Quebec launched its CO2 emission trading system in 2015 with an emission cap of just over 65 Megatonnes (Mt) that is shrinking by a few percentage points each year, to about 55 Mt in 2020. Quebec's emission trading system is linked to California's and is soon to be joined by Ontario. However, all is not well with this scheme. Trouble is looming ahead.

The federal government of Canada just announced its intent to introduce binding minimum carbon prices on the provinces that start at $10/tonne in 2018 and rise to $50/tonne in 2022. The implementation of the minimum price will be left to the provinces, and this means that in principle Quebec and Ontario could continue operating their emission trading system as long as the auction reserve price meets the minimum federal price. The federal guidelines require provinces that continue with a cap-and-trade system to implement emission cuts "equal or greater to what would be achieved by a direct price". Unless Quebec pursued more aggressive targets than other provinces, this would turn the cap-and-trade system into a carbon tax in all but name. It would also threaten the trading link with California. Other problems are looming over the emission trading system as well.

What is the likely impact of the federal minimum carbon price on cap-and-trade systems in Quebec and Ontario?

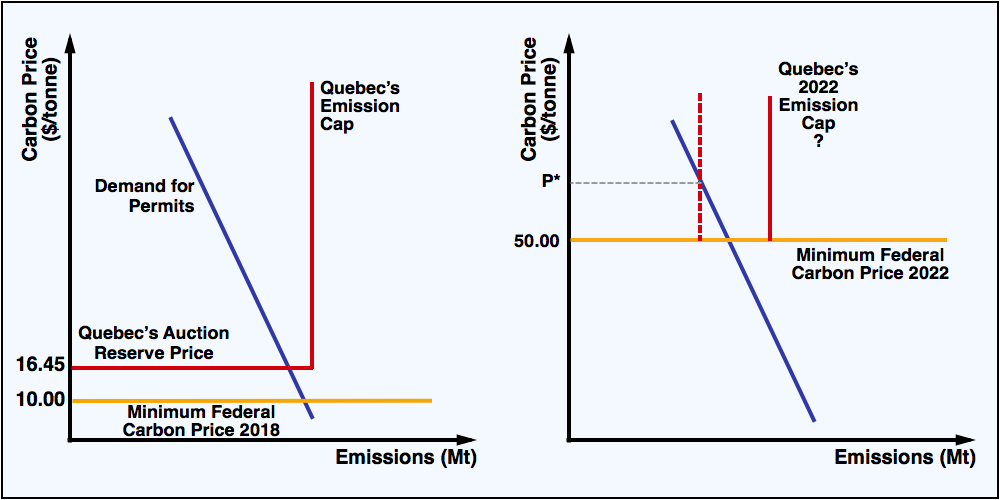

To explain the likely impact that a rising federal minimum carbon price will have on Quebec's (and probably soon: Ontario's) emission trading system, a little bit of economics will help. The two diagrams below illustrate the current state and possible future states. When the federal minimum price of $10/tonne is introduced in 2018, it will not be binding because Quebec's carbon price is higher already. At the August 2016 auction, the reserve price was $16.45 and this also turned out to be the settlement price at which the auction cleared. This in turn means that the emission cap is not yet binding, and Quebec companies would have been able to achieve this year's emission target at a lesser cost than the reserve price.

click on image for high-resolution PDF version

As the federal minimum price is rising quickly until it reaches $50/tonne in 2022, the minimum reserve price for the permit auctions will have to follow. Past 2020 Quebec has not yet defined its emission caps. If the caps move slowly after 2020, the likely outcome is that the minimum reserve price will bind, and not the emission cap. The Quebec permit price will thus settle at the minimum price (and likewise, Ontario's). This is the outcome in the right panel with the solid red line. If Quebec moved to lower its emission cap more aggressively, it is conceivable that the Quebec emission price (P*) exceeds the federal minimum price, as shown by the emission cap with the dashed red line. This second scenario is a bit unlikely because at $50/tonne the federal policy is tougher than is implied by projecting Quebec's emission cap reductions forward. In short, the requirement to meet the minimum federal carbon price would effectively turn Quebec's emission trading system into a carbon tax. There's nothing wrong with that as such, but instituting a carbon tax outright would probably be much simpler than maintaining a cumbersome emission trading system.

