When natural gas is cooled down to –162°C, it turns into

a liquid and its volume shrinks 600 times,

which makes it easier to store and transport

over large distances. Cooling natural gas requires a liquefaction plant,

and there are several technological choices about how to operate it.

There are several combinations of refrigeration methods and methods to

power them. The capacity of a liquefaction plant is measured

in million tonnes per year, abbreviated MTPY or mtpa. An LNG plant

has one ore more so-called "trains". Larger LNG plants have two

or more such trains that work in parallel, but separately.

Each LNG train consists of several stages of processing.

When natural gas is cooled down to –162°C, it turns into

a liquid and its volume shrinks 600 times,

which makes it easier to store and transport

over large distances. Cooling natural gas requires a liquefaction plant,

and there are several technological choices about how to operate it.

There are several combinations of refrigeration methods and methods to

power them. The capacity of a liquefaction plant is measured

in million tonnes per year, abbreviated MTPY or mtpa. An LNG plant

has one ore more so-called "trains". Larger LNG plants have two

or more such trains that work in parallel, but separately.

Each LNG train consists of several stages of processing.

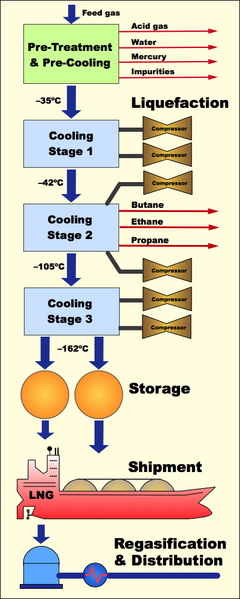

The flow diagram on the left illustrates the different stages of liquefied natural gas (LNG) procesing. Feed gas arrives by pipeline from a gas field. At the gas well, extraneous carbon dioxide (and sometimes nitrogen) is separated and usually released into the atmosphere. However, the natural gas that arrives via pipeline contains traces of gases and other impurities that need to be removed first. The gas also contains water vapor, which is removed in a dehydration unit during pre-treatment. Acid gases (such as hydrogen sulfide and mercaptans) are removed through a type of scrubber. This process is also called sweetening because it entails the removal of sour gas (hydrogen sulfide). Lastly, mercury is removed through a molecular sieve or through adsorption on activated carbon. Nitrogen-rich gas may also need to be treated further.

Once the natural gas has passed through the pre-treatment and pre-cooling process, it enters the liquefaction train. This usually involves several steps of cooling, which allows for the cryogenic separation of various other useful gases: butane, ethane, and propane. These can be stored and sold separately from LNG. Once the remaining methane has cooled below –162°C, it can be stored in (usually spherical) tanks, awaiting shipping. After transportation to the destination market, LNG is converted back into natural gas at regasification terminals, from where it is delivered to consumers by pipeline.

Liquefaction requires powerful compressors, and thse in turn requires lots of energy. This energy can come from two sources: the natural gas that is being liquefied, or the power grid. As a result, there are two major alternatives for operating LNG plants.

- Direct Drive: By far the most common type of

liquefaction process involves gas-turbine driven compressors

that utilize a small share of the natural gas. The key

advantage is that the entire power neeeds are satisfied

locally without reliance on external sources. Currently,

direct drives require about 250 to 330 kWh per tonne of LNG.

Sizes for single LNG trains have continuously expanded over

the last decades and have grown from 2 MTPY in 1990 to 5 MTPY

by 2010. There are two competing techologies for direct drives:

- Industrial Heavy-Duty Gas Turbines are the mainstay of direct drive LNG applications. The have energy efficiencies of around 33-35%.

- Aero-derivative Gas Turbines have only come into use recently. This design is derived from the aeronautical industry. These turbines are lighter in weight and are more compact than industrial gas turbines. Advantageously, they can operate at variable speeds. They reach energy efficiencies between 41-44%, about 25% better than conventional turbines. Aero-derivative turbines also work better in colder ambient climates. The Darwin LNG facility, opened in 2006, was the first to employ aeroderivative turbines. Aero-derivative gas turbines can also be used to generate electricity, which is a technology used at the Sn°hvit plant in Norway.

