Earlier this year, Canada became yet another country to adopt legislation for balanced budgets, the Federal Balanced Budget Act (Bill C-59). Canada is following the lead of other OECD countries. Germany has even put a balanced budget clause into its constitution. What all these efforts have in common, though, is that they are not based on sound economics but on political showmanship. I will take a stab at explaining the economics of such rules below, and show why they don't work. On balance, "debt break" laws do little good and may actually cause harm.

Not all "debt break" laws are made equal. Among them are those that are sophisticated economically, and those that are not. Unfortunately, Canada's particular version of a "debt break" is both amateurish and silly. It is amateurish because it does not even follow "best of class" approaches among such laws to distinguish between a "structural deficit" and a "cyclical deficit". It is silly because a deficit triggers requirements for 5% wage cuts for ministers, ministers of State, and deputy ministers. On September 2, the Liberal Party's John McCallum announced that a Liberal government would scrap Bill C-59. Given the choice between fixing the Federal Balanced Budget Act and scrapping it altogether, scrapping is the better option. Essentially, fixing such laws is impossible. The law may have been based on good intentions for fiscal prudence, but this is a political but not an economic concept.

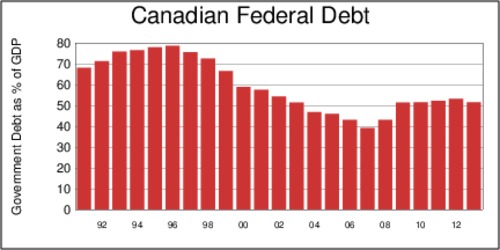

As the chart below shows, Canada's gross federal debt has been decreasing as a percentage of gross domestic product (GDP) between 1996 and 2007. In the wake of the financial crisis of 2007, fiscal stimulus brought the debt-to-GDP ratio back to about 50%, where it has hovered since.

click on image for high-resolution PDF version

Source: World Bank Development Indicators series GC.DOD.TOTL.GD.ZS

The above chart only shows the federal debt. Other levels of government (the provinces and muncipalities) carry debt as well. Canada's consolidated debt-to-GDP ratio is about 87%. It is also important to point out the difference between gross debt and net debt. Gross debt is what the government pays interest on. However, governments also have financial and non-financial assets, for example loans to junior levels of government, or or ownership of land and buildings. The Department of Finance prefers reporting net debt figures in its Annual Financial Report 2013-14. Net debt one can think of as accumulated deficit, whereas gross debt includes other types of borrowing. For the federal government, gross debt (in 2014) was about 53\% of GDP, while the accumulated deficit came to only 33\% of GDP. While the numbers differ, both gross debt and net debt show similar patterns over time and across countries. Therefore, the discussion below centers on "gross debt", with the understanding that similar conclusions apply to trends and comparisons of "net debt".

The evolution of the debt-to-GDP ratio over time is one of two useful yardsticks. The second useful yardstick is a comparison with other major countries. The chart below shows that Canada's debt-to-GDP ratio is the loewst among the G7 nations. Only Germany has a comparably low level. The United States has a debt-to-GDP ratio twice as high (nearly 100%), and Japan's ratio is nearly 200%. If Japan's debt was external (owed to other countries) rather than internal (owed domestically), Japan would be in serious crisis. But Japan is certainly facing a debt overhang that sooner or later will cause problems. However, Canada is in a formidable position.

Source: World Bank Development Indicators series GC.DOD.TOTL.GD.ZS

Achieving Canada's low debt-to-GDP ratio was hard work. Under the Liberal governments of Jean Chretien and Paul Martin, the debt-to-GDP ratio dropped from nearly 80% to 45% in the early 2000s. Coming into office in 2006, the Conservative government of Stephen Harper was faced soon with the financial crisis of 2008 and its aftermath, which brought the debt-to-GDP ratio back to just over 50%. While Canada and its government bears no responsibility for the financial crisis, one fiscal policy has reduced revenues permanently. Popular as it may have been, the reduction of the GST from 7% to 5% has shrunk the share of the federal budget that is financed through indirect taxes. Whereas income taxes (both personal and corporate) contribute aournd 62% of the budget revenue, GST contributes merely 11%. Many economists think that this balance is tilted too much towards direct taxes. In the 2014 budget, GST revenue was projected as $31.3 billion. The 2% tax rate difference is equivalent to about $12.5 billion in lost revenue annually. Sooner or later, discussing the balance between direct and indirect taxation will be back on the agenda.

click on image for high-resolution PDF version

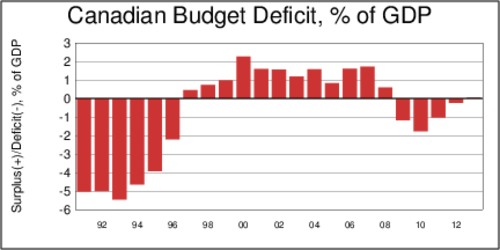

Source: World Bank Development Indicators series GC.BAL.CASH.GD.ZS

‘Canada's balanced budget law is unnecessary and it is also rather flawed methodologically.’

