Today's blog returns to a theme I already explored earlier this year: electric vehicle adoption in Germany. Since I wrote February's blog, EV subsidies in Canada have been "paused" federally and provincially, and carbon pricing on motor fuels has ended in April. I think it may be worthwhile pointing out that Canada's EV adoption path may soon start to resemble Germany's, driven by policies moving forth and back. What can Canada learn from Germany's zig-zag course?

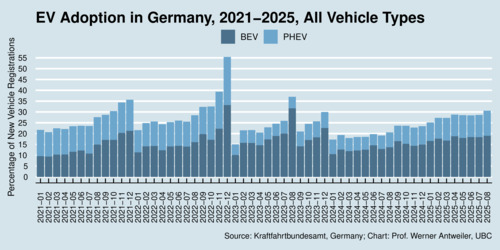

But let me start with a bit of good news. In August 2025, three out of ten vehicles new vehicles bought in Germany was electric—either fully battery-electric or plug-in hybrid electric—without any subsidies. The chart below shows that Germany's path of electric vehicle (EV) adoption has been anything but linear.

click on image for high-resolution PDF version

Germany started incentivizing the sales of electric vehicles in May 2016 with an environmental bonus (subsidy) of €2,000 for battery-electric vehicles (BEVs) and fuel-cell electric vehicles (FCEVs), and €1,500 for plug-in hybrid electric vehicles (PHEVs). In November 2019 the incentives were increased to €3,000 and €2,250, respectively, for vehicles priced below €40,000. Vehicles with a purchase price between €40,000–€65,000 were eligible for a reduced bonus amount of €2,500 and €1,875, respectively.

In June 2020, incentives were doubled with an expiry date of December 31, 2022. BEVs with a purchase price below €40,000 could receive a €6,000 subsidy. That is $9,600 at today's exchange rate. (To convert to Canadian dollars, multiply euro figures with 1.6.) This is roughly the same level of incentive that buyers in British Columbia were eligible to receive in 2024 when federal and provincial incentives were combined. As the chart shows, EV sales peaked in December 2023 just before the policy expired. For 2022, subsidies for BEVs below €40,000 were reduced from €6,000 to €4,500, while subsidies for PHEVs were completely eliminated. Unsurprisingly, as the chart reveals, this change hit PHEV sales the hardest.

Budget pressures let to an abrupt end of EV subsidies at the end of 2023. Germany's constitutional court had ruled on a 60-billion fund earmarked for climate transformation project was an unconstitutional relabeling of funds that were raised under a special provision for exceeding the federal debt ceiling, Germany's infamous Schuldenbremse. Overnight, EV subsidies were history, and EV sales dropped in half from December 2023 to January 2024. Since then, EV sales have recovered little by little and have surpassed 30% again in August 2025. The EV transition is gathering momentum in Germany all on its own.

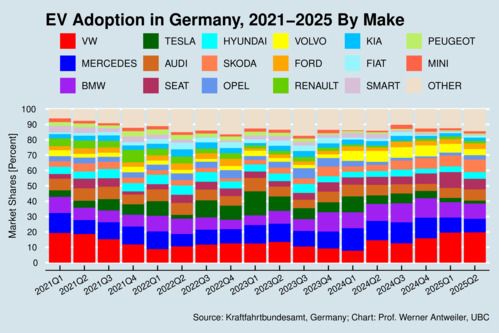

EVs have come of age in Germany. EV sales are moving forward even without subsidies. And this has not spelled the end of car manufacturing in Germany, despite fierce international competition. The next chart shows the composition of vehicle sales, quarter by quarter, by major brands.

click on image for high-resolution PDF version

Germany's automotive market has a strong presence of German car makers, just as you would expect. The first modern gasoline-powered motor vehicle, after all, was invented in Germany by Carl Benz in 1886. In the EV market, Mercedes has established a significant market share, right behind Volkswagen, and before BMW. Tesla held fourth place for some time, but more about Tesla below. Volkswagen affiliates Audi, Škoda, and Seat all hold significant market share as well. Ford and Volvo are also important in the EV market, as are South Korean car makers Kia and Hyundai. Notably absent are Japanese car makers.

