click on image for high-resolution PDF version

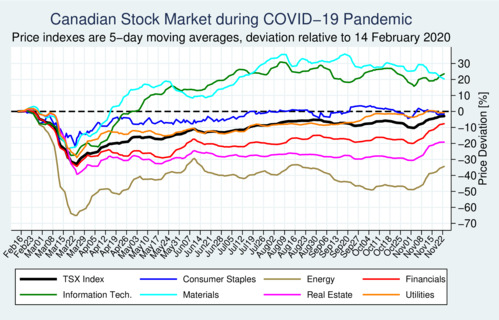

In June 2020 I had blogged about the performance of Canada's stock market during the COVID-19 pandemic. Today I am presenting a quick update on the numbers. The main story remains unchanged: the pandemic has lifted some industrial sectors and hurt other industrial sectors. The trend that was visible in June remains largely in place in November, as the TSX stock market index crossed 17,300 and has exceeded the level it had at the beginning of the year—albeit not quite the level it had at its peak of 17,944 on February 20, 2020.

‘The COVID-19 pandemic has reshuffled sectoral economic fortunes.’

The ranking of sectors has not changed from June. Information Technology is the main winner of the pandemic as consumers have turned massively to online shopping, which has lifted the fortunes of companies that provide related intermediation services. The materials sector has also benefited from a safe-haven effect as the price of gold has risen during the pandemic, but lately has started easing off. Utilities and consumer staples have been largely immune from the pandemic. The weakness in the financial sector is giving way to a more optimistic outlook on the performance of the big banks. The two sectors that have been most impacted by the pandemic are energy (mostly oil and gas companies) and real estate (dragged down by the significant impact on the retail and hospitality sector, and a drop in leasing of commercial space.

Two developments have been boosting stock prices since the beginning of this month. The November 3 election in the United States has put an end to the erratic Trump years and has given world markets new hope that a Biden administration will return the United States to a more responsible style of foreign policy and international trade relations. The second boost comes from the good news about progress on several vaccines, which could lift economic fortunes significantly once they become available widely.

Yet, the COVID-19 crisis is accelerating in many countries—driven in some places by "covid fatigue" and in others by willful ignorance of the dangers of this disease. The greatest danger to a COVID-19 recovery in the short term is the opposition to reasonable lockdown and "circuit breaker" measures that prevent overburdening our health care systems. The longer-term risk is that some countries may be slow to vaccinate—either because vaccines are too expensive (for some developing countries) or because people falsely believe that vaccines aren't safe (in countries where conspiracy theories run rampant). There is one bit of good news in Canada: vaccination rates for the ordinary flu virus are significantly up from last year. Fewer cases of the ordinary flu will help hospitals cope with the growing COVID-19 numbers.

One of the strongest indicators of the ups and downs of the stock market due to COVID-19 are the cruise line stocks. Without a vaccine there is no realistic hope that cruise lines can return to normal operations. Take Royal Caribbean Cruises, for example (NYSE:RCL). Early this year it traded as high as USD 135. When COVID-19 hit, it traded below USD 20 on March 18. Since then the stock has staged a remarkable recovery and today is trading at just over USD 80. Investors who bought this beaten-down stock in late March could have seen their investment quadruple within eight months, whereas those who held on to the stock in March are still down about 40%. The emergence of effective vaccines has clearly buoyed the prospects of tourism and cruise lines.