- Electric drive: This technology is relatively new

and is currently used in Statoil's Sn°hvit ("Snow White")

plant on Melk°ya Island in Norway. This plant has a capacity

of 4.3 MTPY. It is the most-energy efficient technology with

230 kWh per ton of LNG. Another electric-drive plant is

being built in Freeport in Southeast Texas with a

4.4 MTPY capacity, equipped with six 75 MW compressors.

This plant will use grid power.

If the soure of electricity is clean, electric drives have

significant environmental benefits over direct drives.

Because these systems are mechanically less complex, they

tend to have somewhat higher operational availability.

However, e-drives remain a new technology with less of

a proven track record, and as cutting-edge technologies go,

they are somewhat more expensive. The source of the electricity

matters:

- Grid electricity ("outside the fence"): If the LNG plant can be connected to the grid, power can be provided that may be cleaner than using direct drives. In British Columbia, most electricity comes from renewable sources—hydro-electrid dams, run-of-the-river hydro, and wind energy. While this is a very attractive option environmentally, it also incurs public costs for building infrastructure such as new dams and new transmission lines.

- Power plant ("inisde the fence"): The alternative is to built a local power plant that utilizes natural gas. The most efficient type of natural-gas power plant is a combined-cycle gas turbine (CCGT) plant. In such a plant, a gas turbine extracts mechanical energy from burning natural gas, and the waste heat from the burned gas is transferred through a heat exchanger to a secondary steam cycle that powers a second turbine. The thermal efficiency of CCGT plants is very high, reaching 60% rather than the 40% of conventional single-cycle gas plants. Another option, used at the Sn°hvit plant in Norway, is the use of aeroderivative gas turbines—adapted from airplane designs—to generate electricity.

- Power plant with back-up grid power: The two previous options can also be combined. The local power plant can deliver electricity during regular operation, while the power grid cvan deliver electricity when the local gas turbines need to be maintained or repaired. Grid redundancy can be used for all or part of the power needs. Some proposals rely on grid power only for the non-compression part of their energy needs.

- Hybrid systems combine grid electricity for ancillary operations and natural gas for compression. This is the option that is preferred for the LNG Canada 12-24 MTPY project in Kitimat, which is proposed by Shell in partnership with others and is to be built next to the Rio Tinto Alcan plant in Kitimat. BC Hydro will supply about 20% of the overall power needs of this plant— 2,000&GWh/year. The electricity from BC Hydro will not be cheap: the contract with LG Canada will deliver electricity at $83.02/MWh, significantly more than most industrial customers pay in BC.

Technologically, electric drives are more expensive than direct drives, but electric drives are more reliable, more efficient, and safer (as no combustion equipment is within the LNG plant).

The different technology choices have rather different impacts on the environment. The measure for comparing different technologies is the amount of carbon dioxide emissions per tonne of LNG. Typical direct drive plants achieve 0.30 tonnes of CO2 per tonne of LNG, although older plants can emit as much as 0.50. The best-performing plants, for example the Queensland Curtis LNG project in Australia, achieve 0.25 tonnes of CO2 per tonne of LNG. The Sn°hvit plant in Norway, which uses aeroderivative gas turbines to generate electricity, achieves the world's best carbon intensity to-date of just 0.17. This is the benchmark against which proposals for LNG in British Columbia must compare. It is customary to also include upstream emissions of CO2 in comparisons, which depends on the amount of CO2 in the gas extracted at the wellhead. "Good" natural gas can add as little as 0.10 tonnes of CO2 per tonne of LNG, and "bad" fields as much as 0.25.

