Image licensed by iStockPhoto

On August 12, 2025, China announced preliminary anti-dumping duties against Canadian canola seeds at a rate of 75.8 percent. The timing of this move is intended to inflict maximum pain on Canadian farmers, who have already planted the crop for this year and have started harvesting. Canola prices have already dropped, and farmers will be losing much income. China accuses Canada of subsidizing canola farmers, but this allegation lacks substance. Rather, China is retaliating to Canada's 100% tariff on EVs, which were brought in last year, and to the more recent tariff-rate quotas (TRQs) on aluminum and steel. What should Canada do in response? Some are making the case for intensifying the trade war with China. But there is also a good case to be made to make some concessions to China. Most importantly, Canada needs to look to the future and develop a larger domestic market for canola. I explain the reasoning below.

China's trade policy is targeting canola seeds this time. In September 2024, China has already imposed 100% preliminary anti-dumping duties on canola oil and canola meal. The 2024 measure was limited in scope because it targeted a small segment of the canola market. However, Canadian exports of canola seeds is a much larger market segment. The August 2025 move will hurt significantly.

Canola (also known as rapeseed) is a major agricultural product for Canada. During 2024, canola was grown on about 9 million hectares of land, with a harvest of nearly 18 million tonnes. Saskatchewan produced 55%, and Alberta and Manitoba 29% and 16%. Canola seeds are exported directly, but seeds are also crushed and refined into canola oil, with canola meal (which is mainly used as animal feed) as a valuable byproduct.

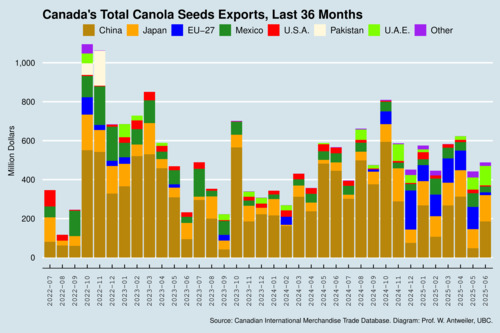

The chart below shows Canada's exports of canola seeds, month by month, over the last three years. Exports to China dominated in recent years. In recent months, exports to Japan and the European Union have noticeably increased. In 2024, Canada exported nearly $5 billion worth of canola to China.

click on image for high-resolution PDF version

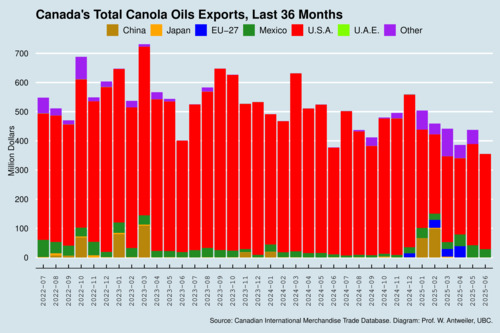

The second chart shows exports of canola oil. Most of it shipped to the United States, and very little is exported to China. Curiously, there was a blip of exports to China in January and February of this year despite the tariffs. Overall, exports of all types of canola to the United States totaled about $7.7 billion in 2024.

click on image for high-resolution PDF version

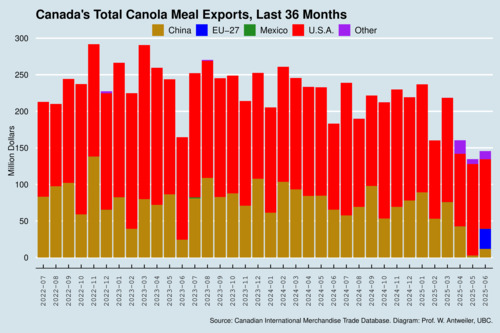

The market for canola meal, a byproduct, is much smaller in size compared to canola seeds and canola oil. Here the United States dominates, but China also imported a significant share. Sales to China have nearly vanished in the last few months. Chinese anti-dumping duties seem to have cut off their market nearly completely.

click on image for high-resolution PDF version

So what can Canada do about the new Chinese tariffs? Is China's government using these anti-dumping duties as a bargaining chip in trade negotiations to obtain concessions on EVs or steel? Perhaps there is indeed scope for Canada to relent on EV tariffs. They were imposed under Section 53 of the Customs Tariff, which allows the government to impose surtaxes on other countries. This procedure does not follow conventional countervailing and anti-dumping investigations under rules of the World Trade Organization. The 100% tariff on EVs was imposed arbitrarily, following the earlier move by the United States. Canada's move was intended to protect North American automakers that have fallen behind their Chinese competitors in developing battery technology and electric vehicles. In my view, this 100% EV tariff was ill conceived and will ultimately hurt Canadian consumers, without protecting jobs in Canada's auto industry in the long term.