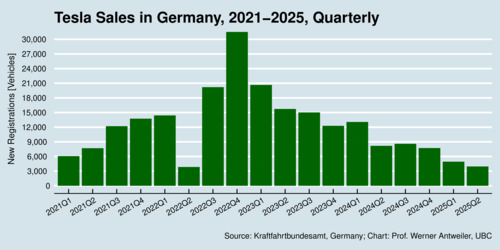

But what happened to Tesla, the EV manufacturer that is so visible in North America? Tesla even opened a plant in Germany, known as the Gigafactory Berlin-Brandenburg, in March 2022. It produces Tesla's Model Y. The plant also manufactures batteries and was designed for a production capacity of 500,000 vehicles annually. The plant supplies many European countries. However, Tesla is not doing well in Germany, as the chart below shows. The trajectory looks catastrophic: in the second quarter of 2025, Tesla sold barely over 1,000 vehicles per month in Germany.

click on image for high-resolution PDF version

Tesla's story in Germany is one that shines a bright light on the company's woes. It is no longer the cutting-edge innovator it used to be. It has become just one of many car makers, and discerning German car buyers are not easily fooled if quality and service don't turn out as promised. And then Tesla suffered from the antics of its CEO, Elon Musk. His proximity to Donald Trump, his endorsement of a far-right party in Germany, and his insufferable social media posts have turned off many potential Tesla buyers in Germany. Tesla sales, which had already suffered during 2023 and 2024, took a further nose dive during early 2025. It is doubtful that Tesla can recover. Trust lost is not easily regained, and Musk has turned Tesla into a toxic brand for many. But Tesla's fate is ultimately that of any car manufacturer: provide a superior product and people will buy it, or provide an inferior product and people will look elsewhere. Tesla's vehicle line-up has become stale. Models have not been updated or replaced, and the only new addition, the cybertruck, is not appealing much to European tastes and is priced well outside the budget range of most buyers.

Tesla's fall from grace in European markets is a boon for Europe's established car makers. Their focus will be on the new competition from China: BYD, SAIC, Geely, NIO, Li Auto, and XPeng. Watch for these car makers to make inroads into Europe. Chinese car maker Chery open its first European plant in Barcelona, Spain. Chinese carmaker XPeng started production of its EVs at a plant in Graz, Austria, in partnership with Magna Steyr. And BYD is building its first European EV factory in Szeged, Hungary. Bye-bye, Tesla; see you in the rear mirror.

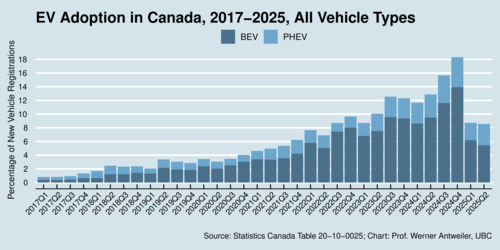

Returning to Canada's EV adoption, the chart below shows a similar drastic reaction as Germany experienced at the beginning of 2024. EV sales were cut in half, with the overall rate dropping from about 18% in the last quarter of 2024 to about 9% in the first quarter of 2025. But as the chart from Germany reveals, there is a ray of hope for a recovery even without subsidies.

click on image for high-resolution PDF version

Which lessons can Canada learn from Germany's zig-zag of EV adoption? First, abrupt shifts in policy make life hard for car makers and their investments into EV manufacturing. Policies need to be stable. Therefore, second, don't introduce subsidies that are too expensive to sustain when EV adoption ramps up. In my last blog, Canada's Zero-Emission Vehicle mandate needs reform, not rescission or derision, I pointed to the need for a renveue-neutral bonus-malus scheme. That's the only way how EVs can (and should be) incentivized in a sustainable fiscal manner. Simple: convert small penalties on ICEV purchases into larger subsidies for EV purchases so that the incentive wedge equals the social cost of carbon (or other pollutants). And third, a thriving EV market comes with plenty of consumer choice. North American car makers still haven't taken up the challenge with heart and mind. EV line-ups are still paltry, with limited choice. No wonder, then, to see European and South Korean car makers to make quicker inroads into Canada than domestic manufacturers.

Further readings and sources:

- Carsten Creutzberg, Leo M. Doerr, and Wolfgang Maennig: Exponential effects of public purchasing subsidies: a full-sample analysis of electric vehicle adoption in Germany, Transportation Research Part A: Policy and Practice 201, November 2025, 104668.

- Michael Schulthoff, Philipp Anstett, Jelto Lange, Dörthe Arend, Emre Gencer, Martin Kaltschmitt: Federal Transformation costs of e-mobility in Germany: Effectiveness and efficiency of EV incentives between 2015 and 2023, Transportation Research Interdisciplinary Perspectives 31, May 2025, 101435.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)