According to their environmental impact statement, the Pacific NorthWest LNG project, proposed by Malaysian energy company Petronas and to be built on Lelu Island in Prince Rupert, will have a fully built-out capacity of 19.2 MTPY and would generate 5.28 million tonnes of CO2(e), which is equivalent to a carbon intensity of 0.27 tonnes CO2(e) per tonne of LNG. However, the project is still undergoing enigineering design improvements and the company is targeting a carbon intensity of 0.22 for their final design, which will likely involve aeroderivative gas turbines. (Unlike the Sn°hvit project in Norway, the turbines would be used as a direct drive, however.) In 2011, British Columbia's GHG emissions totalled 62.213 million tonnes. Adding 5.28 million tonnes amounts to 8.5% of total BC emissions—and this is from one LNG project alone.

From the above discussion it is clear that British Columbia will not be able to meet is greenhouse gas (GHG) reduction targets. British Columbia set itself a target of achieving GHG emissions 33% below 2007 emission levels by 2020, and an 80% reduction below the 2007 level by 2050. The 2020 target translates into 43.48 million tonnes of CO2. Expansion of the LNG industry in British Columbia does not square with this target. The province has three options: it can mandate electric drives with clean energy; it can scrap the GHG target or modifiy it to accommodate LNG; or it can fudge the numbers through "creative carbon accounting".

LNG could indeed be beneficial if every tonne of LNG displaces an equivalent amount of oil or coal, which have higher carbon intensity than natural gas (by 22–45%). The catch is that there are no reliable economic models that deliver a substitution elasticity of one, across the globe. The numbers that I rely on from the US Energy Information Administration suggest a coal-gas cross-price elasticity of just 0.14—too little to offset the emissions in British Columbia. The only viable option to achieve the mandated GHG reduction targets in British Columbia is to mandate e-drives. But mandating e-drives will drive up costs for LNG plants, and will also put the province on the hook for building more electricity infrastructure.

So far, only one of the 18 projects that have been proposed has announced that it would rely on electric drives: the Woodfibre project in Squamish, where grid access is available. However, at 2.1 MTPY, this is one of the smaller projects. The only project that is already under construction is the $400 million expansion of the Fortis BC Tilbury Island plant in Delta. Using electric drives connected to the BC Hydro grid, the plant's liquefaction capacity of only 0.25 MTPY makes it some of the smallest.

LNG plants would be subject to British Columbia's carbon tax of $30 per tonne of CO2(e), which could amount to a significant tax windfall from the province—unless the provincial government decides to exempt LNG plants from this tax. Because BC's 2008 Carbon Tax Act mandates revenue neutrality, the province would be required to disburse the windfall rather than use it to finance other government expenditures or reduce the provincial debt. A conventional 20 MTPY LNG plant would generate about 5 million tonnes of CO2(e) per year—thus generating $150 million per year in carbon tax revenue. Section 56 of Bill 2 left the door open for just this sort of discretionary exemption. At this point it remains unclear whether LNG facilities will become subject to the $30/tonne carbon tax.

As was reported on October 20, 2014 in The Globe and Mail (B.C. promises world-leading emissions targets for LNG industry with new law), B.C.'s Environment Minister Mary Polak announced that it hopes to seee five LNG plants built, and , the tabled a new law, the Greenhouse Gas Industrial Reporting & Control Act (Bill 2 – 2014), that mandates an average carbon intensity of 0.16 tonnes of CO2(e) per tonne of liquefied natural gas produced for the new LNG plants. This is significantly less than the industry benchmarks for direct drive, which can reach 0.25 at best. Electric drives can meet the 0.16 target, however. The new law provides for flexibility meeting the 0.16 target including the purchase of "carbon offsets". LNG plants that operate below the 0.16 target can sell credits to other LNG plants that do not. In practice, this means that LNG plants need to meet the 0.16 target on average rather than individually. If four LNG plants are built and two of them use electric drives, it may be possible to achieve the industry-average target. Of course, this would require that some of the major project proposals switch to electric drives. The other option to meet the target is through carbon offsets.

