Germany is home to some of the world's major car manufacturers, including Volkswagen (with affiliated brands Audi, Seat, and Skoda), BMW, and Mercedes. Germany is also home to car plants from foreign manufacturers. Ford has a plant in Cologne, and Stellantis produces Opel cars in Rüsselsheim. Tesla opened a factor near Berlin. Germany is on the path to transitioning to electric vehicles, but progress is slow and driven by changing policies.

Photograph by Werner Antweiler

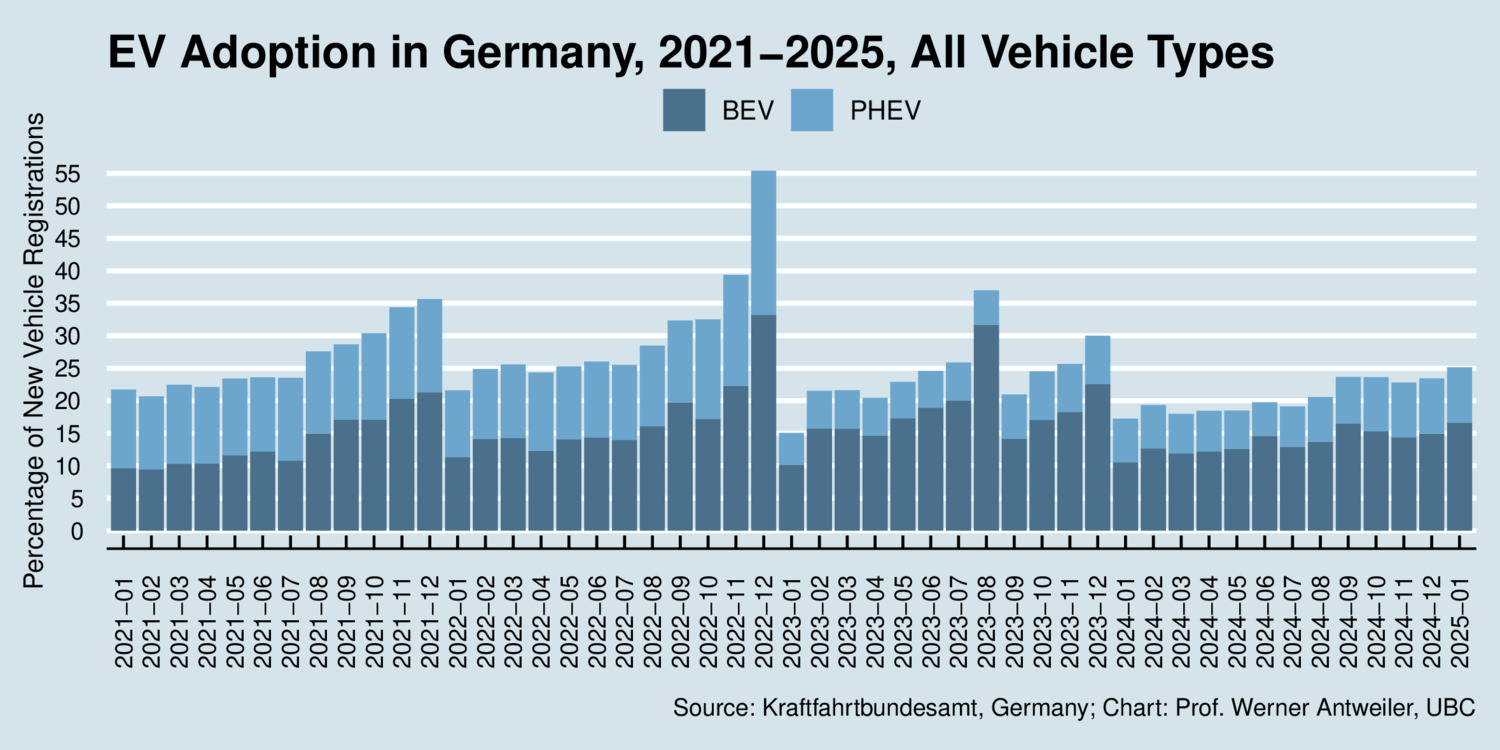

As the first diagram shows, new registration of electric vehicles, which includes both battery electric vehicles (BEVs, darker blue) and plug-in hybrid electric vehicles (PHEVs, lighter blue), hovers around the 15-20 percent mark in recent months. However, there are some noticeable run-ups in EV adoption due to the expiry of support policies in December 2022 and December 2023.

click on image for high-resolution PDF version

Since January 2023, PHEVs receive no more funding, while the funding for BEVs was cut from a maximum of €6,000 to €4,500 for eligible vehicles that cost less than €40,000. More expensive vehicles (between €40-65,000) saw funding reduced from €5,000 to €3,000, while luxury vehicles (more than €65,000) were excluded. Funding for vehicles was to be reduced further in January 2024, capping the subsidy at €3,000 for vehicles up to €45,000, with no subsidy for more expensive vehicles. But in November 2023, following a budget crisis, Germany's federal government abruptly ended its subsidies for individual car owners. In September of 2023 it had already cut support for fleet vehicles. This cut has left EV purchases in Germany without financial support. As the chart shows, sales slumped.

According to EU legislation, car manufacturers must bee fleet limits for their carbon dioxide intensity, or face fines. In 2025, the limit drops from 95 gCO2/km to 93.6 gCO2/km using the New European Driving Cycle (NEDC) for assessing emissions and which is different from the new (and more robust) Worldwide Harmonised Light Vehicle Test Procedure (WLTP). The limit drops further to 49.5 gCO2/km in 2030. If the average carbon dioxide emissions of a manufacturer's fleet exceeds its specific emission target in a given year, the manufacturer must pay a penalty of €95 for each g/km exceedance for each vehicle. Unsurprisingly, politicians are already calling for the penalty payments to be suspended as manufacturers struggle to meet the new 2025 target.

