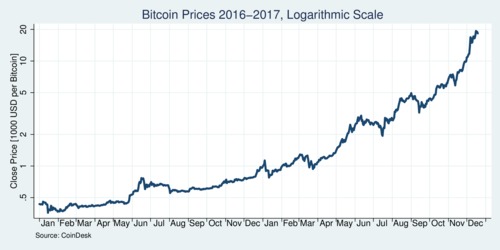

click on image for high-resolution PDF version

The recent surge in the price of bitcoins to stratospheric heights is dazzling. The graph above even uses a logarithmic scale to identify the price movements over the last two years: a forty-fold increase. People have been piling in money in the expectation of higher and higher prices. Everyone knows that this bubble can't last. There is no fundamental value of bitcoins, and given the slow pace at which the supply of bitcoins is approaching its 21 million limit, there is nothing else that determines the price of bitcoins than speculative demand. When the bubble bursts, those who have bought bitcoins last will suffer large financial losses. "Den letzten beissen die Hunde" as a German proverb has it—the dogs will bite the hindmost. It is sad to think that many financially unsophisticated people who can't afford to lose much money, who today are blinded by the prospect of easy money, will suffer the most tomorrow. The question is not if the bubble will burst, but when.

While bitcoins and its many cryptocurrency siblings may well fade into oblivion one day, the blockchain algorithm and the underlying Distributed Ledger Technology (DLT) are here to stay. DLT offers a number of benefits over traditional ways to conduct financial transactions. The Bank of Canada and the financial institutions in Canada are studying the feasibility of DLT. The appeal of DLT is that it is distributed: no single entity controls it, and thus trust is established by the ability for mutual independent verification and consensus.

‘Bitcoins are fundamentally flawed as a commercial medium of exchange.’

Bitcoins, which uses one flavour of DLT, are fundamentally flawed as a medium for clearing transactions efficiently. On one hand, all transactions are visible to everyone, while the identity of the parties involved in the transactions remains anonymous. This makes it unsuitable for banking where knowing the identity of parties is important while at the same time protecting the privacy of the transaction. For bitcoins, anonymity has shielded money laundering and other criminal activities, such as facilitating ransomware targeted at computers. Worse, the "proof of work" that is required to authenticate bitcoins consumes an ever-growing amount of electricity, which has adverse environmental implications. What makes bitcoins entirely unsuitable for real-economy financial transactions is the slow pace of verifying transactions. As recorded, transaction times average about 10 minutes but can even reach 10 hours at times. This is way too slow for settling financial transactions in real time.

It's time to consider DLT separately from bitcoins, which are starting to give this technology a bad reputation. Project Jasper was launched in 2016 by Canadian financial institutions to augment Canada's existing wholesale payment system, the Large Value Transfer System (LVTS) that is operated by Payments Canada and which processes $175 billion each business day. A study by Chapman et al. (2017) discusses the progress of this project. A key feature of the project was to develop a digital depository receipt (DDR) that represents a deposit with the Bank of Canada. DDRs are issued by the Bank of Canada in exchange for other central bank money, which means that creating DDRs does not increase the money supply.

Project Jasper does away with the awkward "proof of work" protocol that underlies bitcoins and other cryptocurrencies. Such protocols are not necessary, and in fact these protocols contribute much to the slowness and environmental wastefulness of using bitcoins. The alternative is to separate the verification into a validation function and a uniqueness function. Validation ensures correctness of the transaction and that the parties have the necessary funds. Uniqueness is provided by a notary, the Bank of Canada, which has access to the entire ledger. Notary-based DLTs ensure privacy of transactions, which is critically important when large values are observed.

The key advantage of DLT is the potential to reduce transaction costs by reducing the need for reconciliation, and by attaching additional functions to go along with payments (such as collateral pledging and asset sales). But DLT is not yet ready for prime time. Moving from "proof of work" validation towards more efficient notary-based validation comes with a trade-off. With notary-based DLT, most nodes in the system do not have a full copy of the ledger. This creates operational risk, which requires further innovation to ameliorate. Notary-based systems are thus less resilient operationally than proof-of-work systems. There may be an operational sweet spot between full decentralization and full centralization of the ledger. Decentralization makes the system more resilient, why centralization makes the system more efficient and allows for greater privacy.

‘Distributed ledger technology is here to stay but will take time to mature.’

There is little doubt that DLT is here to stay, although fully developing it will take time. The advantages are compelling, while the operational drawbacks will find solutions over time. Project Jasper is only one among many international projects to develop DLT. The European Central Bank has been working on its own project but concludes that "At this stage of its development, DLT is not mature enough and therefore cannot be used in the Eurosystem's market infrastructure."

As for bitcoins: caveat emptor—buyer beware.

Further readings:

- James Chapman, Rodney Garratt, Scott Hendry, Andrew McCormack and Wade McMahon: Project Jasper: Are Distributed Wholesale Payment Systems Feasible Yet?, Bank of Canada Financial Systems Review, June 2017.

- Distributed Ledger Technology, European Central Bank In Focus, Issue 1, 2016.

- David Mills, Kathy Wang, Brendan Malone, et al.: Distributed ledger technology in payments, clearing, and settlement, Finance and Economics Discussion Series 2016-095. Washington: Board of Governors of the Federal Reserve System, DOI: 10.17016/FEDS.2016.095.

- Distributed ledger technology in payment, clearing and settlement: An analytical framework, Bank for International Settlements, February 2017.

- Jesse Leigh Maniff and W. Blake Marsh: Banking on Distributed Ledger Technology: Can It Help Banks Address Financial Inclusion?, Federal Reserve Bank of Kansas City Economic Review, 3rd Quarter 2017.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)