"who wishes to fight must first count the cost"

— Sun Tzu, The Art of War

The year 2025 marks a fundamental shift in international trade. The US government has launched a trade war that is on track to upend the rules-based system that was established through the General Agreement on Tariffs and Trade (GATT) and the World Trade Organization (WTO). The economic justification for this radical policy shift remains elusive and shifting. One focal point is the U.S. trade deficit, but mostly the talk coming out of Washington appears to be about "reshoring" manufacturing jobs. Trade appears to be seen as a zero-sum game in which there are only winners and losers, and the new administration essentially wants to be a winner. But there are no winners in a trade war—it's just a matter of how badly one loses. And here a careful analysis reveals that the cards are actually stacked against the United States. In picking a fight with China (currently at a tariff level of 145% on most goods), the Trump administration does not appear to have counted the cards it holds in its hand correctly, and it does not seem to understand the strong cards that China holds in its hand. In a prolonged trade war, China is in a solid position to retain the upper hand. What exactly are the reasons for China's advantage?

Reason 1: China's large stake in US bonds gives it leverage over capital markets and US government debt

In international economics, the current account (which captures trade in goods and services) ant the capital account (which captures investment flows) are mirror images, except for adjustments in a country's foreign reserves. China's trade surplus is America's trade deficit. But China's trade surplus also translates into capital outflows from China because every U.S. Dollar earned from an export surplus needs to be invested wherever a U.S. Dollar can be invested—predominantly in the United States. In the past, the United States could rely largely on capital inflows from China, as China bought US government debt—mostly treasuries securities. China's investment in the United States, mostly in the form of short-term securities, makes the United States vulnerable to a very specific form of retaliation. Unlike foreign direct investment into physical assets, investments into short-term securities can become profoundly footloose.

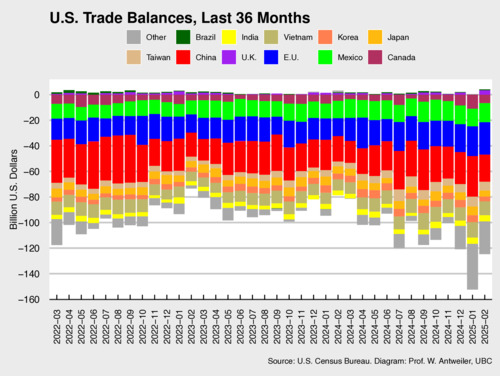

To provide some trade statistics in this context is very helpful. The first chart below shows the monthly trade balances that the United States has with its major trading partners. The U.S. has large deficits with almost all of them. The reason here is twofold. First, the United States provided the world with the most widely-held reserve currency. This means that the United States could print paper money and get goods and services in return—essentially for next to nothing! That is one sweet deal that the current administration in Washington does not seem to comprehend. Why on Earth give up on this beneficial free-ride? Second, the United States is home to one of the most vibrant and innovative economies, attracting capital from around the world to invest in its cutting-edge technology companies. But to soak up all that investment, it is inevitable to run a capital account surplus (more inflows than outflows). All considered, the United States' current account deficit and capital account surplus go hand in hand, and this is mostly a sign of the strength of the U.S. economy.

click on image for high-resolution PDF version

Interesting in the chart above may be the jump in the U.S. deficit in January 2025, as many U.S. importers started to stockpile goods in anticipation of the trade war. The trade deficit with China was noticeably smaller in February.