The route via carbon offsets is fraught with difficulties. Within BC, there are simply not enough quality offsets available. The BC Government scrapped the Pacific Carbon Trust in 2013 and so far has offset only 3 million tonnes of CO2(e) in total, not annually. If not enough offset opportunities are available from the BC Climate Secretariat, LNG plants can purchase pseudo offsets from the Ministry of the Environment at $25 per tonne of carbon dioxide. Technically, these pseudo offsets are called "technology fund units", where funds are used to reduce greenhouse gas emissions elsewhere—although where remains unspecified. If LNG plants fail to find offsets cheaper than $25, they would have to buy the pseudo offsets at $25 per tonne. Consider again the Pacific NorthWest LNG plant, which is projected to emit 5.28 million tonnes of CO2(e) per year. The new regime mandates offsets for emissions that exceed the carbon intensity target of 0.16, so (0.27–0.16)/0.27=40.7% of the total emissions require offsets, for an amount of $53.7 million. If the project actually achieves a carbon intensity of 0.22 rather than 0.27, that cost would drop to about $29.3 million. By cutting the proposed corporate income surtax for LNG firms in half (from 7% to 3.5%), the BC government appears to be shifting revenue from one bucket to another. The tax break will probably be not enough to make major LNG plants switch to e-drives, but instead it will probably suffice to pay for the carbon offsets.

The province also promises to launch an environmental incentive program for facilities that fall in the carbon intensity range between 0.16 and 0.23. This LNG Environmental Incentive Program rewards facilities between a carbon intensity of 0.16 and 0.23 with a pro-rated incentive based on the actual compliance cost. This incentive will be paid for from the revenue collected from the LNG industry, which means that the program will lower the overall tax collected from LNG plants. Ultimately, the program will pay for the LNG adopting cleaner production methods.

Will British Columbia have the cleanest LNG facilities in the World, as Premier Christy Clark has promised? This outcome appears very unlikely unless major projects embrace electric drives, and B.C. Hydro delivers clean electricity. Using carbon offsets and pseudo offsets are an exercise in creative carbon accounting, but don't propel BC's LNG industry to embrace costly but cleaner new technologies. The temptation may be too great to simply walk away—and focus on more economic alternatives in Australia or elsewhere.

Further readings:

- Liquefied Natural Gas: Understanding the Basic Facts, US Department of Energy, 2013.

- Cameron Lusztig: What is the right power solution for B.C.'s LNG industry?, Vancouver Sun, January 3, 2013

- Electricity-fuelled LNG plants create more jobs, less polution: report, Clean Energy Canada, January 16, 2014

- Justine Hunter and Brent Jang: Cabinet minister clarifies LNG's ‘clean’ promise, The Globe and Mail, May 13, 2014

- Zoher Meratla: Powering LNG Export Facilities in British Columbia: Proponent and Regulatory Challenges, Presentation at the BC Power Symposium, Vancouver, 28-29 January 2014

- Justine Hunter: Let's have a conversation about the ‘cleanest LNG in the world’, The Globe and Mail, October 5, 2014

- Justine Hunter: B.C. promises world-leading emissions targets for LNG industry with new law, The Globe and Mail, October 20, 2014

- Dirk Meissner: Is B.C. ducking questions about how LNG would affect carbon emissions targets, The Globe and Mail, November 11, 2013

- Paul Cassidy and Selina Lee-Anderson: BC Sets New Global Greenhouse Gas Emissions Standard for LNG Industry, McCarthy Tretault "Canadian Energy Perspectives", October 22, 2014

- Marc Lee: Competitiveness vs. public benefits: The LNG tax and regulatory regimes, Canadian Centre for Policy Alternatives, October 11, 2014.

- Marc Lee: Path to Prosperity? A closer look at BC's Natural Gas Royalties and proposed LNG Income Tax, Canadian Centre for Policy Alternatives, April 2014

- Adam Baylin-Stern: Carbon regime missing in action in BC's new LNG tax regime, Sustainable Prosperity, February 27, 2014

- Mary Hemmingsen, et al.: Insights and Update on Proposed BC LNG Tax Regime, KPMG, 2014.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)