The fleet of B.C. Ferries vessels is aging noticeably. At the beginning of September, the oldest ship in the fleet at over sixty years of age, the Queen of New Westminster, had to be taken out of service after one of its propellers broke off due to structural fatigue and sank to the sea floor shortly after leaving the Tsawwassen ferry terminal. The ship underwent extensive repairs earlier in 2025, but will now be out of commission again for several months.

Several vessels in the fleet Some are approaching the limits of useful service life and will need to be replaced. On June 10, 2025, B.C. Ferries announced that CMI [China Merchants Industry] Weihai Shipyard, located in the city of Weihai in Chain's Shandong Province, will build four new vessels. Each will be capable of transporting 360 vehicles and up to 2,100 passengers.

‘B.C. Ferries followed a rigorous, professional procurement process.’

B.C. Ferries employed a rigorous procurement process that involved maritime shipping experts. Still, some politicians jumped on the decision to buy ferries made in China and lamented that contracts had not been awarded to domestic shipbuilders. Some politicians, from across the political spectrum, even called for B.C. Ferries to cancel the contract. The criticism misses the point entirely. New vessels are procured with a broad consideration of all relevant factors, starting with cost and the ability to meet requirements in design and propulsion system, but also including a shipyard's capacity and experience, timing of delivery, and construction oversight. The list of criteria is exhaustive and is weighted along all these factors. Essentially, a contract is awarded to the lowest-cost qualified bidder, with an emphasis on the word "qualified". There are numerous factors that can rule out a bidder as being qualified. Among them is the lack of capacity or the inability to build on time. Larger shipyards are simply better equipped to build on time and on schedule, and thus have a crucial advantage. The largest shipbuilders for ferries are in Japan, South Korea, China, and Turkey. In China, CMI Weihai and CSC Jinling are both highly experienced builders of roll-on-roll-off (RoRo) ferries.

When selecting a shipyard, the ability to deliver on time is crucial. Ships need replacement at a specific time, with the four vessels that need replacement ideally staggered at 6-month intervals to train new crews and take new vessels into operation. Delays could become costly. Ultimately, B.C. Ferries needs to deliver service that its customers can afford. The company—which is not a Crown corporation although it is publicly owned—has to follow business principles for delivering value to its customers, and this means buying ferries that are built on time and on budget. Their design will be standardized so as to generate efficiencies during construction. The basic design involved naval architect firm LMG Marin AS, which is based in Norway.

‘Canadian shipyards did not bid on the contract because they were unable to qualify.’

Critics who think Canadian shipyards were in a position to compete effectively are mistaken. First, it has been a long time since they built larger ferries in B.C. (see table below); the two Spirit-class vessels were built over thirty years ago. The industry has no track record of building larger ferries in recent decades, let alone with state-of-the-art diesel-battery hybrid propulsion systems that are equipped with a capability to operate on full electric power once shore-based charging infrastructure becomes available. Second, it appears that the local shipyards' order books are full with other contracts, which would have made it impossible to meet the time line that is needed to replace the aging ferries. Local shipyards will likely get even busier with urgently-needed new ships for the Royal Canadian Navy. Third, size matters. It is economical to build several ships at the same time and in tandem—which favours large shipyards. It economizes on design, helps standardize features and systems, and generates economies of scale. It becomes easier and less costly to maintain ships if there are multiple ship of the same design, with identical components.

Critics also pointed at what appears to be a more favourable treatment of Marine Atlantic, a federal Crown corporation, compared to B.C. Ferries. But the status of Marine Atlantic is rather different. The federal government is obligated under Confederation rules (specifically, the British North America Act of 1949, s. 32(1)) to provide ferry service to connect Newfoundland and the mainland. No similar rules apply to B.C. Nevertheless, BC receives federal money under the 1977 BC Federal Government Ferry Subsidy Agreement; the province receives about $35 million per year.