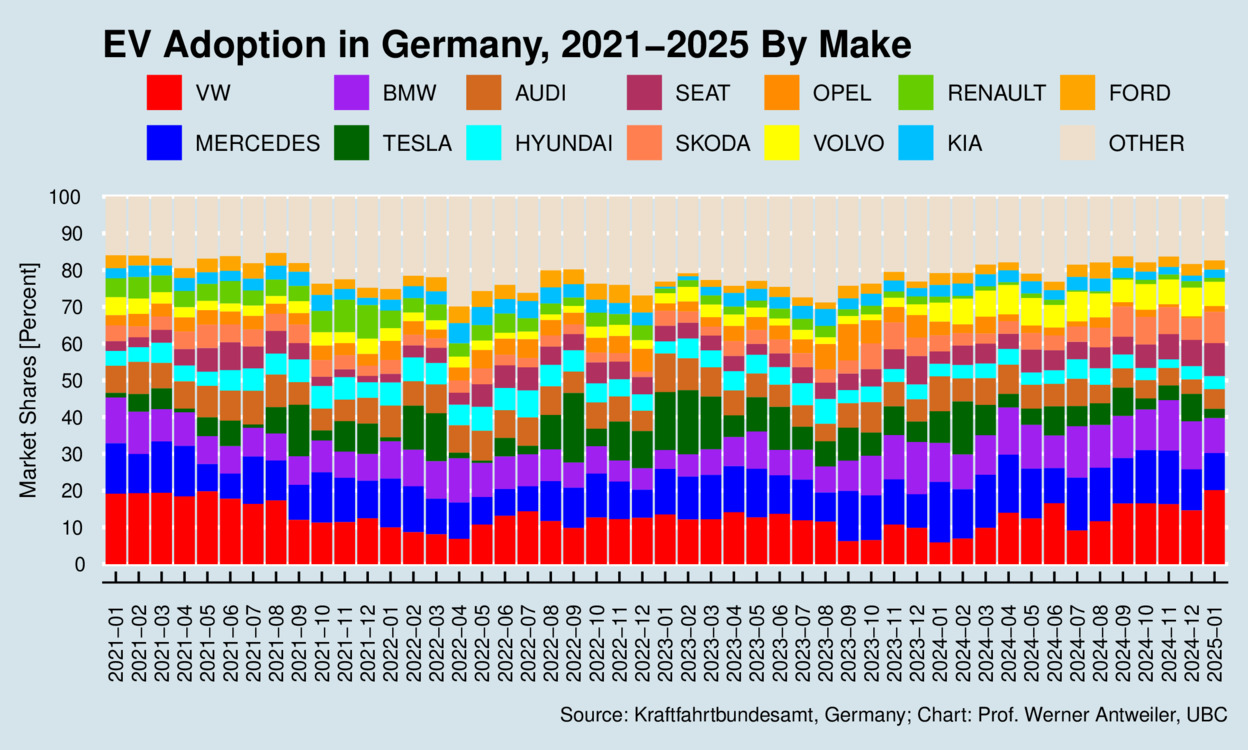

The next chart shows the composition of BEV/PHEV brands sold in Germany, by major manufacturer. Perhaps unsurprisingly, significant chunks of the market are captured by Germany's three large manufacturers (including their affiliate brands). Tesla's role expanded with the opening of a plant in Berlin-Brandenburg in March 2022, but the company's sales are struggling. In January 2025, Tesla sales slumped dramatically in Germany as Elon Musk started to play a major role in the new Trump administration in Washington, while at the same time throwing his support behind a far-right political party in Germany. Musk's politics is turning Tesla into a toxic brand. If the trend persists, Tesla's Gigafactory in Berlin-Brandenburg may well become a stranded asset.

click on image for high-resolution PDF version

The third and last chart shows EV adoption in Germany (BEV+PHEV combined) by federal electoral district. Districts have roughly equal number of people, which makes it a useful way to show the spatial distribution effectively. Quite noticeable is the fact EV adoption is low across Eastern Germany with the exception of Berlin. In general, urban areas (Berlin, Hamburg, Frankfurt, Cologne, Stuttgart, Munich) stand out with higher adoption rates. The median rate lies around 6%, but tops 20% in one district.

There are two factors that stand out explaining the spatial pattern of EV adoption in Germany: per-capita income and population density. Using data from Germany's electoral office for the electoral districts, a regression of the logarithm of EV adoption on the logarithm of income and the logarithm of population density reveals two elasticities that can explain, together, roughly 75% of the observed variation. A 10% increase in per-capita income boosts the EV adoption rate by 13%, while a 10% increase in population density boosts the EV adoption rate by 1.3%. Both effects are highly statistically significant. Urban areas tend to be more affluent than rural areas, but there is an extra boost from population density, which may correlated with shorter driving distances. In short, EV adoption in Germany seems to fit with observations in other countries that point to a significant urban-rural gap in EV adoption.

Germany's transition to electric vehicles is fraught with problems, especially in the aftermath of the end of EV subsidies. Car manufacturers are struggling as high investment costs are not recovered my adequate EV sales. Ford is cutting 4,000 jobs, primarily at is German plant. Volkswagen announced cutting thousands of jobs as well. At the same time, competition from foreign producers is gearing up, in particular with cars produced in China. Countervailing duties on EVs manufactured in China are already in place, but there is growing worry that an increasing number of Chinese-made vehicles may flood the European market. Add to this new worries if a trade war erupts across the Atlantic Ocean. German car manufacturers have arrived at a turning point. Which road taken will turn the industry back to profitability?