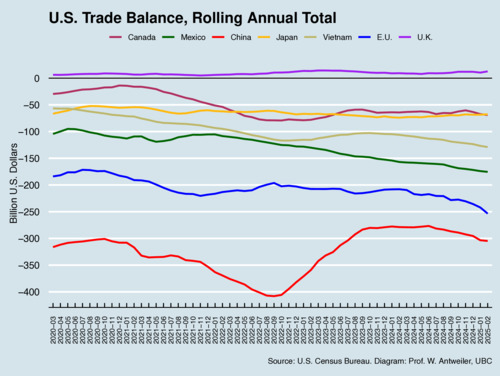

The second diagram shows a rolling annual total of the monthly trade deficit, for major countries. The trade deficit with China hovers around the $300B mark but also touched on $400B. The trade deficit with Canada is largely stable, and comparatively small. Among the major trading partners, the U.S. only has a small trade surplus with United Kingdom. There are some noticeable trends, however. The United States experiences widening trade deficits with Mexico and Vietnam, and this may already be a reflection of trade diversion due to existing U.S. tariffs against China.

click on image for high-resolution PDF version

‘The U.S. government is vulnerable to a run on treasury securities.’

What could happen if China starts pulling out of U.S. treasuries? The answer we have already seen in the days following Trump's so-called "Liberation Day" announcement: bond prices started to fall, and yields started to rise. It appears that money is flowing out of the United States, actually lowering the exchange rate as investors are selling US Dollars for other currencies. With bond yields rising, the cost of financing the burgeoning U.S. debt will rise, reducing the scope for tax reductions more than tariff revenue could possibly be gained. Stirring up a run on U.S. treasuries does not need to rely on Chinese action alone. Investors are a fickle and nervous crowd, and rather than being the traditional "safe haven", the U.S. itself has become the source of uncertainty and capriciousness. The damage could proliferate if it threatened the status of the U.S. Dollar as the world's dominant reserve currency. However, China will be cautious to offload its investments in U.S. treasuries on a large scale. China is not interested in seeing its renminbi appreciate too strongly against the U.S. Dollar, and if China continues to run a trade surplus against the U.S., it needs to park its export revenue somewhere. But even small offloading of U.S. treasury securities can spook the markets sufficiently to get the desired attention. Expect a sequence of needle pricks, not hammer swings.

Reason 2: China's control of critical minerals

China has limited ability to retaliate against U.S. tariffs on a dollar-for-dollar basis, because China's imports of U.S. goods are much less than China's exports to the United States. China has largely announced retaliation on a percent-for-percent basis for tariffs, but the trade asymmetry is not in China's favour. This means that China has been looking for asymmetric responses in its favour.

China has some exports that are critical to the United States, while most U.S. exports to China are not so critical to China. China's leadership has been pushing hard over the last few years to develop economic autonomy and lessen import dependence. China can also import much of the machinery it relies on from other countries, notably the European Union. Need planes? Buy Airbus instead of Boeing. Need turbines? Buy Siemens instead of General Electric.

‘China can retaliate asymmetrically by using its dominance in critical minerals trade.’

China has a near-monopoly in many critical minerals, and the U.S. gets many critical minerals from China. On April 4, China announced export restrictions on seven Rare Earth Elements (REEs) and certain types of magnets that are used in the automobile, energy, and defense industries. These medium/heavy REEs include: dysprosium, gadolinium, lutetium, samarium, scandium, terbium, and yttrium. As of now, these restrictions do not amount to a complete ban, but require Chinese exporters to apply for an export license. As the administrative logistics are yet to be set up fully, the lack of export licenses amounts to a temporary export ban. The message is clear: China is gearing up to pull the plug on these exports if and when needed. The United States is not able to replace these REEs in the short term. There is only one active REE mine in the U.S. ( Mountain Pass, California), and proposed new mines mostly focus on light REEs. The U.S. would need partners elsewhere in the world to close the gap more quickly. For now, China's dominance in rare earths industries and critical mineral processing is much to the disadvantage of the United States. Arguably, loosening this dependence require investment from Western countries, but the United States is picking not only a battle with China, but with the rest of the world too.

China has signaled its ability to impose a ban, and perhaps widen it. If the trade war escalates, expect China to use its critical minerals dominance more fully. Small as the imports may be in value, they are pivotal for some industries. Asymmetric responses in a trade war focus on maximizing harm on the opponent's side at limited cost on the domestic side. China understands this principle well.

