Greece is not the first country to experience a sovereign debt crisis, nor will Greece be the last. How the Greek crisis will continue to unfold the next days and weeks will reveal. Even the readers of the New York Times may find themselves bewildered by the different prescriptions that are offered. The Times Editorial Board urges Greece to stay in the eurozone, and columnists Krugman and Bittner urge Greece to exit the eurozone. Strangely, the lessons of the past are widely ignored. Sovereign debt crises from the 1930s on have taught us what works and what does not. Yet, when politics meets economics, the economics often ends up being ignored until it is too late and the damage is done.

What is ailing Greece is clear to everyone. There is too much debt: roughly €350 billion of it. The average Greek person is thus indebted to the tune of around €31,000—equivalent to about CAD 43,500. Can this debt be repaid? Hardly. A depressed economy such as Greece can't get itself back on its feet without major debt relief. This has been the outcome in many previous sovereign debt crises: from Argentina, to Brazil, to Mexico, and last not least: even Germany in 1953, as Eduardo Porter wrote in the New York Times. When a country goes bust, only a significant "haircut" on bonds will provide a country with a fresh start. A research paper by Carmen Reinhart and Kenneth Rogoff Financial and Sovereign Debt Crises: Some Lessons Learned and Those Forgotten find strong evidence that debt restructuring or conversions, and/or a tolerance for higher inflation, were integral parts of the resolution of significant past debt overhangs even in advanced economies.

‘There is only one reliable cure for Greece’s woes: massive debt relief.’

Despite the compelling economic logic, debt relief is politically unpalatable to most other European nations. Those that emerged from underneath crushing debt successfully in recent years resent that Greece would be treated more favourably than themselves. Voters in the big creditor nations, Germany among them, resent having to foot the bill for what they consider profligacy in Greece. Governments put up a tough stand against Greece as this goes well with an electorate that looks at Greece's crisis in simplistic terms of right and wrong. It sure did not help that the new leftist Greek government (curiously, supported in parliament by an ultra-right party) was alienating its European partners with misplaced rhetoric and political grandstanding. The July 5 referendum did not resolve anything; it was aimed to shore up political support domestically but came at the cost of irritating and offending Greece's European Union partners. Nevertheless, the basic truth remains: Greeks are suffering, and relief is needed. As history has taught us, there is only one reliable cure for Greece's woes: massive debt relief. Whether Greece stays in the eurozone or not is rather secondary despite the amount of attention this question has received. The so-called "grexit"—returning Greece to the Drachma—alone will be insufficient to restore prosperity in Greece, and neither will staying in the eurozone with yet more austerity. If Greece were to reintroduce the Drachma and depreciate its currency, it would help boost exports and replace imports with domestic products. Greece may also attract more tourists if prices drop. However, Greece's economy is insufficiently outward-oriented to benefit from currency depreciation quickly, and it would take a long time until an orderly transition to the Drachma could take place. If Greece were to stay in the eurozone, the overall stability of the currency would be beneficial for businesses by creating a stable environment for investment and facilitate easier trade with its European trading parnters. On balance, one can make compelling arguments for Greece to keep the Euro or drop it. The worst-case scenario, though, is a "disorderly exit" from the Euro, triggered by a banking collapse. The uncertainty and economic disruption caused by a collapse will make things much worse than they already are at the moment. As Paul Krugman has argued, "grexit" may be the lesser evil among two bad choices. The best choice, however, is large-scale debt relief coupled with staying in the eurozone.

‘Lenders and borrowers share responsibility for keeping the level of debt manageable.’

How did Greece get into this mess in the first place? Was it all Greece's fault? As the saying goes, it takes two to tango. In the world of loans, it takes one who lends the money and one who borrows the money. Responsibility does not fall on one side alone. The lender bears responsibility for loaning funds wisely and with restraint, and the borrower bears responsibility for making every effort to pay back borrowed funds timely and fully. Lenders and borrowers share responsibility for keeping the level of debt manageable. Lenders usually make allowance for the creditworthiness of borrowers by adjusting rates through a risk premium: the riskier the borrower, the higher the interest rate. However, after the Euro was introduced in Greece, money was cheap and Greek institutions borrowed funds at rates as low as those elsewhere in Europe. The influx of funds propelled Greece's GDP upward quickly, but the recession struck and propelled the debt-to-GDP ratio into the stratosphere. So who is to blame: Greece taking advantage of cheap money, or lenders who were only too eager to loan money cheaply? Of course the answer is both. We have seen this cycle before: commercial banks, often undercapitalized, lend recklessly and endanger their own existence. Borrowers borrow recklessly because cheap money is irresistible. A crisis strikes and loans cannot be repaid. Banks are in danger of going bust and plead for help from governments. Governments are fearful of the economic repercussions of a banking crisis and take over the bad loans: private risk is made public risk. Governments, beholden to voter sentiment, pledge to recover every last penny of these loans. Much time is squandered agonizing while the crisis gets worse. Only slowly realization sets in that large chunks of these loans are unrecoverable and have to be written off—the much-hated but inevitable "haircut". The European creditor nations still have to (re-)learn this painful lesson: you rescued the banks, but you cannot rescue the loans. The longer-term lesson is to supervise banks more closely: do not allow private lenders to lend recklessly and then dump the responsibility on governments and taxpayers. The Greek debt crisis is also evidence of a systematic failure, or lack, of bank supervision in Europe. If another crisis like Greece is to be avoided in the future, a new code for "responsible lending" and stricter banking oversight will need to be adopted.