Canada's fiscal position is far from crisis territory. Even when the budget deficit was rising during the aftermath of the financial crisis, at its peak in 2010 it remained well below 2% of GDP. During the last years of the conservative Mulroney government, deficits routinely reached 5%. So why do we need balanced budget laws if the last 20 years of government have shown fiscal prudence? Let us have a closer look at balanced budget laws and how they are put together. It will emerge that Canada's balanced budget law is unnecessary and that it is also rather flawed methodologically.

What exactly is a balanced budget law?

A balanced budget law, also known as a "debt break", is a legal and sometimes constitutional rule that requires governments to balance projected revenues and expenditures and post a zero or positive balance. A balanced budget obviates the need to borrow money. If a balanced budget law is adopted when a country is already running a debt, this debt level will be stabilized as no new debt is added. If this country also experiences positive economic growth, the debt-to-GDP ratio will shrink.

To understand the dynamics of budgets, it is important to distinguish between its two components: the cyclical deficit that occurs during a business cycle downturn and is offset by a "cyclical surplus" during the cycle's upturn; and the structural deficit that is the result of a long-term discrepancy between revenues and expenditures.

What is good debt and what is bad debt?

Not all debt is alike. There are actually some good reasons for governments to borrow money, and there are many bad reasons. Essentially, "good debt" is incurred to build capital—physical capital such as infrastructure or human capital such as education and job skills. Borrowing for such investments spreads the burden of paying for them across many years, and even generations. For example, a bridge or wastewater treatment plant that is built today may be expected to last 50 years. It makes good sense to spread the cost of building the bridge over the lifetime of this physical asset. The same logic applies to less tangible capital such as education. On the other hand, "bad debt" is incurred for purely consumptive purposes. This can be in the form of subsidies or tax breaks, or through other types of government expenditures and purchases. With bad debt, a country is essentially living beyond its means by shifting consumption from future generations to the current generation. It is "bad" because it amounts to stealing from your kids. Beyond the "good debt" and "bad debt" is the "transient debt". Keynesian macroeconomics teaches us that during a recession we should borrow money to stimulate the economy, and during a boom we should repay this debt. The trouble is that business cycles do not follow this perfect pattern of a sine wave. Getting the timing right for this "transient debt" is the hard part, and many governments can get that wrong even when they have the best of intentions.

When does debt run out of control?

The number to watch is the debt-to-GDP ratio. As a rule of thumb, government debt below the 80% mark is usually quite sustainable. Up to 100%, mild adjustments are needed. That is where the United States are at the moment. Between 100-125%, the red lights start blinking and call for more rigorous structural adjustments in the economy. Above 125% starts the danger territory. Greece's debt-to-GDP ratio is hovering at 175%, and nothing short than a debt write-down will get the country back on its feet. It also matters if the debt is financed externally (by borrowing from other countries) or internally (by borrowing domestically). The latter debt is more sustainable because ultimately it can be eroded through domestic inflation. Japan's debt of nearly 200% of GDP, larger than Greece's, does not cause a crisis because it is mostly financed internally.

The debt-to-GDP ratio involves two numbers: the amount of debt in the numerator and GDP in the denominator. A country can grow its way out of debt. If the total debt stays flat, a growing GDP will lower the debt-to-GDP ratio. This economic logic has two important implications. The first implication is that austerity measures can backfire, as in Greece. If a budget deficit is trimmed too fast, it can slow economic growth and even trigger a recessions. Then GDP may shrink even faster than public debt, and the debt-to-GDP ratio may even rise. The second implication is that sometimes increasing public debt can help stimulate growth, and this economic growth may help reduce the debt-to-GDP ratio. There is a catch, though. Stimulating an economy through debt financing works well during a recession, but not so well when the economy is booming. And in any case, increasing debt makes more sense if it creates "assets" (i.e., physical and human capital) on one side of the economy's ledger while adding more debt to the "liabilities" side of that ledger.

Why is Germany's "debt break" more sophisticated than Canada's?

