In March the United States imposed a 25% tariff on finished vehicles that are not CUSMA-compliant. This affected a relatively small share of Canadian vehicles, those that were not CUSMA-compliant and exported under Most-Favoured Nation (MFN) tariffs because compliance with Rules of Origins (ROOs) was considered too onerous. In early May, the United States also imposed a 25% tariff on the non-US content of automotive parts. However, CUSMA-compliant automobile parts that are exported to the United States are not subject to the tariff.

Canada retaliated by imposing a 25% surtax on non-CUSMA compliant fully assembled vehicles imported into Canada from the United States, as well as on the non-Canadian and non-Mexican content of CUSMA-compliant US-origin vehicles—which is assumed to be 85% of the vehicle of the value unless the importer can prove otherwise.

Auto manufacturers in the United States are also affected by tariffs on aluminium and steel. These tariffs are expected to raise their costs. However, retail prices for new cars have not budged much yet, in part because of inventory build-up prior to the tariffs, and changing pricing mostly with the introduction of a new model year.

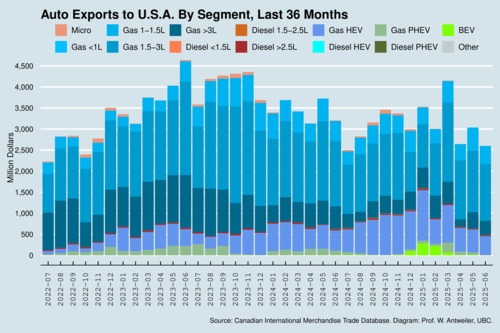

The chart below shows Canadian auto exports to the United States by market segment. There was clearly some inventory build-up in March, and sales in the second quarter are slightly down from the first quarter. Yet, the changes are not as dramatic as feared—at least for now. Exemptions for CUSMA-compliance have kept the industry afloat.

click on image for high-resolution PDF version

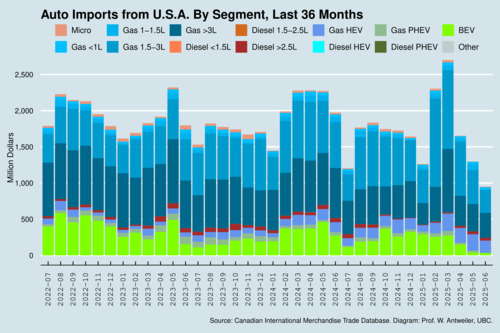

What happened with Canadian imports of U.S. automobiles is a different story altogether. February and March saw rapid inventory build-up. But imports are clearly down in the second quarter, even allowing for the inventory build-up. The trend in April, May, and June points is rather revealing. This is not the effect of tariffs, but mostly shifting consumer preferences. Simply put, Canadians are eschewing U.S.-made cars. It's what happens when Canadians are taking offense to the anti-Canadian 51-state rhetoric coming out of the White House.

click on image for high-resolution PDF version

The drop in EV imports (mostly Tesla) is also rather revealing. On one hand, the (likely temporary) removal of federal EV purchase incentives has slowed down demand. But consumers are also taking offense at Elon Musk's involvement in the U.S. administration by leading the so-called Department of Government Efficiency (DOGE). Canadians are quite apparently dodging Tesla in response.

Ironically, U.S. anti-trade policy seems to widen Canada's export surplus with the United States in the auto sector.

The picture for auto parts is actually quite stable. Most of these goods are CUSMA-compliant, so tariffs likely will not apply. If anything, it will drive manufacturers that preferred MFN tariffs over ROO paperwork to shift to becoming CUSMA compliant. For now, full CUSMA compliance is the best remedy for all auto and auto parts manufacturers in Canada.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)