Reason 3: China's coherent and disciplined leadership faces incoherent and haphazard U.S. leadership

The current U.S. leadership presents an image of incoherence and chaos. Decisions are made, then pulled back or paused, moved forward again in a different form, and the pulled back partially again, with every-varying explanations. One has to second guess statements from the White House to filter out what the true (or primary) intentions may be: reducing the trade deficit, raising revenue to finance tax cuts, forcing trade partners to lower their tariffs, reshoring jobs, or using economic coercion to make foreign countries to do whatever pleases the U.S. administration (which may shift every day). There is no coherent message from the U.S. administration about what the goal is. The various proposed or implemented tariff measures are not well suited for any of the aforementioned objectives—if any of these were truly the primary target, for each there are better economic instruments at the government's disposal.

The approach that the U.S. administration has chosen creates confusion and uncertainty. Some supporters of the U.S. government argue that there is "method to this madness", but to most observers there is only madness to this method. Some countries are trying to appease the U.S. President, and this is of course exactly what the U.S. President wants: foreign countries as supplicants. Their entreaties are met with disdain, disrespect, and derision. Other countries, including China and Canada are fighting back, and preserve their dignity in doing so. As more countries are banding together to take a stand for free trade, expect China, Canada, the European Union, and other countries to start collaborating on a more coordinated response.

‘Incoherent tariffs create trade chaos and compound self-inflicted economic harm in the United States.’

Compared to the chaos of the Trump administration, China's leadership appears focused, competent, and principled. Most importantly, they focus on the long term and are willing to suffer short-term pain for long-term gain. There is significant ability in China to absorb short-term pain, much more so than in the United States where public sentiment could (and likely will) swing against the tariff policies once the economic harm arrives in towns and homes across the country.

China is not without fault in all of this. China's export surge, commonly known as the "China Shock" after the country's WTO accession in 2001, has indeed contributed to the erosion of manufacturing industries in Western countries. China's export boom has been fueled by an astonishingly high savings rate, which combined with easy financing has prompted industrial build-up with significant overcapacity. But America has also hugely benefited from China as the world's manufacturing base—affordable products have improved the lives of many Americans. Furthermore, trade was not the only, and perhaps not even most important, factor in the erosion of manufacturing industries in the United States. Technological change and automation also contributed significantly, and therefore no level of tariffs will restore these jobs that were swept away by technological advances. The U.S. will never regain most of the manufacturing jobs that were lost, not from China and not from any other countries. Any "reshoring" of manufacturing to the United States will be mostly cosmetic and symbolic, rather than substantive.

The bottom line is that China's Xi Jinping will never deal with America's Donald Trump as anything less than his equal as a world leader. Xi Jinping has already demonstrated that he is an apt negotiator. During the first Trump administration, China agreed to buy vast amounts of agricultural goods from the United States, but did not follow through. That's the nature of a Trump deal: all bravado, much pomp and circumstance, and little substance or follow-through. The main purpose of a deal for Trump is to make himself look grandiose; the substance counts very little for him (if at all). One cannot blame China for not holding up to the original bargain because Trump himself does not stick to agreements that he has signed. Recall that Trump's new tariffs against Canada and Mexico profoundly violate the Canada-US-Mexico Agreement, a deal he himself signed.

Reason 4: America has alienated its allies and friends

If the United States wanted to prevail in a prolonged trade dispute with China, it would need the full support of its former friends and allies. Yet, the Trump administration has done everything to alienate and antagonize everyone, treating some foes as friends and most friends as foes. Threatening or unleashing economic mayhem on neighbours is not putting them in the mood to cooperate with the Trump administration, or help them out if needed. Need critical minerals? Sorry, our store is closed. Need cheaper pharmaceuticals? Take a number and have a seat. Want to sell us defense gear? Wait, we've started producing those ourselves now. Cooperation with the United States will now come with a price sticker.

‘America will be weaker without strong allies.’

