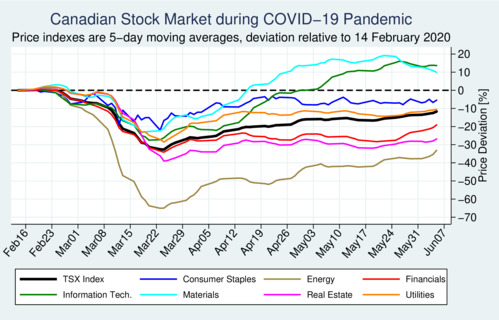

The effect of COVID-19 on the stock market was swift and painful for investors: markets dropped by roughly a third in value between mid-February and mid-March 2020. Yet, stocks also staged a quick rally and markets have recovered a lot of the lost ground. By early June, Canada's TSX was just about 10% down from its peak in February. Considering that the COVID-19 pandemic has done great damage to our economy, today's valuation seems rather optimistic.

‘The effect of the pandemic on industrial sectors is far from uniform.’

Markets reacted far from uniform to the COVID-19 shock. The sudden shock to demand patterns had rather differential effects on different sectors. On top of the COVID-19 pandemic, oil markets were rattled by an oil price war between Saudi Arabia and Russia, where Saudi Arabia attempted to regain lost market share. The double shock thus hit the energy sector hardest, and the pain of this double shock was felt immensely all across the oil-producing regions of Canada.

The chart below shows how different sectors performed during the COVID-19 pandemic so far. Rather than using theoretical indexes, I am using the proxy of exchange-traded funds (ETFs) that track S&P/TSX sector indexes. They are the family of iShares capped sector ETFs (XST, XEG, XFN, XIT, SMA, XRE, XUT) that can be held easily by retail investors and thus track investment performance more realistically than artificial sector indexes. The prices have been smoothed by a 5-day moving average to suppress some of the daily trading noise. The baseline for the prices is February 14.

click on image for high-resolution PDF version

‘Consumer staples and utilities remained a safe haven for investors.’

The patterns that emerge make a lot of economic sense. During the COVID-19 pandemic, consumer staples (blue curve) were the least affected. People still need to eat. Likewise, utilities fared really well (orange curve). People still consume electricity, and only modestly less than before the pandemic (see my article on electricity demand in BC during the COVID-19 pandemic). The sector that is noticeably absent from the Canadian list is what is generally referred to as "consumer discretionary". The market for this is thin in Canada and generally includes leisure and travel companies, entertainment, and so on.

The energy sector was hit by far the hardest, with an initial price decline of over 60%. Canada's oil patch is particularly vulnerable because it has one of the highest production costs. Bitumen and other heavy crudes are costly to produce and refine, and thus oil prices well below USD 50 per barrel threaten the economic viability of production. The break-even cost for new mines is more in the USD 75-85 per barrel range, but to cover variable costs prices need to be at least about 30 USD per barrel for the Western Canadian Select (WCS) blend. Lately, oil prices have been inching up again and WTI and Brent have now reached the $40/bbl mark. The picture for the oil industry is improving, but threats remain (most of all from continuing price wrangling among OPEC+ countries).

Real estate has also been hit hard in Canada for several reasons. During the pandemic, there is no opportunity to visit homes, and increased uncertainty about the future may make many potential buyers jittery about future increases in home prices. Canada's influx of overseas money into the real estate sector has also been abruptly halted in part due to the inability to travel. As the chart shows, the real estate sector has hardly moved since bottoming out in late March.

‘And the winner is: IT. Thanks to online shopping and videoconferencing.’

Canada's stock market has also revealed two outperforming sectors: materials and information technology (cyan curve and green curve, respectively). The story for these two sectors is rather different. There has been a boom in everything IT related because much work has gone online. In Canada, the four biggest companies in the XIT index are Constellation software, Shopify, CGI Inc, and Open Text Corp. The star in this group is Shopify, whose stock price has about doubled. COVID-19 has invigorated the push towards online shopping, and Shopify is benefiting from this trend.

The materials sector has benefited from what is generally thought to be the "safe haven" effect of precious metals. The heavy weights in the XMA index are Barrick Gold (19%), Franco Nevada, Nutrien, and Wheaton Precious Metals. Materials is usually a risky sector because adverse changes in the business cycle are usually felt rather quickly in materials that are at the beginning of the supply chain. COVID-19 would be considered damaging for materials in general, but Canada's materials sector is heavily exposed to precious metals, which in turn explains the unusually strong performance.

Canada's largest sector is financials, dominated by the big banks, insurance companies (Manulife, Sun Life) and Brookfield Asset Management. Royal Bank alone accounts for 21% of the index. Unsurprisingly, the TSX overall tracks the financials sector closely. Banks have been exposed to the COVID-19 pandemic through credit risk as insolvencies jeopardize their loans. Canadian banks passed a stress test by the Bank of Canada. Canada's central bank has injected sufficient liquidity into the banking system, and the banks' funding pressured have eased markedly in recent weeks.

So where do stocks go from here? The remarkable rebound is probably fragile. Markets seem to have shrugged off much of the economic effect of the pandemic before most of the economic effect has fully percolated through the economy. Whether the economy will simply "snack back" into before-coronavirus gear is rather questionable. Jobs have been lost, and many small retail and food service businesses may not survive if they cannot operate above break-even capacity utilization. If there is a second wave of COVID-19 in the fall, the markets may take another dive as the outlook worsens. For now, the markets appear detached from the bleak economic data coming from our statistical agencies. Or, as the Jeff Sommer explained in the New York Times Why the Stock Market Just Doesn't Care: traders bet heavily on rising market while the Federal Reserve is massively bolstering it.

‘The pandemic holds three important lessons for investors about sectoral responses.’

Wary investors can learn from the above chart three essential lessons. The first lesson is that even during a massive downturn there are safe sectors. People always need to eat and power their homes and offices. Consumer staples and utilities are among the safer bets during the crisis. The second lesson tells us that a crisis creates new winners and losers. Information technology got a boost; if only we had bought stock in Zoom last year! Consumer discretionary spending is probably the hardest hit, but the Canadian TSX is not exposed much. And the third lesson is that crisis can come in pairs and triplets. This time, the oil price war and COVID-19 coincided to hit the energy sector doubly. This is why Canada's TSX, which is energy heavy, has still not rebounded as much as the US S&P 500. Canadian investors should be mindful that Canada's economy exhibits a strong industry sector bias, and thus investing outside Canada provides important balance to this bias.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)