies will be needed to deal with hardship for many households and particular industries.

‘The scenario of a complete Russian natural gas cut-off is not inconceivable but won't spell disaster.’

Scenario #3 is the worst-case scenario. Russia retaliates against Western sanctions by cutting off gas supplies completely. This is a two-sided sword for Russia: cutting off gas supplies will hurt Germany's economy, but it will also cut off significant export revenues for Russia. Russia's leadership may calculate that if they can't use the export revenues because their foreign currency reserves are frozen, they may as well stop deliveries. Yet, Russia's economy will suffer far worse than Germany's if natural gas trade ceases, given the modest size and export-dependence of Russia's economy. Ultimately, Germany's economy is three times that of Russia's, and much more diversified and resilient. The EU's combined economy is about ten times that of Russia's. Scenario #3 is far from inconceivable. If economic sanctions against Russia start to bite, there is no telling what madness may befall the Kremlin's leader.

Germany— and to varying degree its European Union partners—must prepare for the bad-case and worst-case scenarios. I trust that experts in Berlin and Brussels are working overtime developing scenario analyses and contingency plans. Even the worst-case scenario will not spell economic disaster: significant pain, likely, but not disaster. There are even some long-term upsides to the worst-case scenario.

Can LNG imports replace Russian natural gas imports?

Unsurprisingly, the answer is: not completely, not in the short term. Surprisingly, however, the answer is also: in the long term, quite possibly. The proposed LNG import terminals in Germany may only bring additional 20 bcm/a import capacity online, but Germany's gas pipelines are connected well throughout the region, and there is now a significant amount of LNG import capacity all around the European coast lines. Germany's total natural gas demand has been about 80-90 bcm/a in recent years, so with 20 bcm/a from LNG, Germany could only cover about a quarter of its total demand. But 20 bcm/a would replace about a third of what is imported from Russia. Europe has a total of 28 large-scale regasification terminals with a combined import capacity of 237 bcm/a. More intra-European pipeline can be built to connect the system. The European Union has the Southern Gas Corridor in works, and it adds more capacity step by step. But LNG alone won't suffice to replace Russian gas. What else is needed?

First, let the market do its magic. High gas prices need to be passed on to households and businesses in order to incentivize conservation. This means reducing demand. Less affluent households need financial assistance, which can be achieved in part through a suitable two-part tariff for delivering natural gas to households. The upside of high prices is that Germany will accelerate weaning itself off natural gas quicker. Households will start deploying heat pumps on a large scale, a trend that has already taken off because heat pumps provide heating in the winter as well as cooling in the summer. Shielding households against the full financial impact of over-the-top natural gas prices will require keeping electricity prices low, encouraging switching. Some of the shortfall on the natural gas side must be compensated by an increase in electricity supply. Households will also need to adjust their demand. Lowering their thermostats by just 1°C is estimated to save European households about 10 bcm/a in natural gas.

Second, in order to keep electricity prices affordable, Germany needs to contemplate the previously unthinkable: keeping the remaining thre nuclear reactors online past 2022 (when they were scheduled to be shut down), and perhaps even bringing back to life some of the most recently mothballed nuclear reactors. Rather than spewing carbon dioxide into the air by relying more on coal-fired power plants that are due to be phased out, it would make eminently more sense to rely on nuclear power for a bit longer than planned. However, doing so will not be easy—many of the workers at these plants have moved on already, and re-certification and re-supply of nuclear fuel is far from guaranteed. Nevertheless, if that is what it takes to bridge the energy transition and keep homes heated in the next winters and thus avert the worst of the Energieschock, then this option should be back on the table for discussion. Germany's government should give careful consideration to extending the life of the remaining three reactors.

Third, Europe needs to urgently build out more natural gas storage: replenish it during the summer, and use it during the winter. Europe needs both seasonal storage to manage the cyclical variation as well as strategic reserves to deal with unexpected demand and supply shocks. The Institute for Energy Economics at the University of Cologne is reportedly working on a study for Germany's Economy Ministry to identify policies that would require or incentivize gas providers to invest into sufficient storage capacity. Essentially, come October of the year the existing storage tanks need to be nearly full in order to make it through the winter.

If the Russia-induced Energieschock ultimately accelerates the deployment of renewable energy, increases energy conservation and the electrification of heating, cooling, and mobility, and also makes Germany reconsider its aversion to nuclear power to some extent, I can see a bright light at the end of the dark tunnel. A crisis can be an opportunity too; it appears as if Germany's government is rising to the challenge.

The world has changed

Germany's Chancellor Olaf Scholz spoke of a Zeitenwende in his historic speech to Germany's parliament. The German word Zeitenwende means "turning point in history", the moment when political paradigms shift in recognition of a changed reality. Scholz is right that we are living through a watershed moment, a bifurcation point in history. There will be reorientation in many policy areas, with energy policy perhaps one of the most exposed areas.

‘Who can we trust with our critical energy supplies? Our friends.’

Germany is joining its European neighbours in cutting Russia's major banks out of the SWIFT network, in particular targeting Russia's central bank and its vast foreign currency reserves. Germany will also supply military aid to Ukraine, in a major policy turnaround. Germany's military will receive an immediate €100 billion injection, and defense spending will rise to 2% of Germany's GDP. In recent years it had fallen below 1.2% and only rose to 1.4% in 2020. Defense is not just military hardware. It also includes defending critical infrastructure ("hardening") and even includes financing economic development in other countries to reduce potential military threats. In a global world, defense starts with global diplomacy, building friendships and alliances that share our values of democracy, justice, and civil liberties. But ultimately our democracies also need protection against aggressors, and that requires sufficient military capabilities (and that means: closing existing notable capability gaps first) and a reliable military alliance of like-minded nations: NATO's thirty member countries. If anything, Russia's war against Ukraine has already succeeded in one thing: it has reinvigorated NATO and the transatlantic partnership. This political partnership will also increasingly evolve into a stronger energy partnership. When it comes to our critical energy supplies, who can we trust?

The Zeitenwende will go beyond the war in Ukraine. It is time to reassess geopolitical vulnerabilities in international trade and replace wishful thinking and purposeful optimism with some hard-nosed reality checks and scenario analyses. After all, Russia is not the only military power with territorial ambitions. If Russia gets away with raging war against its neighbour, it will only embolden military adventurism elsewhere.

Further readings and information sources:

- Kate Connolly: Can Germany function without Vladimir Putin's gas?, The Guardian, 25 February 2022.

- Niclas Poitiers, Simone Tagliapietra, Guntram B. Wolff, and Georg Zachmann: The Kremlin's Gas Wars: How Europe Can Protect Itself From Russian Blackmail, Foreign Affairs, February 27, 2022.

- Could Europe manage without Russian gas?, The Economist, October 27, 2021.

- International Energy Agency: A 10-Point Plan to Reduce the European Union's Reliance on Russian Natural Gas, March 2022.

- Rüdiger Bachmann et al.: What if? The Economic Effects for Germany of a Stop of Energy Imports from Russia, ECONtribute Policy Brief No. 028, March 2022.

- Ben McWilliams et al: Preparing for the first winter without Russian gas, Bruegel Blog Post, February 28, 2022.