Does the federal policy threaten Quebec's link with the California carbon trading system?

As soon as the federal minimum price exceeds the auction reserve price set across the California-Quebec permit market, there is a problem. If Quebec companies are allowed to bypass the auction and simply by permits at a lower price in the cross-border permit market, their effective carbon price would remain below the federal minimum price. This means that the link to California's market would need to be severed in order to comply with the federal price target. Essentially, Quebec would be forced to go it alone with Ontario. Meanwhile, California's cap-and-trade system also lingers at the minimum price set by the state's Air Resources Board, USD 12.73 a ton. There are too many allowances and too few buyers—perhaps California businesses are ahead of schedule reducing their carbon emissions. California's program is set to expire in 2020, and it is unclear whether the California state legislature will renew the program. If California drops out for political reasons, Quebec businesses won't be able to buy cheap California permits to satisfy their demand for permits.

How does the USD-CAD exchange rate change emission trading in Canada?

Linking up with California's emission permit market, which at over 370 Mt is about five to six times larger than Quebec's, introduces a significant new problem: exchange rate fluctuations. When the Canadian Dollar dropped in value against the US Dollar from near parity down to about 0.75 USD per 1 CAD today, the auction reserve price—which is effectively set in USD—translates into increasing auction reserve prices in Canadian Dollar terms. The reserve price has risen from $12.82 in November 2014 to $16.45 in August 2016 (a 28% increase). This puts Quebec businesses at a disadvantage and at the mercy of the exchange rate. A falling Canadian Dollar makes the permits more expensive and raises production costs. Exporters who ship to the United States will remain competitive because the falling Canadian Dollar creates a bigger advantage than the rising cost of buying permits, but producers who only sell in Canada will face an increasing disadvantage compared to provinces that remain without a carbon price yet. Only once all provinces face the same carbon price this exchange-rate distortion will fade away. Meanwhile, exchange rate fluctuations will continue to make carbon prices less predictable in Quebec, and this increased price uncertainty diminishes firms' willingness to invest in carbon abatement technologies because their return on investment is less predictable. Stable and predictable carbon prices create "dynamic efficiency"—a greater incentive to innovate because of a more predictable return on investment.

Could large cross-border transfers undermine political support for cap-and-trade?

Cross-border cap-and-trade carries a significant political risk: if one jurisdiction ends up buying lots of (cheaper) permits from the other jurisdiction, the buyers transfer large amounts of money to the sellers. If Quebec firms end up sending large amounts south of the border, expect a political storm to form. This is precisely the reason why Alberta would never agree to join a multi-jurisdiction cap-and-trade system, as any jurisdiction with a large carbon footprint would see an outflow of money to other jurisdictions. Politically, it is much more preferable to keep the money at home. Alberta is about to implement a carbon tax similar to British Columbia's, where the revenue stays at home and lowers income taxes.

Will Quebec's Green Fund pay a double dividend?

Revenues from Quebec's carbon permit auctions are put into the province's Green Fund. Money from this fund is used to pursue a variety of other environmental goals, or to further reduce carbon emissions. The revenues from carbon permit auctions are meant to deliver a double dividend: the immediate effect through the carbon cap, and a further effect through the investments into green technologies. Unfortunately, governments have had a poor track record delivering results with such schemes, as subsidies to reduce carbon emissions further (e.g., for buying hybrid-electric vehicles) often had a very high implied carbon price. If governments uses the green fund to pay off its highway investment debts rather than invest in new public transit, not much will come of this promised double dividend. The temptation is great for governments to use the Green Fund opportunistically rather than strategically.

Do double-dividend approaches deliver?