In 2009 Germany changed its constitution, the Basic Law, and adopted a debt break ("Schuldenbremse") as articles 109(3) and 115. This law allows the country to run a "structural deficit" up to 0.35% of GDP. The law allows the country to run a "cyclical deficit" on top of the structural deficit during a recession. By allowing explicitly for cyclical deficits, the law anticipates that fiscal manoeuvering room needs to expand during a recession, and needs to turn into a small surplus during an economic boom. Canada's law is simplistic in the sense of demanding perfect balancing, and allowing departues during a recession, but with no clear limits stipulated.

If the objective of a "debt brake" is to keep the debt level steady, allowing a small expansion of debt over time is perfectly feasible as long as debt growth does not exceed GDP growth. A trivial version that simply calls for balanced books ignores the potential that "good debt" can do in an economy. Therefore, allowing a small structural deficit (such as 0.35% of GDP in Germany) is consistent with sound economic policy.

What is a structual deficit, and how is it calculated?

Much hinges on the definition of a structural deficit. It is calculated as total government debut minus cyclical deficit minus one-off measures (such as emergency spending). A structural deficit is the government deficit that would have emerged when an economy is running at full capacity. This shifts the problem to defining a "cyclical deficit". A cyclical deficit is the product of two numbers: the output gap (the difference between "potential output" and "realized output", expressed in percent) and the "fiscal balance elasticity" (which captures how a 1% increase in the output gap affects the government's balance of expenditures minus revenues).

A structural deficit—also known as a "cyclically-adjusted budget balance" or CAB— is simply \[\mathrm{CAB} = \frac{B}{Y} - \eta\left[\frac{Y-Y^\ast}{Y^\ast}\right]\] where \(B/Y\) is the observed budget balance expressed as a percentage of actual GDP, the term in square brackets is the output gap that identifies the position in the business cycle, and \(\eta\) is an elasticity measure that tells us about the cyclical sensitivity of the budget balance. The semi-elasticity is different for different countries, but a rough-and-ready number is about 0.5. Note that CAB is expressed as a percentage of potential GDP, not actual GDP.

For the economists among you, I'd like to get a fair bit more technical. The common approach to measuring the output gap involves a country-level production function with capital \((K)\), labour \((L)\), total factor productivity \((E)\), and labour share \(\alpha\). \[ \ln(Y)=\ln(A)+\alpha\ln(L)+(1-\alpha)\ln(K)+\ln(E) \] First, the trend value of \(\ln(E)\) is obtained through a smoothing filter (the Hodrick-Prescott filter), and this number is put back into the equation together with the level of potential employment \[ L^\ast = \bar{L}\cdot(1-\mathrm{NAWRU})-L_G \] that is in turn calculated from the smoothed labour force \(\bar{L}\), the product of the working age population and the trend participation rate, the estimated non-accelerating wage rate of unemployment (NAWRU), and the employment in the goverment sector \(L_G\). An estimate of NAWRU is obtained as \[\mathrm{NAWRU}= U-\Delta U \frac{\Delta^3\ln(W)}{\Delta^2\ln(W)}\] where \(W\) and \(U\) are the levels of wages and unemployment. This estimate is often smoothed to eliminate erratic movements. Then the estimates are put back into the production function \[ \ln(Y^\ast)=\ln(A)+\alpha\ln(L^\ast)+(1-\alpha)\ln(K)+\ln(E^\ast) \] to obtain an estimate of \(Y^\ast\). To complete the calculations, the output gap is calculated as \( (Y-Y^\ast)/Y^\ast\) and is used in the CAB equations. With the output gap defined, the last step involved quantifying the cyclical sensitivity of the budget. The elasticity \(\eta\) is often estimated separately for government revenues \(R\) and government expenditures \(G\) so that \(\eta = \eta_R - \eta_G\).

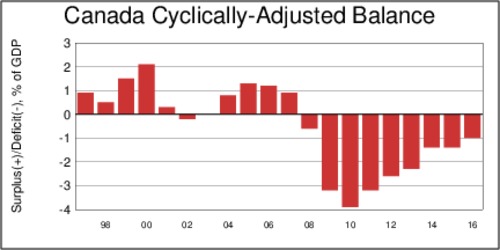

So what does Canada's CAB look like? Below is a chart based on calculations of the OECD, as reported in its annual economic outlook. The numbers also include forecasts for 2015 and 2016. Canada is running a structural deficit since 2008 that continues today. The structural deficit was larger in the aftermath of the recession. This is odd. If the CAB measures was reliable, the cyclicality should make the time series smoother rather than more erratic. Note though, that the CAB is expressed as a percentage of potential GDP rather than actual GDP, which is higher during a recession. Whether CABs are a reliable tool for policy making is questionable.

click on image for high-resolution PDF version

Source: OECD Economic Outlook 2015 Annex Tables

Why are balanced budget rules problematic?

