Experienced hikers in the mountains are familiar with the notion that climbing up the mountain, strenuous as it may be, tends to be less dangerous than climbing down the mountain. With gravity propelling you forward on the way down, it's easy to pick up too much speed, and stumble and fall. Experienced hikers therefore take their time, step carefully, and wear sturdy hiking boots with a good grip. When it comes to household debt, the problem is similar. Accumulating debt is the easy part, but winding down debt is much harder. Canadians have climbed up on a mountain of debt, but how difficult will it be to climb down again?

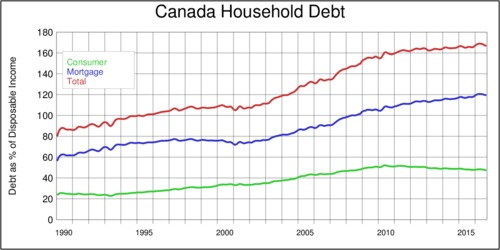

In September 2015, Gordon Isfeld reported in the Financial Post that Canada's household debt is now bigger than its GDP, for the first time. The chart that has been making the rounds across the news media in Canada is the one below that shows the household debt as a percentage of disposable income. I have compiled the numbers from Statistics Canada using quarterly income data and from Bank of Canada monthly debt data. What you see is that household debt has been rising steadily since the 1990, with particularly fast growth in the early 2000's, unencumbered by the financial crisis ("the great recession") in in 2008/2009. Since about 2010 the growth has slowed down, but the climb down from the mountain of debt has not yet started.

click on image for high-resolution PDF version Source: CANSIM Tables 176-0032 and 380-0073

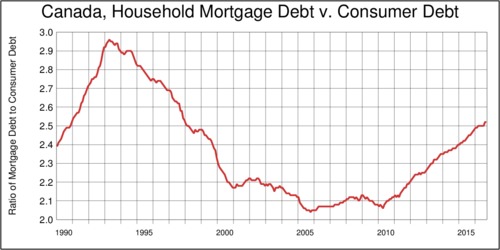

The blue and green lines in the diagram above also reveal a bit about the composition of household debt: mortgage debt (for buying homes) and consumer debt (for buying consumer goods and cars). Both have been rising throughout the 1990s and 2000s, but consumer debt has leveled off. The next diagram reveals the composition effect more clearly. It depicts the ratio of mortgage debt to consumer debt. This ratio peaked in 1993 at about 3.0, and bottomed out at just about 2.0 in the mid 2000s. Since 2010, the ratio is rising again steadily. The rise in household debt is virtually all coming from mortgages rather than consumer loans.

click on image for high-resolution PDF version Source: CANSIM Tables 176-0032 and 380-0073

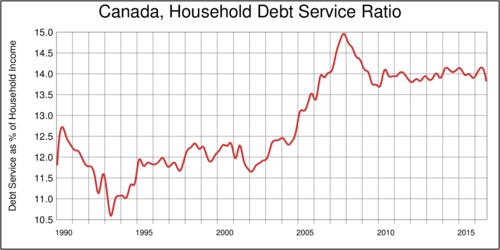

Can Canadians afford that much debt? The number to look at for this is the debt service ratio, which is defined as the debt payments (interest plus paying back principal) divided by total household income. The debt service ratio peaked during the 20098/09 recession at about 15%, but it has kept steady—thanks to record-low interest rates—at about 14% since 2010. This level is higher than during the 1990s (about 12%), but does not ring alarm bells. If interest rates staid as low as they are, there would be not much to worry about. But the picture is not quite as rosy when we allow for the high probability that interest rates will rise again, as they have already started to rise in the United States. Even though Canada's economy looks more sluggish and is further away from full capacity than the United States, we may see the first interest rate hikes in 2017 in Canada as well. Are Canadians prepared for climbing down the debt mountain?

click on image for high-resolution PDF version Source: CANSIM Tables 176-0032 and 380-0073

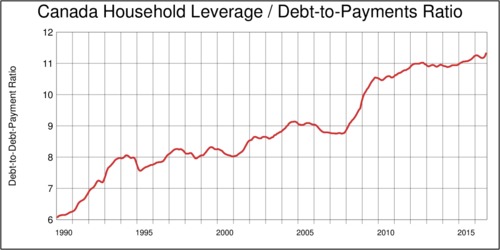

This brings me to the last chart, and this one is scary. The last diagram shows the household debt leverage, the ratio of debt to debt payments (interest and principal). What this diagram is saying is that in 1990s, your dollar available to finance debt could afford six times as much debt. If you had $25,000 per year that you could afford to pay on debt service, you could afford loans worth $150,000. Compare this to 2015, where the ratio has climbed to 11. Now, for the same $20,000 per year, you could carry a debt of $275,000 instead of $150,000. Low interest rates have allowed the average Canadian to more than double up on debt. That is what has been driving the real estate market in major cities. Great for real estate brokers and the construction industry, but a clear and present danger for the homeowners who are saddled with too much debt. When interest rates rise, interest charges could quickly pile up and put mortgages in distress.

click on image for high-resolution PDF version Source: CANSIM Tables 176-0032 and 380-0073

Can we avoid disaster?

