As the first jurisdiction in North America, British Columbia imposed a carbon tax in July 2008. First set at $10 per tonne of carbon dioxide equivalent, it was increased in $5 steps and has been at $30 per tonne since July 2012. The table below shows the increments and how the carbon tax prices translate into higher prices in cents per litre (¢/L) at the pump.

| until 2008-06-30 |

2008-07-01 2009-06-30 |

2009-07-01 2010-06-30 |

2010-07-01 2011-06-30 |

2011-07-01 2012-06-30 |

2012-07-01 forward |

|---|---|---|---|---|---|

| $0/tonne | $10/tonne | $15/tonne | $20/tonne | $25/tonne | $30/tonne |

| 0 ¢/L | 2.2 ¢/L | 3.3 ¢/L | 4.4 ¢/L | 5.6 ¢/L | 6.7 ¢/L |

The carbon tax was conceived in a revenue-neutral way, with revenue from the tax refunded to tax payers through lower income taxes and through other benefits. In fact, the tax has been slightly revenue-negative, with tax reductions exceeding the revenue from the tax slightly. Whether BC's carbon tax has been an effective policy instrument to reduce carbon emissions in British Columbia remains an important empirical question. With only a few years of the tax being in effect, there is not yet a lot of data to give a fully satisfactory answer to the question about how much the carbon tax has reduced emissions. GHG Inventories are prepared in B.C. only in even-numbered years. The latest is from 2012, and the 2014 report will be released in 2016.

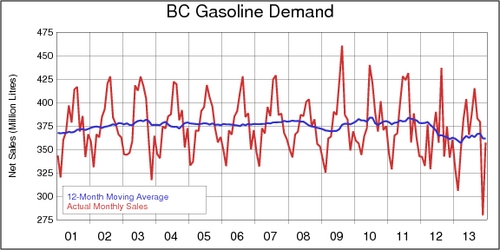

In the absence of solid data on total GHG emissions, much attention has been focused on one significant contributor: carbon dioxide emissions from automotive gasoline demand. The chart below shows that total gasoline demand has a strong seasonal pattern, but the 12-month moving average indicates a drop of about 5% between December 2007 and December 2013.

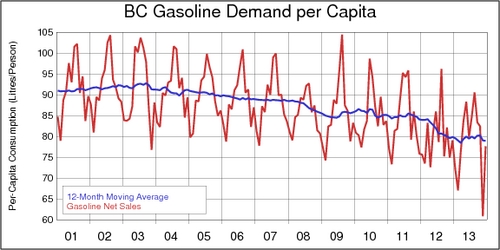

When the above data are expressed in per-capita terms as shown in the next diagram, the drop in the 12-month moving average from December 2007 to December 2013 is even larger: it comes to about 11%. The question is then: can this drop be attributed to the carbon tax, or are there other viable explanations?

Stewart Elgie and Jessica McClay maintain that BC's Carbon Tax Shift Is Working Well after Four Years in a paper in Canadian Public Policy in 2013. Nic Rivers and Brandon Schaufele have looked at the demand for gasoline in BC and tried to infer the effect of the carbon tax. In their 2014 paper Salience of Carbon Taxes in the Gasoline Market they write:

[T]he carbon tax imposed by the Canadian province of British Columbia caused a decline in short-run gasoline demand that is significantly greater than would be expected from an equivalent increase in the market price of gasoline. That the carbon tax is more salient, or yields a larger change in demand than equivalent market price movements, is robust to a range of specifications.

Their paper has been well received by environmentalists, who see it as strong evidence to support the case for carbon pricing. On the other hand, the paper has also been derided by critics, who find fault in the paper's methodology. An article in the Financial Post claims that there was No B.C. carbon tax miracle on 120th St.. Critics take aim at the concept that Rivers and Schaufele base their results on: salience theory. So what exactly is salience theory?

Shelley Taylor and Suzanne Thompson defined "salience" in their 1982 research paper Stalking the Elusive "Vividness" Effect: as follows:

Salience refers to the phenomenon that when one's attention is differentially directed to one portion of the environment rather than to others, the information contained in that portion will receive disproportionate weighting in subsequent judgments.

