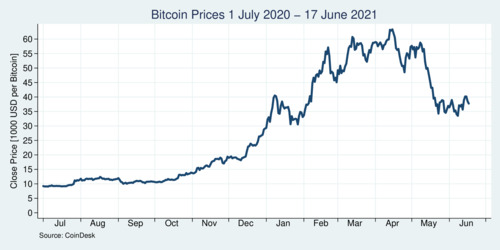

Cryptocurrencies are much in the news these days. Bitcoin prices have been excessively volatile in recent months. Anyone looking to use bitcoins as a storage of value should think twice before buying some. As the chart below shows, prices took of from around USD 10,000 last summer to reach a peak of over USD 60,000 in early April 2021, only to fall back to about USD 36,000 today. A rollercoaster of a ride that is more reminiscent of a hyped-up penny stock rather than a global currency.

click on image for high-resolution PDF version

In a recent contribution to The New York Times, Cornell University professor Eswar Prasa delivered The Brutal Truth About Bitcoin. He writes: "Bitcoin became cumbersome, slow, and expensive to use" and "Bitcoin's unstable value has also made it an unviable medium of exchange." As a currency, Bitcoins are an abject failure in two of the three functions of money: medium of exchange, unit of account, and store of value.

‘Bitcoin mining has become a global environmental menace.’

The environmental harm of bitcoin mining has been well publicized. For example, in February 2021 The Guardian's Lauren Aratani reported that Electricity needed to mine bitcoin is more than used by ‘entire countries’. The method that is used to process and validate bitcoin transactions and add them to distributed ledgers, known as "proof of work", is immensely computation-intensive and therefore electricity-intensive. Bitcoin mining is carried out in several jurisdictions with a high coal content in their power supply, notably China. Worldwide bitcoin mining is estimated to exceed 100 Terawatthours (TWh), although estimates are not very reliable at this point. All this power use contributes to climate change and ultimately can also drive up electricity costs. The rising environmental footprint of bitcoin mining is worrisome and worsening. Proof-of-work cryptocurrencies are wasting enormous amounts of resources. An April 2021 study by a group of Chinese researchers published in Nature Communications concluded that "without any policy interventions, the annual energy consumption of the Bitcoin blockchain in China is expected to peak in 2024 at 296.59 TWh and generate 130.50 Megatonnes of carbon emissions." Laudably, China's government has started taking action: China bans financial, payment institutions from cryptocurrency business.

But will bitcoin mining continue to grow or will it eventually fail because it is no longer profitable? In fact, bitcoin mining is standing on a fatally flawed business model. The essence of using distributed ledgers means that many people must carry out bitcoin mining in order to verify transactions. The people who carry out bitcoin mining (and thus provide transaction verifications to the network) are rewarded by receiving new freshly-mined bitcoins. However, the total number of bitcoins is limited at 21 million. As of today, 18.7 million bitcoins are in circulation, leaving just 2.3 million bitcoins to be mined. At current prices, these would be worth about USD 83 billion. This is the reward that is being chased by bitcoin miners, and it explains why people are buying up specialized GPUs. As The Economist reported on June 19, Crypto-miners are probably to blame for the graphics-chip shortage. But how many more transactions can be processed before it is no longer profitable to do so? Our financial system charges fees for each transaction, with an unlimited revenue stream for the future. Not so for bitcoins: the revenue for processing all future transactions is limited, and eventually will dry up because no prices will rise forever. Research also suggests that the marginal cost of production of a bitcoin is a floor for its value (Hayes 2018).

‘Bitcoin mining cannot defy basic economics.’