To prevent disaster, the federal government has wisely tightened the rules for lending. Finance Minister Bill Morneau has followed his predecessor's path towards reducing mortgage risk. Increasing minimum down-payments for receiving CMHC Mortgage Loan Insurance, shortening maximum mortgage durations, as well as better stress tests, all help at the margin to reduce the risk that mortgages end up "underwater"—when the outstanding mortgage exceeds the equity in the home. But have we done enough? There are dangerous signs of back-sliding in my home province, British Columbia.

‘B.C.'s 5-year interest-free loan for first-time homebuyers is an election ploy that will do little good and instead pours fuel on the housing price fire.’

It is deeply troubling that the provincial government of British Columbia, going into an election in May of this year, has just announced to subsidize debt by extending interest-free loans for first-time home buyers. While I do not doubt the good intentions to find novel ways to help British Columbians get a toehold into property ownership, this new policy is foolhardy and counterproductive. This policy is meant to please some young voters, but probably benefits mostly home sellers and real estate brokers. As my SFU colleague Andrey Pavlov put it in the Globe and Mail on December 16: "It will push people to stretch themselves even further financially and to take on even more debt. This comes at the worst possible time, just when interest rates are clearly on the increase [...]". And my Sauder School of Business colleague Tom Davidoff pointed out that the policy will benefit more the sellers than the buyers: "[...] to the extent you have multiple first-time home buyers bidding on the property, all this does is hand money to the property owner." The B.C. Minister of Housing, Rich Coleman, thinks otherwise and points at housing markets outside the Lower Mainland. It may well be the case that outside the Lower Mainland, this policy may stimulate more supply than in the supply-constrained Lower Mainland, but even outside the Lower Mainland a significant share of the subsidy will end up in the hands of sellers, builders, and real estate agents. Whatever the differential regional effects may be, the Minister is wrong on two more basic points: the importance of home ownership, and the long-term debt dynamics. If homeowners are enticed to take on more debt (and perhaps too much debt as stress tests aren't perfect), after the five years of interest-free mortgage are over, the homeowners will have to find a few thousand dollars a year to cover the interest on the $37,500 that the government enticed then to load up. Subsidizing debt is always a bad policy. The folly of this policy is only trumped by making mortgage interest payments tax-deductible, as in the United States. As The Economist magazine argued, subsidies that make borrowing irresistible need to be phased out. The magazine pointed out "Not only do these subsidies increase financial fragility, they fail to achieve their purported goal of promoting home-ownership." B.C.'s interest-free loan for first-time home-buyers is an election ploy that will do little good and instead pours more fuel into the housing price fire. Taxpayer money spent on this policy could have easily found many better uses.

Why promote home ownership? Are homeowners better people?

I will go one step further and challenge the very notion that home ownership is a desirable economic or social goal. According to data by the OECD, the French and Germans prefer to rent rather than own a home (Andrews and Sánchez The Evolution of Homeownership, OECD 2011). In Germany only four in ten people live in their own homes; renting is viewed as socially acceptable and respectable. By comparison, home ownership in North America has almost turned into a dogma. Perhaps it is time to challenge this dogma (as Floyd Norris did in the New York Times in 2013). The case for home-ownership hinges on the notion that it generates "positive externalities". As Daniel Aaronson reports in A Note on the Benefits of Homeownership, these externalities are elusive and seem to be simply correlated with family characteristics (such as income). Note to politicians: by suggesting that everyone ought to aspire to become a homeowner, you are belittling all those voters who are renting.

There is also the implicit notion that investing in real estate is a smart investment strategy. But even that argument does not hold up to scrutiny. Yes, some people can make a lot of money flipping properties in a bubbly real estate market by riding the up-wave. However, for the majority of us homeowners, does tying up the vast majority of our wealth in real estate deliver the best return on our investment? Yale economist Robert Shiller, who won the Nobel Prize in 2013, doesn't think so. His essay Why Land and Homes Actually Tend to Be Disappointing Investments in the New York Times on 15 July 2016 sets the record straight.

The Bank of Canada remains highly concerned about the high level of household debt. A serious correction in the frothy real estate market could wipe out a significant chunk of this equity in an instant. Overall, Canadian households have a cushion, but at the margin there will be households that will suffer tremendously once interest rates in Canada move up and put stress on residential mortgages. Let us hope that the mountain of debt will not crumble down on us in avalanches of bankruptcies and mortgage foreclosures.

What about consumer debt?