The simple truth is that the United States, mighty as its military may be, cannot project its power without a community of like-minded countries that support the United States logistically, politically, and ideologically. The United States used to fully embrace the traditional values of the Western world: competitive democracy, human rights, freedom of expression, the rule of law, and economic freedom. In short: Modern Liberalism, with a strong infusion of social and environmental responsibility. It feels as if the current U.S. administration is turning away from some of these values. This, in turn, turns other democracies away from the United States. JD Vance, Trump's vice president, described European allies as "pathetic" in an infamous group chat on Signal, as revealed by The Atlantic magazine. Insults don't help make friends. Slights from U.S. officials are not easily forgotten. Friendship requires mutual respect, and disrespect can ruin even the best friendships. Who will benefit from divisions among Western countries? Russia and China. America will be so much weaker without strong, reliable, and supportive allies.

In addition to alienating allies and friends, the Trump tariffs are attacking many countries, such as Vietnam and Cambodia, that were trying to keep an uneasy equi-distance to both China and the United States. Being targeted by prohibitive tariffs, 46% and 49% (now paused), these countries may decide—hesitantly—that closer ties with China may ultimately serve their economic interests better than be subjected to economic ruin. Beijing has already launched a charm offensive, although the response has been lukewarm so far. There is considerable risk that Trump's tariffs will drive South-East Asia closer into China's orbit—just the opposite of what previous administrations tried to accomplish.

David Pierson and Damien Cave wrote in the New York Times that China has not been a universal beacon of free trade. China has relied on extensive and opaque subsidies for select industries and its own coercive behaviour against trade partners. They opine that "the world's eroding trust in Washington has not immediately led to new-found alignment with Beijing." Contrary to popular wisdom, your enemy's enemy is not automatically your new best friend.

Reason 5: Trade wars have more holes and bulges in the front line than hot wars.

After the first trade war with the United States in 2018/19, China realized that it needed to deploy defensive strategies to insulate itself against future trade wars. China's economy has diversified in anticipation of a "Trump shock". Many of China's industries have matured significantly. An auto industry that was once dominated by foreign brands through joint ventures with domestic firms, China is now producing vehicles at scale and at quality that satisfies not only domestic consumers, but increasingly also discerning consumers elsewhere in the world.

‘The larger the tariff gap between countries, the larger the incentive for origin obfuscation.’

With tariffs remaining in place against Chinese goods even during the Biden administration, Chinese companies opened up assembly plants and light-value-added plants in neighbouring countries such as Vietnam and Cambodia. This allows Chinese companies to provide intermediate goods, relabel the goods as no longer "Made in China", and avoid the U.S. tariffs. Subterfuge is an effective line of defense, and companies have become very adapt at disguising the origin of products. The larger the tariff gap between countries, the larger the incentive for origin obfuscation. Expect many goods to slip through the U.S. tariff wall by way of third countries. How many more people would U.S. Customs and Border Protection need to hire to enforce rule of origin verification?

Workarounds using third countries have limits, however. China will be prompted to find alternative buyers for their products. Large market such as the European Union will be wary to allow Chinese producers to undercut European producers, and may likely respond with protectionist measures of their own. The E.U. has already put significant tariffs on imports of Chinese electric vehicles. China wants to partner with the E.U. to counter U.S. tariffs. Expect cooperation to be limited. Salvaging the World Trade Organization through a dispute settlement reform without the U.S., through the Multi-Party Interim Agreement (MPIA) that China has joined, may be one are of closer cooperation. Consider the MPIA one of the "bulges" in the trade war.

Reason 6: U.S. tariffs will wound and weaken the U.S. economy

‘Tariffs are a tax. Soon, U.S. consumers will start feeling the pain.’

