During the coronavirus pandemic, energy topics have receded somewhat into the background. Thus it is not surprising that British Columbia's Bill 17 that amends the province's Clean Energy Act from 2010 has not received a lot of attention. Perhaps it should have received more attention because the forthcoming changes are quite fundamental. They also make economic sense, although the changes will not be popular with independent power producers in the province.

‘Self-sufficiency has shackled BC Hydro's ability to realize the full benefits from trading electricity with the US.’

In February 2019, a report commissioned by the provincial government came to two rather unpleasant conclusions about the consequences of entering into power purchasing agreement (PPAs) with independent power producers (IPPs)—wind farms and run-of-the-river hydro installations. The report, authored by Ken Davidson, found that (1) BC Hydro bought too much energy (8,500 GWh), (2) bought energy with the wrong seasonal profile, and (3) paid too much for the energy it bought ($16.2 billion over 20 years). The Clean Energy Act and its self-sufficiency mandate shackled BC Hydro and its trading arm, Powerex. BC's hydro power resources allow the province to engage in a profitable seasonal trading pattern (described below), and the requirements to buy power from IPPs limited Powerex's ability to engage in seasonal trading optimally.

The trouble with self-sufficiency is its creation of artificial demand of 5,500 GWh pear year for local IPPs, rather than relying on the market to deliver it. On top of that is another 3,000 GWh per yer "insurance capacity" above the self-sufficiency level. Combined, this created an artificial 8,500 GWh electricity deficit. The PPAs stipulate guaranteed delivery at a fixed rate, which makes electricity from PPAs more expensive than from BC Hydro's portfolio of own generation and electricity trades.

Bill 17 drops the self-sufficiency mandate from the Clean Energy Act, allowing BC Hydro and Powerex to return to a more efficient level of operation. The winners are BC rate payers, who won't see their electricity rates go up more and more. The losers are IPPs in BC who will likely not see most of their PPAs renewed, and instead may have to face market rates. This is a highly welcome move from an economic point of view. Fixed feed-in-tariffs for renewable energy are no longer needed as a form of subsidy. Wind farms in particular have come of age and can compete on market terms. Given that BC has cheap hydro and a brand-new hydro dam under construction, only cost-effective new wind farms that can make a profit on market terms will have a future in this province.

As with any policy change, not everyone is beter off. Existing IPPs are obviously unhappy.

‘For 20 years IPPs benefit from lucrative guaranteed feed-in-tariffs which cannot be sustained indefinitely.

The thorny question is about what to do with the existing IPP projects. A recent article in the Globe and Mail pointed to the adverse effect on several indigenous communities in BC who have invested in clean power projects. Some of their contracts expire as early as 2025. From an economic point of view, power projects that have fully amortized after 20 years should simply receive market rates. The correct electricity price is the locational marginal price (LMP), something that is not yet widely used. The marginal cost for run-of-the-river hydro projects is quite low, and certainly below the feed-in-tariff of the original power purchasing agreement. Yet, the LMP is what electricity generators should be paid. Some communities, as those mentioned in Brent Jang's article, count on the income. What can be done about it?

Communities that have invested in power projects may have hoped to receive income in perpetuity at levels of the feed-in-tariff set out in the original PPA. However, the contracts are only for 20 years, not perpetuity. The initial high rates are meant to help amortize the project and pay off the fixed costs of building the generators. Beyond that, economic circumstances change and market forces apply.

Existing IPPs will continue to operate, but less profitably. IPPs in BC willstill be able to sell their electrricity, but it will have to be at market rates rather than inflated feed-in-tariffs, and that means less income. If there is excess supply, BC Hydro needs to have the ability to curtail purchases. IPP investors, whether they are communities or corporations, will not be happy. However, PPAs should not become vehicles for subsidizing communities by exempting them from market forces. One might argue that other sectors are subsidized—the agricultural sector has several examples—so why not subsidize power projects? That is a faulty argument. The correct course of action is to get rid of existing market distortions, not to create new ones.

Going forward, some indigenous communities may well receive extensions (perhaps five years?) if they can demonstrate that their projects haven't fully amortized in the first 20 years. BC Hydro may find ways of easing the pain for community-owned projects, although these cases will need to remain exemptions and demonstrate a trajectory to full market pricing eventually. It is not BC Hydro's mandate to subsidize communities. If communitie need economic assistance and opportunities, there are better pathways for provincial governments to provide these than using inflated PPAs.

But what about the benefits of getting rid of self-sufficiency?

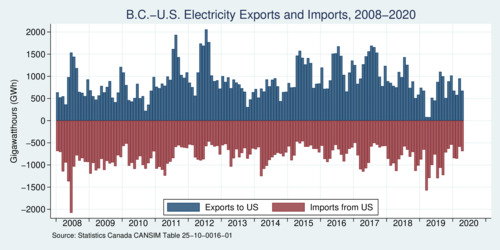

Below are charts that show British Columbia's electricity trade, which is mostly with the United States. There is a smaller power line connecting Alberta and British Columbia, but the vast majority of electricity trade is with US states, notably California through the Pacific DC Intertie that connects the Bonneville Power Administration in Washington State with the Golden Sate. The fist diagram shows monthly exports and imports. It reveals a pattern of two-way trade even within the same months. This is the pattern driven by the dual static and dynamic comparative advantage that I have described in my research paper Cross-border trade in electricity (Journal of International Economics, 2016). Electricity is moving forth and back across the border to balance loads efficiently.