Economists have gradually embraced this notion, but with caution. Perhaps most prominently, Raj Chetty, Adam Looney and Kory Kraft have looked at the evidence in their 2009 American Economic Review paper Salience and Taxation: Theory and Evidence. They argue that consumers under-react to taxes that are not salient. Rivers and Schaufele argue the opposite direction: that the carbon tax is particularly salient and leads consumers to over-react.

Rivers and Schaufele's key result is that the BC carbon tax generated a demand response that is seven times larger than an equivalent change in the gasoline price without the carbon tax. According to their calculations, at the full carbon price of $30/tonne, gasoline demand in BC should drop by about 15% relative to the era before the carbon tax.

For the carbon tax to be "salient", it has to be highly visible and stand out more than other taxes. There is some notion among economists that sales taxes are more salient than income taxes. However, the carbon tax is absorbed into the "all-in" price at the pump. Consumers are unable to distinguish it from the value-added tax (GST) or the federal and provincial fuel excise taxes. To the consumer, the carbon tax is just one more element in a long list of embedded taxes. While it is true that the carbon tax was widely advertised when it was introduced in 2008 (and all BC residents received a "climate dividend" cheque), it is difficult to argue that carbon taxes have any special visibility for the typical motorist in British Columbia. Prices have been much more variable over time since the carbon tax was introduced. Between 2008 and 2013, retail gasoline prices have been as low as 85¢/L and as high as 145¢/L. It stands to reason that a 6.7¢/L tax does not stand out particularly in this volatile price environment. Even Chetty et al. (2009) define "tax salience" as the visibility of the tax-inclusive price.

There are alternative hypotheses that could explain the drop in per-capita gasoline demand since 2009 that do not depend on tax salience. One strong contender is carbon leakage. I am currently working on research questions about the effects of the carbon tax on transportation in British Columbia. My sense is that there are some surprising new insights. So stay tuned if you want to find out whether BC's carbon tax has had positive effects on transportation. Also keep in mind that the efficacy of BC's carbon tax is not determined solely in the transportation sector; emissions from industry and households are also contributing to the overall picture.

‘How much BC's carbon tax reduces carbon dioxide emissions will take another decade to determine reliably.’

Getting a comprehensive picture about how the carbon tax reduces emissions is not straight-forward. The tax affects different sectors of the economy and through different transmission mechanisms. How much BC's carbon tax reduces carbon dioxide emissions will take another decade to determine reliably. A satisfactory answer depends on reliable data and sufficient time for various slow adjustment mechanisms to play out. Many important adjustments happen on the investment side, where changes are slow, rather than the consumption side, where changes are fast. Economic theory tells us that marginal abatement costs will equal the carbon tax, and GHG-reducing technologies will be deployed accordingly. Innovation and technological progress play an important role in lowering abatement costs. A predictable carbon price is a good way to stimulate innovation into carbon-reducing technologies, ensuring predictable returns on these investments. As Ross Beaty, Richard Lipsey, and Stewart Elgie pointed out in a contribution to the Globe and Mail in July 2014, the shocking truth about B.C.'s carbon tax [is that] it works—and perhaps even without salience.

References:

- Stewart Elgie and Jessica McClay: BC's Carbon Tax Shift Is Working Well after Four Years (Attention Ottawa), Canadian Public Policy 39(s2), August 2013, 1-10.

- Nicholas Rivers and Brandon Schaufele: Salience of Carbon Taxes in the Gasoline Market, SSRN working paper 2131468, October 22, 2014.

- Terence Corcoran: No B.C. carbon tax miracle on 120th Street, Financial Post Comment, January 13, 2015.

- Ross Beaty, Richard Lipsey, and Stewart Elgie: The shocking truth about B.C.'s carbon tax: It works, The Globe and Mail, July 9, 2014.

- Shelley E. Taylor and Suzanne C. Thompson: Stalking the elusive "vividness" effect, Psychological Review 89(2), March 1982, pp. 155-181.

- Raj Chetty, Adam Looney, and Kory Kroft: Salience and Taxation: Theory and Evidence, American Economic Review 99(4), September 2009, pp. 1145-1177

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)