The European Union is much more exposed to Chinese EVs than Canada, primarily because European motorists prefer smaller and mid-sized vehicles that China is now excelling at producing. Despite this greater threat, the E.U. has chosen a softer approach than Canada, and one that relies on fact-based economic analysis. After an investigation of Chinese subsidies to their EV industry, the European Union imposed countervailing duties of 7.8% on Tesla in China, 17% on BYD, 18.8% on Geely, 20.7% on other cooperating companies, and 35.3% on SAIC and other non-cooperating companies. These numbers are all economically plausible, even though China obviously objects. Unlike Canada's 100% tariffs, these tariff rates are intended to level the playing field and do not make Chinese EV sales completely unprofitable. Canada should follow the E.U.'s lead and replace the 100% tariffs with countervailing duties that vary by manufacturer, and can be based on solid empirical investigation of unfair state subsidies. Canada's federal government should engage China to explore whether a move on EV tariffs would allow China to abandon their tariffs on canola.

‘Canada should follow the European Union's example and apply modest countervailing duties on Chinese EVs based on a fact-based investigation rather than an arbitrary and prohibitive 100% level.’

Allowing Chinese EVs into the Canadian market could also boost the ailing uptake of electric vehicles, which has slumped following the drop of federal purchase incentives. Chinese EVs have clearly come of age. Their quality has improved to make them very competitive in some market segments, and in some instances these vehicles have broken through the purchase price parity barrier that has been holding back EV uptake. Nevertheless, Chinese cars will not upend the North American auto sector. North American car makers understand their local markets and produce cars and trucks suitable for their customers. But North American automakers should not be shielded from competition entirely. They must innovate to stay competitive. Of course, the current US administration is trying to lull these auto makers into the false sense of security that there is no threat from EV competition. The economic trend points into a different direction: as batteries get cheaper, EVs are increasingly reaching and exceeding purchase price parity with gasoline-powered vehicles. Ultimately, consumers will buy what's cheaper when the quality is the same. Chinese EV makers have not succeeded merely because of subsidies; they have developed massive economies of scale through their domestic market, and they have improved battery technology faster than others.

Even successful trade negotiations with China should not distract from an underlying problem. Canada's canola farmers are overly exposed to the whims of foreign markets. Canada needs to grow its domestic market, and in fact it can and must. Canola oil has become the major input into the production of renewable diesel (RD) and sustainable aviation fuel (SAF). On August 5, Imperial Oil announced that it has started producing RD at its Strathcona refinery near Edmonton. The new plant (integrated with its existing conventional refinery) has the capacity to produce a billion liters of diesel per year. RD is a drop-in fuel that can be used without engine modifications just like conventional diesel made from fossil sources. To make one liter of RD one needs about 2.85 kilograms of canola. A plant with an annual capacity of 1 billion liters would require 2.85 million tonnes of canola, roughly half of the 5.86 million tonnes of canola exported to China in 2024. Hopefully, much of the output that was supposed to be sold to China will now find its way into domestic RD and SAF!

‘Canada must grow and protect its domestic biofuels market by amending its Clean Fuels Regulations.’

The case for developing a stronger domestic biofuels market is strong. It would enhance energy security. It would give Canadian farmers a reliable and predictable market for their crop. It would reduce carbon emissions as renewable diesel replaces the conventional kind. It would extend our agricultural value chain and create new jobs. And politically, it should be a case for broad consensus across party lines. What needs to be done is to beef up the federal Clean Fuel Regulations (CFR) to mandate Canadian content in biofuels. BC has already paved the way for this with its recent changes (in April) to its Low Carbon Fuel Standard (LCFS). The renewable fuel requirement for diesel was increased from 4% to 8% for the 2025 compliance period, and the minimum 8% renewable fuel requirement for diesel must be met with eligible fuels produced in Canada.

Beefing up the federal CFR may also deal with unfair practices by our Southern neighbour. Section 45Z of Biden's Inflation Reduction Act introduced generous subsidies for RD and SAF. Foreign producers such as Canada cannot claim these subsidies, but US producers can obtain these credits for fuels produced from Canadian feedstock. This distorts trade and could swamp the Canadian biofuels market with subsidized US output. Minimum Canadian content for biofuels should prevent such unfair trade practices. Canada should increase the domestic content to ensure that domestic RD and SAF refineries are not disadvantaged. Canada needs to build its own refining infrastructure and not let the United States monopolize the market unfairly.

Further readings and sources:

- Werner Antweiler: Scaling Up: The Promise and Perils of Canada's Biofuels Strategy,, C.D. Howe Institute, November 2024.

- The Editorial Board: Disquiet on the Western front of the tariff war, The Globe and Mail, August 14, 2025.

- Omar Saleh: You can't fly sovereignty on foreign fuel, The Globe and Mail, August 14, 2025.

- Imperial Oil: Imperial now producing renewable diesel at Strathcona refinery, Press Release, August 5, 2025.

- Thomson Reuters: China to set preliminary duty on Canadian canola after anti-dumping probe, CBC News, August 12, 2025.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)