Even though the trend line for consumer debt is flat, this hides the fact that many Canadians are still rather prone to buy goods and services with borrowed money. Unlike mortgages where debt is matched by equity, consumer goods depreciate fast and furious and thus the money spent on them is gone for good. As credit card statements are arriving in the mail after the Christmas season, the high interest rate on credit cards (typically around 20%p.a. these days) will hit many Canadians hard. With a credit card it is all too easy to fall into the credit trap, especially those who are poorer or lack financial astuteness. Getting out from underneath is challenging. TV ads by the not-for-profit Credit Counselling Society are a reflection on how climbing down from the debt mountain may need professional help, especially this time of year. Lenders make it all too easy to load up on debt. And the major culprit is that bit of plastic in your wallet: your credit card. Perhaps the very notion of the credit card needs challenging.

‘Credit cards boost consumer debt. Switching from credit to debit cards is eminently sensible but the obstacles are formidable.’

Even though credit cards are a convenient and efficient method of clearing payments, as an instrument of borrowing they are horrible. Would our country be better off if we all used debit cards instead of credit cards? Probably, because the transaction costs for debit cards is tiny compared to credit cards. Credit cards boost consumer debt. Switching from credit to debit cards is eminently sensible but the obstacles are formidable. It would mean saying good-bye to the reward points, minor benefits, and cash-back incentives offered by credit card companies. Credit card users do not get good value from these so-called rewards. Credit cards mostly benefit those of us who pay off their balance each month as we get the credit card kick-backs. Moving to debit cards means giving up these kick-backs—a point I argued previously in my July 2, 2016 blog.

How can we ween off Canada from credit card use?

The only way to make consumers move en masse from credit cards to debit cards is to allow merchants to charge you for the privilege of using a credit card. A poll by CreditCards.com in 2012 found that two-thirds of Americans would stop using credit cards if they had to pay a fee. Simply capping credit card fees (as the European Union has tried in 2016 and Bill C-236 proposes in Canada) will not solve the debt problem. Let merchants charge the full cost of using a credit card. We need a level playing field for all payment methods, and that means making costs explicit. As consumers change to using debit cards more, fewer will load up on consumer debt.

Since 2003 merchants in Australia are allowed to apply a surcharge on credit card use. More than 40% of Australian retailers use them now. In the United States, retailers were allowed to impose surcharges up to 4% since July 2013 as a result of a court settlement, which was overturned by the 2nd U.S. Circuit Court of Appeals in June 2016. Surcharges are out again in the U.S., but the battle will surely resume in the courts. In Canada, the Competition Tribunal dismissed an application by the Commissioner of Competition in 2013 that would have allowed surcharging. Australia's experience was not without complications, as some merchants used inflated surcharges. Australia corrected this problem with the Competition and Consumer Amendment (Payment Surcharges) Act 2016 that bans excessive credit card surcharges. Australia's model makes sense to me: give consumers choice over their payment options by making the cost fully transparent and upfront, but protect consumers from merchants abusing the surcharge option. Once consumers pay for the full cost of credit cards explicitly (rather than implicitly through higher prices), they may well switch to debit cards. The Competition Tribunal was right to dismiss the case at the time, because it really needs federal laws and regulation. There will be zero cooperation from the credit card industry. And merchants prefer plastic over cash because of the convenience and efficiency. But they prefer the better kind of plastic: debit rather than credit. And soon mobile payments (e.g. Apple Pay and Android Pay) will even make plastic look old-fashioned.

Hidden credit card fees are an invisible tax. Parliamentarians in Ottawa should take notice. A first step ought to be putting a cap on interchange fees. The second step ought to be allowing merchants to charge a capped surcharge for credit card use.

Let's resolve to make 2017 the year that marks the beginning of climbing down from Canada's Mons Debitum—safely and with sturdy boots.

Sources and further readings:

- Andrey Pavlov: B.C.'s help for first-time home buyers is a trap, The Globe and Mail, December 16, 2016.

- Richard Zussman and Karin Larsen: B.C. offers interest-free loans up to $37,500 to 1st-time homebuyers, CBC News, December 15, 2016.

- Rob Carrick: The dark side of the boom, The Globe and Mail, December 12, 2016.

- Gordon Isfeld: Canada's household debt is now bigger than its GDP, for the first time, Financial Post, 15 September 2016.

- Dan Kelly: Credit card fees a tax on consumers, small businesses, Financial Post, 1 April 2013.

- Floyd Norris: Challenge to Dogma on Owning a Home, New York Times, 9 May 2013.

- Robert Shiller: Why Land and Homes Actually Tend to Be Disappointing Investments, The New York Times, 15 July 2016.

- Daniel Aaronson: A Note on the Benefits of Homeownership, Journal of Urban Economics 47(3), May 2000, pp. 356-369.