After Canada's federal government announced in mid-November to pursue net-zero carbon emissions by 2050, the question that arose immediately was: how do we get there? The answer came on December 11, when prime minister Justin Trudeau announced a bold strategy to increase carbon pricing from $50/tonne in 2022 (the current policy target) in $15/tonne annual increments to $170/tonne in 2030. This is great news for the environment and, once put into law, provides clarity for investment decision for the entire decades. The federal tax-and-rebate scheme is also smart politics with an eye towards the next federal election, as the conservative opposition only offers hollow promises with no concrete perspective towards reaching Canada's commitments under the Paris Agreement (30 percent below 2005 levels by 2030).

What is the proposed path of carbon price increases?

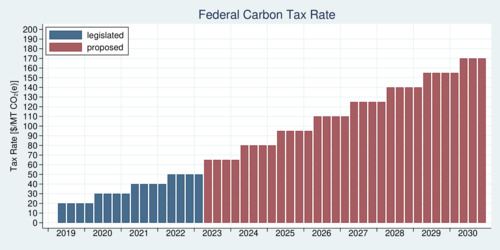

The federal government's proposal is meant to continue and accelerate the current trajectory of $10/year increments until 2022 with new $15/year increments between 2022 and 2030. The diagram below shows how the prices will change each April 1st.

click on image for high -resolution PDF version

For most people this per-tonne price is not particularly informative because households pay the price on fuel purchases such as diesel and gasoline. To calculate the carbon price in cents per one litre of gasoline, divide the carbon price by 4.525. This means that the 2020 price ($20/tonne) amounts to just 4.4 cents per litre, due to rise to 11 cents per litre in 2022. Continuing on the proposed trajectory will raise gasoline prices by 37.6 cents per litre in 2030. This may sound like a lot but pales by international comparison. Germany's fuel tax is just over $1 per litre (and their value-added tax is higher too). If the German economy can thrive with fuel prices that are already today higher than in Canada by the end of the decade, it would be ridiculous to assert that Canada's economy and Canadian motorists could not adapt as well.

Is the $170/tonne target sufficient to meet our climate goals?

It was clear that leaving the carbon price at $50/tonne after 2022 was insufficient to meet the Paris Agreement target. Modeling carried out by Canada's Ecofiscal commission calculated a carbon price of $210/tonne as adequate to reach the target. Results from other computable general equilibrium (CGE) models of the Canadian economy that I have seen over the past years all put the required carbon price over $150/tonne as well.

The beauty of carbon pricing is that the burden diminishes as people shift to cleaner modes of operation. Motorists who shift to driving electric vehicles (EVs) will not pay a carbon price for gasoline or diesel fuel. An effective carbon tax will eventually make itself mostly obsolete.

Carbon pricing also has another highly desirable effect: it will help make carbon-negative technologies commercially viable. Carbon-negative technologies include carbon capture and storage (CCS) and other methods that take carbon dioxide either directly out of the air or separate it from combustion processes. Carbon-negative technologies will play an important role in reaching "net-zero" emissions by 2050. Some industrial processes will not be able to capture all of their emissions, and some buildings will be too expensive to retrofit to become more energy efficient. To offset their emissions, it is necessary to develop commercially viable carbon-negative technologies.

How is the tax rebated?

Ninety percent of the revenue from the carbon tax is rebated to households through the Climate Action Incentive Payment on an annual basis. It is planned to shift these payments from annual to quarterly frequency in 2022 in order to make the impact more tangible for households. The rebates are not distributed on a simple per-capita basis but are differentiated by type of household. There is a 4:2:1 formula used for allocating the rebate to the first person, second person, and all other children in a household. The result is what you see in the table below for four provinces.

| Category | Climate Action Payments 2020 | |||

|---|---|---|---|---|

| Ontario | Manitoba | Sask. | Alberta | |

| A: Single adult or first adult in a couple | $224 | $243 | $405 | $444 |

| B: Second adult in a couple, or first child of a single parent | $112 | $121 | $202 | $222 |

| C: Each child under 18 (starting with the second child for single parents) | $56 | $61 | $101 | $111 |

| Example: family of four | $448 | $486 | $809 | $888 |

A family of four receives about $450 in Ontario, and close to $900 in Alberta. Carbon taxes are rebated on a provincial basis, so revenue raised in one province stays in that province. Because Alberta is more carbon-intensive than Ontario, the rebates are higher in Alberta.

How much households will receive back in future years depends, of course, on the effectiveness of the policy. The more effective the policy, the less revenue is raised and eventually less and less goes back to households as a result. After all, the goal of the policy is to make itself disappear (as carbon emissions approach net zero by 2050). However, at first the rebates will rise. The Ecofiscal Commission calculated that annual rebates on a per-capita basis could rise to roughly $1000 in Ontario, over $2000 in Alberta, and over $4000 in Saskatchewan.

Rebates will make most households better off. A study by the Parliamentary Budget Officer suggests that between 60% (Ontario) and 80% (Alberta) of households will be better off on balance. How is this possible? While lower-income households have a relatively small carbon footprint, the higher-income households have a significantly larger carbon footprint. This means that carbon tax-and-rebate systems tend to redistribute wealth from fewer rich and carbon-intensive households to many poorer but carbon-frugal households. In the end, a majority of households benefits.