If you have skipped over the last few paragraphs because the mathematics above looks like gobbledygook to the non-economist, you should not feel bad. In fact, estimating elasticities and output gaps is prone to error. Statistically speaking, the confidence interval around the point estimate is large enough to worry that a balanced budget rule based on a structural deficit definition may be triggered even when the true structural deficit is more benign. Worse is only the simplistic rule that is triggered even by a nominal (cyclical) deficit. The razor blade approach to triggering balanced budget rules makes little sense when the blade is really as blunt as a crowbar. The OECD time series on Canada's cyclically-adjusted balance (see diagram above) gives little confidence that it identifies a smooth trend of structural deficits. Ultimately, what is a cyclical deficit and what is a structural deficit is often difficult to tell apart. It is not made easier by the fact that there are numerous competing definitions of a cyclical deficit. The European Union has a definition, the OECD has a definition, the IMF has a definition, and Canada's Parliamentary Budget Office (PBO) has yet another [see references below].

Why did the Conservatives adopt a balanced budget law, and why do the Liberals want to scrap it?

Many politicians and voters on the conservative side of the political spectrum distrust governments and their ability to maintain fiscal prudence. They are worried that governments overspend and increase public debt. The "debt brake" is meant to impose fiscal prudence on governments. Of course, if it is just a law, it can be overturned by the next government. That is one reason why Canada's law is rather different from Germany's. In Germany, the "debt brake" has constitutional status; it was enacted with a parliamentary super-majority and can only be overturned with such a super-majority. A simple law is useless as it can be changed or dropped by the next government. This is precisely what one party proposes to do. But whether a debt break has constitutional status or not, it still remains a rather unwieldy and ultimately problematic instrument. It puts fiscal policy in an unnecessary straight-jacket. It is up to voters to turf out fiscally irresponsible governemnts. Legislating fiscal responsibility is unnecessary, and it is counterproductive when fiscal leeway is needed. Even worse, balanced budget laws can induce governments to cook the books in order to meet the nominal targets.

‘Balanced budget laws belittle voters’ ability to judge fiscal prudence.’

The bottom line is simple: balanced budget rules are trying to fix a problem that defies easy fixing. Instead, whether a government is "fiscally prudent" or not should be left to the voters. The high level of debt played a significant role in the defeat of the Mulroney/Campbell government in 1993. For voters, it is easy to see how well Canada is doing budget-wise by looking at the trend in its debt-to-GDP ratio, and comparing Canada's debt-to-GDP ratio to other large developed economies. By that standard, Canada is in excellent shape. Balanced budget laws, including Canada's, are more an exercise in political windowdressing than in sound macroeconomic policy. In my considered opinion as an economist, the Liberal Party of Canada is right to call for the abolition of Bill C-59. Countries such as Germany that have incorporated balanced budget laws into their constitutions will find it even more difficult to change course when the need arises. I guess that they will find ways of "creative accounting" and changing the definition of "structural deficit" when the need arises, or will take their constitutional defiance to the voters by seeking an explicit mandate. Balanced budget laws belittle voters' ability to judge fiscal prudence.

References:

- Bill Curry: Liberals vow to scrap balanced budget law to clear way for stimulus, The Globe and Mail, September 2, 2015.

- Globe Editorial: Balanced budget bill: Great politics, bonehead economics, The Globe and Mail, April 8, 2015.

- Globe Editorial: On the deficit, Canada's running a surplus – of politics, The Globe and Mail, September 1, 2015.

- Claude Giorno, Pete Richardson, Deobrah Rosevaeare, Paul van Noord: Estimating Potential Output, Output Gaps, and Structural Budget Balances, OECD, Paris, 1995.

- Christopher Ragan and William Watson (eds.): Is the Debt War over? Dispatches from Canada's Fiscal Frontline, McGill-Queen's University Press, 2004.

- Gilles Mourre, George-Marian Isbasoiu, Dario Paternoster and Matteo Salto: The cyclically-adjusted budget balance used in the EU fiscal framework: an update, European Commision Economic Papers 478, March 2013

- Office of the Parliamentary Budget Officer: Estimating Potential GDP and the Government's Structural Budget Balance, January 2010

- OECD Annual Economic Outlook Annex Tables

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)