U.S. import tariffs will not stimulate economic growth. Instead, there are many ways in which these tariffs can weaken the U.S. economy, however. Tariffs are a tax. Tariffs will raise import prices, and these higher prices will quickly make many consumer goods less affordable for many Americans. Tariffs also reduce economic efficiency, as U.S.-manufactured substitutes are generally more expensive than imported alternatives. That is of course the reason why they were imported in the first place. Protectionism is protecting inefficient domestic industries from more efficient industries abroad. With tariffs, consumers always pay a higher price. Whatever domestic jobs are created through tariffs in import-competing industries, export-oriented industries may lose jobs. Exporters are harmed through three channels. First, they may rely on imported intermediate goods subject to tariffs, or they may be forced to buy more expensive domestic intermediate goods. This raises costs and reduces competitiveness. Second, other countries may retaliate. This means exporters may face tariffs abroad, reducing their demand. Third, exporters compete in the labour market, and may find that workers drifting into protected industries raises wage costs in order to compete for these workers. What happens to the exchange rate may matter as well. Normally, broad unilateral import tariffs reduce demand for foreign currency and thus lower their value: the U.S. Dollar appreciates against them. This in turn can make exporters even less competitive abroad.

The self-harm even goes even further. Investments by businesses depend on the economic outlook: how they view the future. The most detrimental element in investment planning is uncertainty. The larger the uncertainty, the less investment takes place. Trump's chaotic approach to economic policy leaves investors cautious and worried. Who will build a new plant based on any policy announcement that comes out of Trump's White House? The only certainty about Trump is that nothing is certain. Nothing he says can be trusted, as he contradicts himself frequently, or be trusted to last.

Macroeconomics can be fiendishly complex. You pull a string in some place, and you end up pulling connected strings everywhere. Economists have studied to understand all these strings, and are mindful about unintended consequences and counter-effects. Political adventurism means pulling on a string without having a clue as to what this string is connected to. Too bad for America that many of these strings can be pulled from the White House, and even formerly-independent institutions such as the Federal Reserve are increasingly under attack to bend to Trump's wishes. Sadly, the US Congress appears completely acquiescent as their constitutional rights and prerogatives are surrendered willingly to the White House. Tariffs are the responsibility of the legislative branch, not the executive branch, of government.

✶ ✶ ✶

On balance, China is in a solid position to withstand the Trump tariffs. China's economy has noticeable domestic weaknesses, and its main external vulnerability is its large export surplus. But (direct) exports to the United States make up only 15% of total exports. Allowing for re-exports of intermediate goods through third countries may add indirect exposure. Losing a significant chunk of these exports will be painful for China, but will not be catastrophic. China is already retaliating, and can escalate its level of retaliation significantly. China's leadership appears to have decided on a determined but relatively calm course of action. I have a sense that China's leaders are rather familiar with Sun Tzu's wisdoms. I speculate that they are looking towards two of them in particular: "in war, the way is to avoid what is strong, and strike at what is weak", and "build your opponent a golden bridge to retreat across".

The United States has made itself uniquely vulnerable economically all of its own accord. China will take full advantage of these vulnerabilities. If China prevails in a trade war with the United States, don't be surprised. The United States can only blame the person they elected to become their 47th president for any ensuing economic mayhem. Will U.S. Americans come to regret their electoral choice?

Further readings and references:

- Trade Wars Are Easy to Lose, Foreign Affairs, April 9, 2025.

- How America could end up making China great again, The Economist, April 3, 2025.

- China hits back hard against Trump's tariffs, The Economist, April 4, 2025.

- Why China thinks it might win a trade war with Trump, The Economist, April 8, 2025.

- Patrick Wintour: Will Trump's tariff chaos be China's gain in global trade wars?, The Guardian, April 10, 2025.

- Eric Reguly: China has sights set on EU as the U.S. shields itself with tariffs. The EU is not so sure., The Globe and Mail, April 15, 2025.

- Robert Wu: Trump Has Botched His Tariff War With China, The New York Times, April 17, 2025.

- David Pierson and Damien Cave: China Wants Countries to Unite Against Trump, but Is Met With Wariness, The New York Times, April 17, 2025.