click on image for high-resolution PDF version

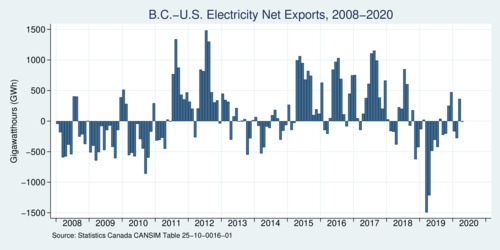

The next chart distills the exports and imports into net exports. It becomes readily apparent that there is a seasonal pattern to it. British Columbia is a winter-peaking jurisdiction where demand is highest when the weather is cold. Many homes in BC heat with electricity rather than natural gas. In California, on the other hand, power demand tends to peak in the summer when temperatures are hot and people run their air conditioners. California is a summer-peaking jurisdiction. It is easy to see that this creates another trading opportunity. BC sells power in the summer and imports power in the winter. Both sides gain.

click on image for high-resolution PDF version

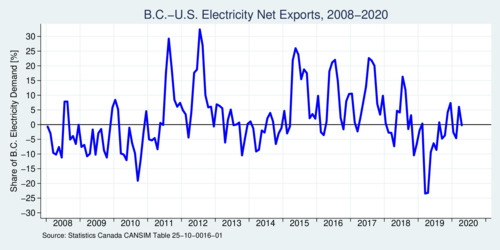

Exactly how large is the trade volume? What is the magnitude relative to total electricity demand in BC? The third chart expresses the monthly net exports as a share of total electricity demand. There are periods where exports and imports can reach large shares, even 20% or even 30%. Overall, in 2019 BC imported 17.2% of its electricity: 16.6% from the U.S. and 0.7% from Alberta. In 2019, BC was a net importer (5.5% of total demand).

click on image for high-resolution PDF version

The volume of electricity imports has worried environmentalists because these imports from the United States are still produced to some extent with fossil fuels and thus carbon emissions. However, overall the Western Interconnection, of which BC is a part, is much cleaner than the Eastern Interconnection. Still, even California's electricity profile 2018 shows that generating one MWh of electricity generates 223 kg of carbon dioxide, and our immediate neighbour Washington State 91 kg CO2/MWh. If we take a rough average of 150 kg/MWh for carbon emissions for electricity imports, how much carbon emissions did we import? We need to look at net imports because of the two-way trade. In 2019 BC imported a net amount of 3,706,171 MWh, which equates to 0.55 million tons (MT) of CO2. Total emissions in BC were estimated at 64.5 MT in 2017, so 0.55 MT is less than 1%. It is difficult to see the volume of electricity imports as a significant environmental concern. There are much larger carbon policy issues in British Columbia.

click on image for high-resolution PDF version

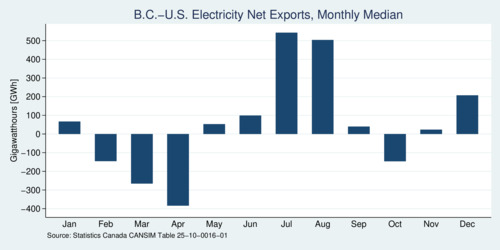

This brings us back to the self-sufficiency problem and power trade across the border. The last chart shows the seasonal pattern, showing the median net exports (pointing up) or net imports (pointing down) for each month. July and August are export months—that's when our southern neighbour crank up their A/C units. Our imports peak in March and April. Allowing BC Hydro to import more electricity from the U.S. if it is cheap will benefit British Columbian economically, at at very low environmental cost. In the long run, the Western Interconnection is continuing to improve its carbon footprint, and in particular California is set to produce much more solar power in the near future. This will help lessen environmental concerns.

Meanwhile, Bill 17 that reforms the Clean Energy Act will leave local IPPs unhappy. They had hoped for continuing profits after their projects have amortized during their initial PPA. They will likely face a reality where their revenues will be low—in line with the low marginal cost of these generators. But this is as it should be. Overly generous PPAs are unsustainable, as Ontario has discovered painfully and with significant political backlash. With Bill 17, BC's provincial government is putting a lid on this before the issue becomes a political soccer ball. Minister of Energy Bruce Ralston has taken the Davidson report to heart and acted swiftly. As we are moving into a future where our electricity consumption will increase as we move away from powering our cars with gasoline, keeping our electricity rates low will be of great benefit to all of us. And if electricity demand grows faster than expected, IPPs in BC stand to benefit again from higher market prices for electricity.

Further readings and information sources:

- B.C. Clean Energy Act [2010]

- Bill 17-2020: Clean Energy Amendment Act, 2020

- Ken Davidson: Zapped: A Review of BC Hydro's Purchase of Power from Independent Power Producers conducted for the Minister of Energy, Mines and Petroleum Resources, report for the BC Government, February 2019.

- Nelson Bennett: BC power producers alarmed by plan to buy power from U.S., Business in Vancouver, 30 June 2020.

- Sarah Cox: Clean B.C. is quietly using coal and gas power from out of province. Here's why, The Narwhal, 3 December 2019.

- Brent Jang: B.C.'s Indigenous power producers fear they'll be short-circuited by Clean Energy Act changes, The Globe and Mail, July 11, 2020.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)