Some shipbuilders in Canada claim that Chinese shipyards have unfair advantages due to lower labour costs and government subsidies. To the extent that unfair trade advantages exist, it is the federal government that has the instruments at its disposal under international trade law to level the playing field: anti-dumping and countervailing duties. However, using these instruments only makes sense if there is material injury to domestic producers. Domestic shipbuilders did not bid for the ferries contract because they did not qualify, and thus they cannot claim injury. But even if they had bid on the contract, questions about international trade relations are within the purview of the federal government, not individual businesses. BC Ferries cannot take political concerns into consideration beyond what may constitute business risk. Whatever concerns one may have about geopolitical factors involving China, ferry building contracts are ultimately purchases that do not expose Canada to geostrategic risks. After all, once purchased, the ferries are maintained and repaired locally, creating many well-paid jobs for decades to come.

‘CMI Weihai has experience building ships for Canada.’

Among the bidders, CMI turned out to be the winner. CMI is a well-established shipyard for building ferries, with a long and successful track record. Customers include Stena RoRo of Sweden and Grimaldi Lines of Italy. The shipyard has also built RoRo and RoPax ferries for other ferry operators, including Corsica Linea in Italy and Brittany Ferries in France. More importantly, CMI Weihai has built vessels for Canada's Marine Atlantic ferry company such as the MV Ala'suinu. Because the shipyard has built ships for a Canadian customer before, it is familiar with meeting Transport Canada regulatory requirements. Moreover, during the construction, B.C. Ferries staff has the ability to supervise the process on site and ensure that specifications are met fully. Not all shipyards offer that level of transparency and accountability.

The team at B.C. Ferries responsible for the procurement process, the executive team and the Board of Directors, followed all due diligence processes that are customary to businesses. All public records point to a process that follows standard procurement protocols in the marine industry. Simply put, politicians who are unhappy about B.C. Ferries's decision are barking up the wrong tree. It's not the job of B.C. Ferries to fix capacity inadequacies of local shipbuilders, or to subsidize them at the expense of their customers. Put another way, what extra cost are these politicians willing to impose on all of us, and what level of service disruption if domestic shipyards can't deliver anywhere near on time? They won't say because they know the answer would be upsetting to most of their voters.

‘The CIB loan benefits British Columbians, not the shipyard in China.’

There is one issue that still receives scrutiny: a one-billion dollar loan from the Canada Infrastructure Bank for the procurement, which some (mis-)interpret as a subsidy for China. The benefit of any advantages from a CIB loan, which comes with a slightly more favourable interest rate than a commercial loan, stays with Canadians. The terms of the loan don't change the purchase price, just how it is amortized domestically. Ths same loan would have been obtained regardless of where the ferries are bought from. It is not a subsidy for the builder. Shipbuilders tender their bids based on their costs, not on the buyer's ability to pay. The CIB loan benefits British Columbians rather than the shipyard in China.

Moving away from the political storm in a teacup, let's return to the real question at hand: the aging fleet of B.C. Ferries, and the need to update the fleet. The table below shows the entire fleet of BC Ferries, arranged by age with the oldest ships at the top. The four ships that are being built are not the only ones that need replacing. The four new ferries will replace the Queen of Alberni, Queen of Coquitlam, the Queen of New Westminster, and the Queen of Cowichan during 2029-2031. B.C. Ferries also plans on retiring the Queen of Surrey and the Queen of Oak Bay in the mid-2030s.