From an environmental economics point of view, double-dividend schemes are unnecessary once the carbon price reaches a meaningful level (that equates with marginal damage). Really, one policy is enough—unless there is a compelling case that there is an additional market failure that renders a carbon price ineffective. In short, set the carbon price and let the market figure out how to reduce emissions most cost-effectively. Double dividend schemes are a clumsy and often ineffective way to fix the problem that the prevailing carbon price is much below what is necessary to achieve significant reductions in carbon emissions to reach the targets agreed on in the Paris Agreement, which took effect on October 5, 2016. If the carbon price is below what is deemed necessary to achieve the Paris Agreement targets, the right course of action is to raise the price until that target is reached. Keep in mind that even a $50/tonne carbon price amounts to merely an 11.1¢/L increase in the price of gasoline. (On June 2 this year, Newfoundland raised its gasoline tax from 16.5 to 33.0¢/L; this increase is equivalent to a $74.25/tonne carbon tax.) And if there are other policy deficits (e.g., public transit), then these ought to be addressed with separate policy instruments and separate channels of funding. Revenues from carbon taxes or cap-and-trade auctions are better used to reduce other taxes, or return the money to citizens on a per-capita basis through a carbon dividend.

What is the best way of carbon pricing?

David Popp has written a very insightful policy brief about the five rules for governments that want to go green for the C.D. Howe Institute. For a deeper economic analysis, Ross McKitrick's A practical guide to the economics of carbon pricing, publishd by the University of Calgary's School of Public Policy, sheds light on the pitfalls of mixing multiple carbon policies. Alberta's "hybrid model" of carbon pricing—a broad-based carbon tax on buildings, transport, and light manufacturing that is coupled with a carbon allowance system for emission-intensive trade-exposed industrial emitters—is able to avoid competitive distortions in international markets. Andrew Leach, Mark Cameron, and Christopher Ragan have penned an op-ed for Maclean's magazine How a revenue neutral carbon price can help Saskatchewan that shows convincingly how a carbon price can even work in that province, whose premier remains opposed to carbon pricing.

So what is the lesson for Ontario?

‘Ontario should embrace a revenue-neutral carbon tax instead of following Quebec into cap-and-trade trouble.’

Ontario's plan to join Quebec's emission permit system risks falling into the aforementioned quadruple trap of (1) binding auction reserve prices, (2) importing exchange rate fluctuations into a carbon price system when the federal minimum price is not binding, (3) recycling auction revenue through an opaque "green fund" rather than through tax reductions, and (4) potential out-of-jurisdiction transfers of funds causing political backlash. Ontario has still time to avoid these traps. Ontario should join Alberta and British Columbia by implementing a provincial carbon tax instead of joining Quebec's cap-and-trade system. Advantageously, a carbon tax that is revenue neutral (by lowering other taxes) should face much less political opposition. More importantly, a carbon tax lets the market do what it does best: find the efficient allocation of resources to abate carbon. Saddling a cap-and-trade system with an opaque Green Fund to pursue double dividends will likely deliver sub-par results and make voters unhappy. Ontario should reconsider its approach to carbon pricing and embrace a revenue-neutral carbon tax instead of following Quebec into cap-and-trade trouble.

Further readings:

- Ontario joins Quebec and California in carbon trading, my blog from May 18, 2015

- Government of Quebec: A Brief Look at the Québec Cap-and-Trade System for Emission Allowances

- Dale Kasler: California's cap-and-trade carbon program sputters again, Sacramento Bee, August 23, 2016.

- Chris Megerian and Ralph Vartabedian: California's cap-and-trade program faces daunting hurdles to avoid collapse, Los Angeles Times, June 14, 2016.

- Ross McKitrick: A practical guide to the economics of carbon pricing, The School of Public Policy, University of Calgary, SPP Research Papers Volume 9, Issue 28, September 2016.

- David Popp: The five rules for governments that want to go green, C.D. Howe Institute, Intelligence Memo July 19, 2016.

- Andrew Leach, Mark Cameron, and Chistopher Ragan: How a revenue neutral carbon price can help Saskatchewan, Maclean's Magazine, October 18, 2016.

- Mark Cameron, Kaitlin Szacki, Chris Bataille, and Dave Sawyer: The least costly path to climate action, Clean Prosperity, August 25, 2016.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)