Won't rebates offset the beneficial effect of carbon pricing?

A common objection from opponents to carbon tax-and-rebate schemes is the idea that people who receive a rebate will not adjust their consumption behaviour. If you pay $100 in carbon taxes and get $150 back in rebates, won't you end up driving more? The answer is: very unlikely. This objection is a fallacy based on an incorrect understanding of economic principles. The point of carbon pricing is that it makes carbon-intensive activities more expensive, regardless of the rebate. Even if you get more money back than you pay, you will not all spend it on the carbon-intensive activity. The rebate, as general income, will also be spent on a variety of other activities. Even if your driving demand was completely price-inelastic (for example because there is no other option to commute to work than drive), the higher carbon price will eventually entice you to buy a more fuel-efficient car because driving a more frugal car will be more economical than driving a gas guzzler. Or your next car will be electric. Your purchase decisions will be influenced by the carbon price regardless of the rebate you get. So in short, rebates don't offset the beneficial effect of carbon pricing. Rebates will generate a small rebound effect, but it is not leading to a "backfire effect" or Jevons Paradox.

Could carbon pricing undermine the competitiveness of trade-exposed carbon-intensive industries?

The federal carbon pricing system is coupled with an Output-Based Pricing System (OBPS) that protects industries that would be vulnerable to international trade disadvantages. To keep industries competitive, they are subject to the full marginal carbon price but ultimately end up paying a much lower average price. This works by using an emission intensity threshold that is slightly below the average emission intensity for individual industries. Firms above the average (those that are more carbon intensive) pay the marginal price for emissions above the average, while firms below the average (those that are cleaner than average) receive a credit at the marginal price that they can sell to other firms. This is an ingenious system that decouples marginal from average carbon prices, creates the right incentives for reducing carbon emissions, while protecting industries from competitive disadvantages in international markets. In fact, the cleanest firms in an industry actually gain a small competitive edge because of the carbon credits. It pays to be a "green leader".

Why is carbon pricing superior to other policies?

Carbon pricing is a market-based instrument. This means that market forces determine the most cost-effective way to reduce carbon emissions. Government regulation (also known as "command and control") is less effective because of information asymmetry: governments cannot know the exact ability of each firm and each household to reduce emissions. However, the market mechanism makes firms and households reveal their ability through their purchase decisions. There is a broad consensus among environmental economists that market-based policies are the gold standard for achieving emission reductions. Economic theory tells us that putting a price on pollution is the "first-best" policy to reduce pollution.

What other policies are needed to achieve our climate goals?

Carbon pricing cannot fix additional market failures that prevent the adoption of energy-efficient low-carbon technologies. If you cannot buy an electric vehicle because there is nowhere to charge it, we have a problem. If you cannot put an EV charging station in your parking stall because your strata or condominium association won't let you, we have a problem. If a builder puts cheap but energy inefficient appliances into a new home and the new home buyer ist stuck with it, we have a problem. These problems require separate interventions to address these market failures: infrastructure spending by utilities and municipalities; revisions of the building code that promote "green building" standards; introducing a "right to charge" into strata property law. These and other policies are crucially important to open the door to adopting low-carbon and zero-carbon options.

We also need governments to advance research and development in partnership with businesses. We need innovation into new technologies from grid-scale electricity storage, cheaper and safer batteries for motor vehicles, to hydrogen fuel for ships and planes. Accelerating innovation will require suitable policies that promote them.

In which provinces does the federal policy apply, and is there a cause for harmonizing provincial policies with federal policies ?

Some provinces have their own carbon policies, such as British Columbia with a carbon tax that predates the federal scheme, and Quebec with a cap-and-trade system that is administered jointly with the state of California. The federal carbon tax-and-rebate system was intended as a "backstop" for provinces that otherwise do not have a carbon policy. Other provinces have to adopt policy that is deemed "equivalent" to meeting the federal target. Currently, Manitoba, New Brunswick, Ontario, Saskatchewan, and Alberta are subject to the federal system (see specific rates here), and additionally to the northern territories. The provincial governments of Saskatchewan, Ontario and Alberta oppose the federal policy and have launched challenges that are now heard by the Supreme Court of Canada. Hearings started in September 2020. The federal government had prevailed in two rulings by lower courts: Saskatchewan's Court of Appeal had ruled in a 3-2 decision in May 2019, and Ontario's Court of Appeal had ruled in a 4-1 decision in June 2019, that the federal policy is consistent with Canada's constitution. Based on these two previous rulings, it is likely that the Supreme Court of Canada will allow the federal government to proceed with its policy.

As the carbon price rises, provincial governments that currently have their own programs may find it useful to fold into the federal program, which has features superior to their local alternatives. British Columbia's carbon tax, originally envisioned to be revenue neutral, is revenue neutral no longer since the carbon price increased over $30/tonne. However, folding it into the federal program will require some adjustments to the rebate system because the original revenue neutrality was accomplished through reductions of the province's income and sales taxes. Yet, the federal rebate system is highly desirable because it addresses the regressivity of carbon pricing—the fact that energy expenditures are a higher share of the budget for lower-income households—in a very proactive way that is more equitable than BC's own approach. Quebec's cap-and-trade system will be in peril because of its link to California, as prices are linked.