| Code | Name of Vessel | Gross Tonnage |

Built [Year] |

Origin | Capacity | |

|---|---|---|---|---|---|---|

| Cars | Psgrs. | |||||

| QNWM | Queen of New Westminster | 6,129 | 1964 | Victoria | 254 | 1,332 |

| QQII | Quadra Queen II | 819 | 1969 | Vancouver | 26 | 150 |

| TACH | Tachek | 772 | 1969 | Vancouver | 26 | 150 |

| KLI | Klitsa | 450 | 1972 | Vancouver | 19 | 150 |

| KAHL | Kahloke | 496 | 1973 | Vancouver | 21 | 200 |

| KWUN | Kwuna | 503 | 1975 | Victoria | 16 | 150 |

| QALB | Queen of Alberni | 6,422 | 1976 | Vancouver | 280 | 1,200 |

| QCOQ | Queen of Coquitlam | 6,465 | 1976 | Vancouver | 316 | 1,494 |

| QCOW | Queen of Cowichan | 6,508 | 1976 | Victoria | 312 | 1,494 |

| QNIT | Quinitsa | 1,099 | 1977 | Vancouver | 44 | 300 |

| QOAK | Queen of Oak Bay | 6,673 | 1981 | Vancouver | 311 | 1,494 |

| QSUR | Queen of Surrey | 6,556 | 1981 | Vancouver | 311 | 1,494 |

| QSAM | Quinsam | 1,431 | 1982 | Vancouver | 63 | 400 |

| KUP | Pune'luxutth | 648 | 1985 | Bullfrog, Utah | 26 | 269 |

| QCAP | Queen of Capilano | 2,500 | 1991 | Vancouver | 100 | 457 |

| QCUM | Queen of Cumberland | 2,662 | 1992 | Vancouver | 112 | 462 |

| SOBC | Spirit of British Columbia | 11,642 | 1993 | Vancouver | 358 | 2,100 |

| SOVI | Spirit of Vancouver Island | 11,681 | 1994 | Vancouver | 358 | 2,100 |

| SKEN | Skeena Queen | 2,942 | 1997 | Gdańsk, Poland | 92 | 450 |

| NSW | Northern Sea Wolf | 1,547 | 2000 | Salamis, Greece | 35 | 150 |

| NADV | Northern Adventure | 5,983 | 2004 | Perama, Greece | 87 | 500 |

| REN | Coastal Renaissance | 10,034 | 2007 | Flensburg, Germany | 310 | 1,604 |

| CEL | Coastal Celebration | 10,034 | 2008 | Flensburg, Germany | 310 | 1,604 |

| INS | Coastal Inspiration | 10,034 | 2008 | Flensburg, Germany | 310 | 1,604 |

| ISKY | Malaspina Sky | 3,437 | 2008 | Vancouver | 112 | 462 |

| NEXP | Northern Expedition | 8,726 | 2009 | Flensburg, Germany | 115 | 638 |

| BSC | Baynes Sound Connector | 750 | 2015 | Vancouver | 45 | 200 |

| EAG | Salish Eagle | 4,227 | 2016 | Gdańsk, Poland | 138 | 600 |

| ORCA | Salish Orca | 4,227 | 2016 | Gdańsk, Poland | 138 | 600 |

| RAV | Salish Raven | 4,227 | 2017 | Gdańsk, Poland | 138 | 600 |

| IAUR | Island Aurora | 1,778 | 2020 | Galati, Romania | 47 | 399 |

| IDSC | Island Discovery | 1,778 | 2020 | Galati, Romania | 47 | 399 |

| HERO | Salish Heron | 4,227 | 2020 | Gdańsk, Poland | 138 | 600 |

| IGWA | Island Gwawis | 1,778 | 2022 | Galati, Romania | 47 | 399 |

| IKWG | Island Kwigwis | 1,778 | 2022 | Galati, Romania | 47 | 399 |

| IKTA | Island K'ulut'a | 1,778 | 2023 | Galati, Romania | 47 | 399 |

| INGL | Island Nagalis | 1,778 | 2023 | Galati, Romania | 47 | 399 |

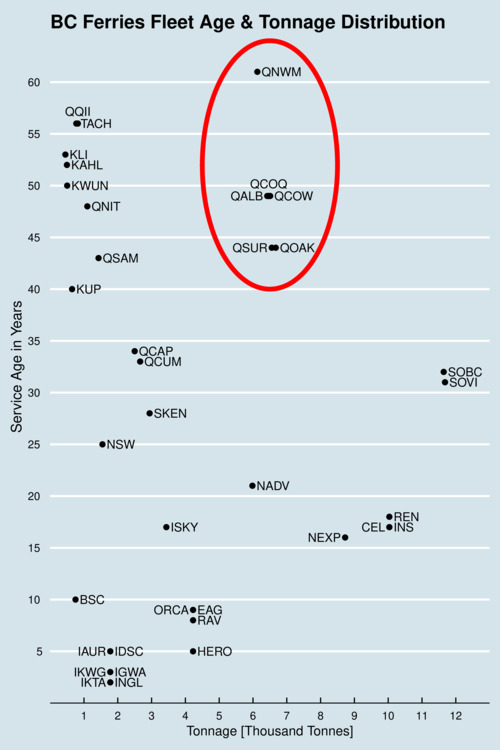

The chart below visualizes the data in the diagram in a more useful way. The vertical axis shows the age of the ships, and the horizontal axis shows the tonnage of the ship. Each ship is identified with the code that matches the description in the table above. This visualization helps identify clusters of ships. The largest ships are the three super-C ships Coastal Renaissance, Coastal Renaissance and Coastal Celebration, and the two Spirit class ships Spirit of British Columbia and Spirit of Vancouver Island. All five ships have a gross tonnage over 10,000. The red circle identifies the six ships approaching their end of life, with the four at the top being replaced with the four vessels that were just contracted. When they are replaced, each vessel will be over 50 years of age.

