British Columbia is poised to become a major exporter of liquefied natural gas (LNG). There are many questions about LNG technologies, environmental impact, and the economics of LNG markets. In my blog I will try answer some of them over the next weeks and months. First up: the economics of LNG with a look at markets and prices. Prices for LNG are determined by supply and demand, and there are big uncertainties about both.

‘Prices for LNG are determined by supply and demand, and there are big uncertainties about both.’

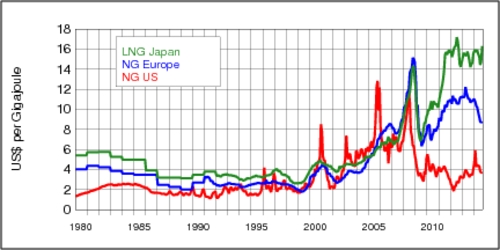

Markets for natural gas are structured differently in different world regions. In North America, natural gas markets are spot markets where supply and demand determine prices. In Europe, natural gas prices are often determined through long-term contracts, while some supplies are traded in spot markets. Natural gas in Asian markets is often imported as liquefied gas because there are few local sources. As a result of these geographic segmentations, there are distinct prices for natural gas in the North America and Europe, and for LNG in Asia. The chart below shows the evolution of three benchmark prices (not corrected for inflation) since 1980. The data were obtained from the World Bank. The North American benchmark price is known as the "Henry-Hub price," named after a distribution hub in Louisiana where major gas pipelines meet.

Prices above are quoted in US dollars per Gigajoule, although in some markets (in particular in North America) it is still common to use antiquated imperial measures rather than modern metric measuers. In those markets prices are often quoted by million British thermal units (MMbtu). Fortunately, 1 Gigajoule is almost the same as 1 MMbtu. (Precisely, 1 MMbtu equals 1.05587 GJ).

What is most noticeable in the chart is that LNG prices tend to be higher than the natural gas prices in Europe, which in turn are higher than in North America. Hydraulic fracturing has led to a significant increase in natural gas supplies in the United States and Canada, and this has kept prices low in recent years. LNG prices also tend to be higher than natural gas prices because of the cost of liquefaction and transportation. Natural gas prices peaked shortly before the global recession in 2008/2009 and dropped sharply during the recession. In North America, fracking kept prices low afterwards, but natural gas prices recovered in Europe.

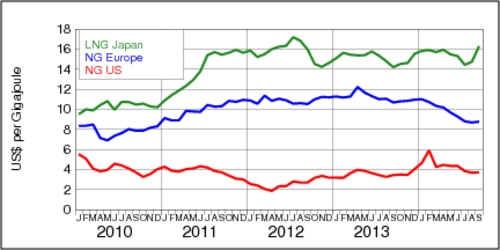

The next chart shows a close-up view of natural gas and LNG prices since 2010. After the Fukushima nuclear incident in Japan, the country halted operations of its nuclear reactors and had to start importing LNG to meet its energy demand. During 2011, LNG prices rose from about $10 per GJ to about $16 per GJ. Prices have remained at this high level since.

Historically, natural gas prices followed oil prices. In many long-term contracts natural gas pries were even linked directly to oil prices because these fossil fuels were seen as direct substitutes (1 MMbtu has the energy content of one-sixth of a barrel of oil). However, the link between oil and gas prices has been broken in recent years because of different dynamics in the two industries. While it still holds that fossil fuels are substitutes in the long run, in the short run prices can and do differ substantially.

For LNG, the key question is whether prices will remain at the lofty heights seen since 2011. The answer to that question is of course: supply and demand. On the supply side, more LNG facilities are being built around the world, driven by increasing availability of gas reservoirs due to hydraulic fracturing. On the demand side, Japan is on a course back to nuclear power, which will dampen their demand of LNG significantly. China's economic growth is slowing down, and this may also dampen its demand for LNG. At the same time, China is aggressively expanding other energy sources, in particular nuclear energy. China's goal is to become less reliant on energy imports. It is possible that LNG demand may go up if Europe carries out sanctions against Russia, which could stop exports of Russian natural gas to Western Europe. On balance, I find it difficult to trust the rosy forecasts that predict that China wil quadruple its imports of LNG by 2020.

In the National Post of July 11, 2014, Henning Gloystein poses the question: Could failing natural gas prices kill some LNG projects? This is an important and troubling question for the nascent LNG industry in British Columbia.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)