Can provincial opposition undermine federal efforts to reach Canada's climate targets?

As previously mentioned, several provinces have launched legal challenges that seek to overturn the federal law on carbon pricing. These provinces argue that the federal government lacks constitutional jurisdiction over the environment and thus cannot impose carbon pricing on provinces. Simply put, the argument is that Ottawa is overstepping its authority. However, the evolving interpretation of Canada's constitution clearly recognizes issues of "national concern", and climate change is the ultimate transboundary concern—it is global. While the Supreme Court could in principle rule against the federal government of Canada, in my opinion that is improbable. It would go against recognizing the already well-established role that the federal government has in matters of the environment that are transboundary in nature, and its role as partner in international treaties. In fact, the Trudeau government has proceeded with great caution and given provinces much leeway to choose its own methods of reaching the climate goals.

The federal government has broad powers under the constitution for taxation as well as for "peace, order and good government" that encompasses the notion of "national concern". The federal government also has criminal law power, and courts have recognized that federal criminal law can be used to influence behaviour in addition to prohibiting behaviour. All in all, the legal basis for federal carbon pricing appears to be robust and solid.

How will the $170/tonne target influence the next federal election?

Moving from analysis to opinion, let me add some thoughts about what I see as the possible political effects. In my opinion, the announcement to raise the carbon price to $170/tonne is a very smart political move. It gives the Liberal government an opportunity to demonstrate to voters that its commitment to climate action is real and not just lip service. This will resonate strongly with the large part of the electorate in Canada that favours strong climate action. Pollsters find that two out of three people in Canada would like to see Canada as either "world leading" or "among the most ambitious" countries in the world when it comes to a shift towards clean energy and clean technology. The NDP would have difficulties outflanking the Liberals on this issue and instead will likely find the policy worth supporting in Parliament. The Liberal government should therefore not have difficulties passing their policy into law—and going into the next election with confidence that they have a clear and decisive vision for climate action.

Based on the polling data, Conservatives in Canada seem to be out of tune with the preferences of a broad majority of Canadians when it comes to climate action. Of course, this picture is incomplete without acknowledging the regional differences across the country. Opposition is concentrated in Alberta, Saskatchewan, and pockets of Ontario. Nevertheless, Conservatives have largely dropped the ball on climate action as they have either opposed effective climate action (by rejecting carbon pricing) or merely pointed the finger at foreign countries (as Saskatchewan premier Brad Wall did in an editorial piece in The Globe and Mail in October 2016). During the 2019 federal election, the Conservatives' election platform proposed various subsidies and tax incentives that were meant to foster innovation. However, these measures are demonstrably insufficient to reach the Paris Agreement goals. It is also remarkable that Liberals prefer market-based solutions when Conservatives embrace subsidies and command-and-control interventions. If Conservatives don't get serious about climate action and instead embrace climate nihilism and anti-tax populism, they may find that what appeals to their base in rural parts of the country will distance them even further from urban parts of the country.

For anyone who cares about the climate future of our planet, as I do, the Liberals' plan to raise carbon prices to $170/tonne by 2030 is putting Canada on the right track. There can be no doubt that it will be difficult to convince some voters of the merits of a carbon tax-and-rebate system, but the hope is that quarterly rebates will make the nature of the system more tangible and appealing to a broad majority of voters. The economic and environmental logic of the carbon pricin system is compelling. Businesses will adapt now that the path is clear. Making a bold step forward on climate action could well pay off at the next federal election (which could happen in 2021). The federal carbon policy that combines environmental efficacy with smart redistributive effects that ultimately benefits most low-income and middle-income households may turn out to be an appealing combination to voters.

Further readings and information sources:

- Government of Canada: Net-Zero Emissions by 2050 and .

- John Paul Tasker: Ottawa to hike federal carbon tax to $170 a tonne by 2030, CBC News, December 11, 2021.

- Michael Barnard: A Carbon Price In Canada Of $170 CAD By 2030 Is Great Climate News, CleanTechnica, December 11, 2020

- Marieke Walsh and Emma Graney: , The Globe and Mail, December 11, 2021.

- Dale Beguin, Brandan Frank, Glen Hodgson, Richard Lipsey, Nancy Olewiler, and Chris Ragan: Clearing the Air: How Carbon Pricing Helps Canada Fight Climate Change, Canada's Ecofiscal Commission, April 2018.

- Bridging the Gap: Real Options for Meeting Canada's 2030 GHG Target, Canada's Ecofiscal Commission, November 2019.

- The Globe and MailEditorial Board: Justin Trudeau goes all in on the carbon tax. It's the right thing – for the environment, and the economy, The Globe and Mail, December 13, 2020.

- Parliamentary Budget Officer: Reviewing the Fiscal and Distributional Analysis of the Federal Carbon Pricing System, Ottawa, February 4, 2020.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)