click on image for high-resolution PDF version

The diagram above is organized by tonnage, identifying the scale at which ferries operate on different routes. There are different clusters along the horizontal axis, with short-haul ferries, mid-sized ferries, long-haul ferries (operating on Northern routes), and large ferries for the busiest routes that connect Vancouver Island to the mainland. The portfolio of vessels needs careful and consistent procurement to renew the fleet, but at a pace that does not overwhelm the system.

In 2003, B.C. Ferries was transformed from a provincial Crown corporation to a private company, with the BC Ferry Authority (BCAF) as the single owner. The Coastal Ferries Act of 2003 establishes the BCAF and the B.C. Ferries Corporation. In turn, the Coastal Ferry Services Contract stipulates the terms of service between B.C. Ferries and the province of BC.

‘Remember the lessons from the fast ferry scandal in the 1990s.’

The older readers of this blog will likely remember the fast ferry scandal of the 1990s, when B.C. Ferries was still a Crown corporation. The provincial government at the time, led by premier Glen Clark, aimed at boosting BC shipbuilding by commissioning a fleet of three high-speed catamaran ships. They were built, but at more than double the planned cost, and delivery was delayed by three years. The fast ferries did not perform as expected. They were fuel-intensive, could not deal with flotsam, created a wake that damaged waterfront properties, and couldn't operate at their full speed. The comfort level on the ships was sub-standard and perceived as cramped. Ultimately, the next premier placed the ferries up for sale, at a steep discount. It is safe to say that everyone at the executive level at B.C. Ferries is well aware of this troubled history. It was a painful lesson to learn for the province, and it ultimately led to the new arrangement of B.C. Ferries operating at arm's length to policy makers in Victoria. I can only applaud B.C. Ferries president Nicolas Jiminez and his executive team at B.C. Ferries for sticking to their guns: making sound business decisions in the interest of their fare-paying customers—keeping ferry service reliable and affordable.

Further readings and sources:

- B.C. Ferries: New Major Vessels, Web Site.

- Bailey Seymour: BC Ferries hires Chinese state-owned company to build 4 new ferries, Victoria News, June 10, 2025.

- Michael John Lo, Minister flags concern over B.C. Ferries' deal with Chinese shipyard for new vessels, Business in Vancouver, June 11, 2025.

- Carla Wilson: B.C. Ferries aims to add seven new major vessels to its fleet, Victoria Times Colonist, September 16, 2024.

- Vaughn Palmer: Ferries CEO explains what it would take to actually build major ferries here in B.C., Vancouver Sun, September 5, 2025.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)