When trading in commodities futures, a situation in which the future price exceeds the spot price is known as contango. This means that there is a forward premium and the forward curve is upward sloping. Contango situations are rare. The opposite, backwardation, is the default scenario. When a commodities market is in contango it means that there is an opportunity to arbitrage because buying and storing the commodity will deliver a guaranteed return on investment through locking in a sale through a futures contract. If the profit from this transaction is large enough to cover the storage costs (the cost of carry), then contango will be a very attractive investment option. Why does contango not simply go away through arbitrage? If storage capacity is limited—as it is for crude oil—then contango situations can persist as traders are simply not able to take advantage of arbitrage.

Oil markets have been in double turmoil for over a month. First up is the COVID-19 crisis that has significantly reduced demand for oil products. Second up is the price war between Saudi Arabia and Russia, and even a recent OPEC+ agreement to cut production by about 10 million barrels a day (about 10% of world production) is very likely not going to be enough to balance supply and demand. Some of the drop in demand for oil products has been compensated by demand for inventory, but oil storage facilities are quickly approaching their limit. Storage at Cushing, Oklahoma, is expected to be full by mid-May, and storage facilities elsewhere in the world already have or will be soon approaching their limits.

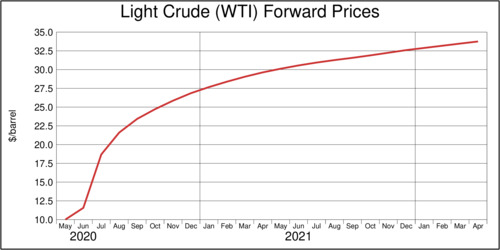

The first chart below shows the forward prices as determined on the Chicago Mercantile Exchange yesterday. West Texas Intermediate (WTI) was trading at just around $10 per barrel. Prices even reached negative territory earlier this week as settlement for the May contracts caught some traders on the wrong side of their positions. Such anomalies are truly exceptional: negative prices means someone is getting paid to take your oil, not the other way around. In the chart below, prices rise to $34 per barrel for delivery two years from now.

click on image for high-resolution PDF version

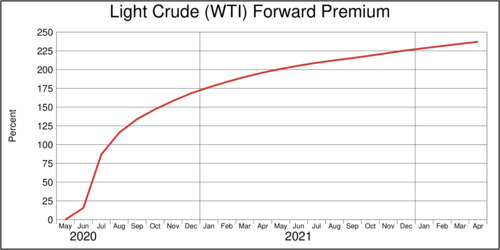

The next chart turns the price premium into a percentage premium It reaches extraordinary heights of over 200%. This means that prices are expected to triple over the next two years.

click on image for high-resolution PDF version

Now consider this an investment position with a carry cost of $0.02 per day per barrel—equivalent to a storage cost of just over $7/barrel per year. One can calculate the return on investment \(r\) with the following approximation, with spot price \(p_t\) and futures price \(p_{t,f}\) for delivery \(f\) months into the future, using the formula.

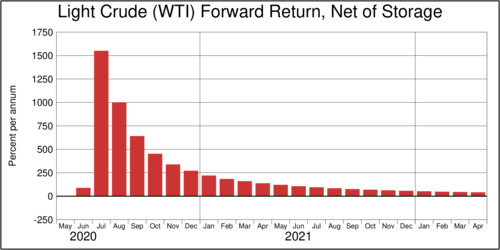

\[r = 100\%\cdot\left[\left(\frac{p_{t,f} -0.02\cdot f}{p_{t}}\right)^{12\,/\,f}-1\right]\]The chart below shows the returns on investment for the next few months. The returns are so large that the term super-contango is well justified.

click on image for high-resolution PDF version

The returns on investment exceed any regular type of investment. For delivery of crude oil in April 2021, the return is 138%. For delivery in April 2022, it is still a remarkable 41%. With returns like these, it is not surprising that storage capacity is filling up to the brim.

Will oil markets recover? Shutting down and restarting oil production is costly, and thus producers try to avoid this drastic step until they have no other option. However, if demand is simply not there because of COVID-19, sooner or later cuts have to be made much beyond what OPEC+ announced. Even if cuts are agreed upon, this does not mean that countries stick to their commitments. There is a strong financial incentive to exceed the targets at the expense of other OPEC members. A recent Bloomberg News article showed this problem in detail. More cuts are needed and sooner than planned, and there is indication of accelerated production cuts.

Yet, the U.S. Energy Information Agency presents relatively optimistic forecasts for total production for 2020. Their most recent April short-term economic outlook predicts average production of about 95 million barrels per day for 2020, down just 5 million barrels per day from 2019. The EIA expects a rebound in 2021. It remains to be seen if these somewhat rosy forecasts come to pass. Even if demand returns to normal, the current crisis may reshuffle oil markets. Marginal producers may not be able to weather this storm as well as more profitable producers. And this is what Saudi Arabia was aiming for all along when it started the price war. The battle is about market share.

If North American oil producers feel threatened by foreign competition, it is possible that North America detaches itself to some degree from international markets because North America has become self-sufficient over the last decade and a half. The US and Canada combined are net exporters of crude oil, not net importers. Given the market disruptions caused by the current crisis, it is not unthinkable that protectionism could arise even in global oil markets. Yet, even curtailing imports will not prevent hardship. Oil producers in Canada face massive cutbacks as storage capacity runs low. In the long run, today's financial losses and uncertain prospects for the future may also imperil much of the capital spending that was planned for the next years. Even if the economy returns to a more normal state of operation by the fall, the current crisis is very likely to cause lasting damage.

Further readings and information sources:

- Stanley Reed and Clifford Kraus: Too Much Oil: How a Barrel Came to Be Worth Less Than Nothing, New York Times, April 20, 2020.

- Stanley Reed: OPEC and Russia Agree to Cut Oil Production, New York Times, April 9, 2020.

- Brian Wingfield, Samuel Dodge, Demetrios Pogkas and Cedric Sam: New Decade, New OPEC Oil Curbs. Same Mixed Results, Bloomberg News, February 25, 2020.

- Jeffrey Jones and Emma Graney: Canada's oil industry facing deep production cuts as demand dwindles and storage capacity runs low, The Globe and Mail, March 25, 2020.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)