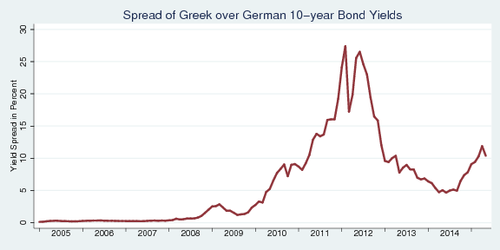

Complicit in the debacle were rating agencies that issued long-term sovereign risk ratings for Greece that did not match reality. It was not until late in 2009 that Greece's A rating (Fitch) dropped to BBB, and to junk grade (CCC) in July 2011. The watchdogs were sleeping. Perhaps they were blinded by Greece fudging its budget numbers to secure entry into the Euro, which the Greek government admitted on 15 November 2004. Perhaps they were reluctant to assess fundamentals when spreads in the bond market did not suggest a problem. Perhaps mindful of doom-loops, they dithered. Gibson et al. (2011) show that "spreads were significantly below what would be predicted by fundamentals from end-2004 up to the middle of 2005". This should have raised alarm bells then, if anyone had cared to pay attention. The chart below shows the yield spreads for Greek bonds over German bonds since 2005. The spread did not indicate any risk with Greece until 2008, and then it was too late already.

click on image to view high-resolution PDF version

How much debt relief is needed, and which form it should take, is a matter of debate and a subject for negotiation. Some debt relief could be a restructuring of debt rather than a nominal haircut. This involves extending maturities of existing loans. There are also proposals for GDP-linked bonds—bonds whose return fluctuates with a country's GDP. When growth is strong, the bonds yield more, and when growth is weak, they yield less. Some compromises are needed to find a face-saving formula that makes the proposed solution palatable to electorates in the creditor countries. The current level of debt, nearing the 180% mark for the debt-to-GDP ratio, is unsustainable, as the International Monetary Fund reports. The level that could be considered "barely manageable" is closer to 130%. This means that roughly 25-30% of the current debt needs to be written off in some form or another, and that amounts to about €80 billion. Writing off this debt may still be the lesser burden compared to the repercussions from an economic collapse of Greece.

Debt relief is of course not the only medicine that Greece needs. Along with the macro-economic medicine, Greece needs a fair bit of micro-economic medicine as well. Creditor nations have correctly identified many necessary reforms: cutting red tape for businesses, liberalizing a number of sclerotic markets, privatizing inefficiently-operated state-run compannies, fighting and suppressing corruption, improving tax collection and tax honesty, and last not least: streamlining a bloated public sector. Interestingly, Greece had made noticeable progress on many of these fronts until the arrival of the new government, which promised relief from the bitter medicine. The microeconomic reforms that Greece still needs will remain a bitter pill to swallow. Greece's economy must move firmly into the 21st century or will fall back into third-world poverty. Nevertheless, creditor nations will need to give Greece the breathing room for that medicine to do its free-market magic.

It is time for European nations to find the courage to face reality. Creditor nations need to wake up to the reality that debt relief is an act of solidarity and not capitulation. Greece needs to wake up to the reality that there is still a long way to go to implement economic reforms that will lay the foundation for a new era of prosperity. Both sides need to come together and find a viable solution that gives Greece a fresh start and assures the country's place in the European family. Perhaps both sides can agree on milestones for economic reform that, when achieved, will be rewarded with significant debt write-off.

References:

- Editorial Board: For Europe's Sake, Keep Greece in the Eurozone, New York Times, July 6, 2015.

- Paul Krugman: Ending Greece's Bleeding, New York Times, July 5, 2015.

- Eduardo Porter: Germans Forget Debt Relief History Lesson in Greece Crisis, The New York Times, July 7, 2015.

- Jochen Bittner: It's Time for Greece to Leave the Euro, New York Times, July 8, 2015.

- Carmen M. Reinhart and Kenneth S. Rogoff: Financial and Sovereign Debt Crises: Some Lessons Learned and Those Forgotten, IMF Working Paper WP/13/266, 2013

- Michael King: What the IMF already knows about Greece, Commentary, The Globe and Mail, July 7, 2015.

- Heather D. Gibson, Stephen G. Hall, and George S. Tavlas: The Greek Financial Crisis: Growing Imbalances and Sovereign Spreads, Bank of Greece working paper 124, March 2011.

- Heather D. Gibson, Stephen G. Hall, and George S. Tavlas: Doom-loops: The Role of Rating Agencies in the Euro Financial Crisis, University of Leicester, Department of Economics, working paper 14/16, December 2014.

- Moody's Global Credit Research: Sovereign Default and Recovery Rates, 1983-2007, March 2008.

- David Barr, Oliver Bush, and Alex Pienkowski: GDP-linked bonds and sovereign default, Bank of England working paper 484, January 2014.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)