Let's apply some economic thinking to the bitcoin mining problem. As more bitcoins are being mined, the remaining number will shrink. At the same time, bitcoin mining will get harder as the transcation ledgers grow in size and the mining algorithm requires more and more proof of work to receive the next bitcoin. In other words, marginal costs of bitcoin mining are rising. The only way for bitcoin mining to remain profitable is therefore through rising marginal revenue, that is, rising bitcoin prices. Unless bitcoin prices rise to astronomical levels, the economic logic implies that at some point marginal costs will exceed marginal revenue. When bitcoin mining is no longer profitable, it will cease. And with nobody processing transactions, the entire system collapses. The only way for bitcoins to survive is to become infinitely precious. But if confidence in this ever-growing price bubble weakens, collapse is the only logical outcome.

Bitcoin mining cannot defy the laws of economics. One such principle is self-evident: there is no free lunch; someone has to pay for it, even if you don't pay for it yourself. In the case of bitcoins, someone has to pay for processing these cryptocurrency transactions. Either bitcoin prices keep on risising faster than the cost of proof-of-work computations, or the system implodes. Owners of bitcoins should be well aware that the entire bitcoin system is built on quicksand. The decentralized system of bitcoins makes it impossible to introduce a transaction fee system because of the unlimited potential for free-riding. The way I see it: the inventors of bitcoin (whoever they may be) should have taken a course in economics first.

Should regulators wait until market forces reign in bitcoins all by themselves? There are significant costs to the current laissez-faire approach. The environmental cost is significant. There are also important societal costs. Bitcoins remain the payment method of choice for criminal activity of all kinds, including money laundering, internet fraud, ransomware attacks, and financing terrorism. In a statement to the US Senate, US Treasury Secretary Janet Yellen said that many cryptocurrencies "[...] are used, at least in a transaction sense, mainly for illicit financing. And I think we really need to examine ways in which we can curtail their use [...]". While a significant number of bitcoin users are simply speculators, there can be no doubt that bitcoins have facilitated criminal activity as well.

‘The future of crypto has a name: Central Bank Digital Currency.’

While bitcoins are harmful, the same is not true about all types of crypto-money. There are alternatives to the computation-intensive "proof of work" approach such as proof of stake or proof of bid. Central Bank Digital Currency (CBDC), fully backed by a government's central bank, would provide a digital counterpart to cash. CBDCs could deliver what bitcoins cannot: lower transaction fees, value stability, full fungibility, and immediacy. The latter point is about the problem that confirming bitcoin transactions takes considerable time, on average about 10 minutes, but on occasion much longer. CBDCs would facilitate true real-time transactions as they can be processed in fractions of a second. The Bank of Canada is conducting active research on this topice (see here), as do other central banks. There is a bright future for cryptocurrenices, but Bitcoin isn't one of them. Elon Musk, please take note!

Further readings and information sources:

- Susanne Köhler and Massimo Pizzol: Life Cycle Assessment of Bitcoin Mining, Environmental Science & Technology 53, 2019, pp. 13598–13606.

- Jiang, S., Li, Y., Lu, Q. et al.: Policy assessments for the carbon emission flows and sustainability of Bitcoin blockchain operation in China, Nature Communications 12, No. 1938 (2021).

- Fahad Saleh: Blockchain without Waste: Proof-of-Stake, The Review of Financial Studies 34(3), March 2021, pp.undo 1156–1190.

- Wai Kok Chan, Ji-Jian Chin, and Vik Tor Goh: Proof of Bid as Alternative to Proof of Work, International Conference on Advances in Cyber Security 2019, pp. 60–73.

- Jonathan Chiu and Thorsten V. Koeppl: The Economics of Cryptocurrencies — Bitcoin and Beyond, Bank of Canada Staff Working Paper 2019-40.

- Rainer Böhme, Nicolas Christin, Benjamin Edelman, and Tyler Moore: Bitcoin: Economics, Technology, and Governance, Journal of Economic Perspectives 29(2), Spring 2015, pp. 213&ndash238.

- Adam S. Hayes: Bitcoin price and its marginal cost of production: support for a fundamental value, Applied Economics Letters 26(7), 2019, pp. 554-560.

- Quinn Slobodian: Cryptocurrencies' dream of escaping the global financial system is crumbling, The Guardian, 5 July 2021.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)