The effects of climate change can be felt around the world in increasing intensity. British Columbians have experienced another summer of wild fires, with the tragic destruction of the town of Lytton. In Germany, devastating floods inundated the Ahr and Eifel regions. Taking action to limit greenhouse gas emissions is gaining urgency, and the electrification of mobility is a key element in transitioning away from fossil fuels wherever clean electricity is abundant. British Columbians are increasingly taking to buying electric vehicles, as I reported in my blog The state of EV Adoption in British Columbia. Today's blog expands on this topic by looking at the state of EV charging networks in the province.

Understanding the economics behind EV charging is part of my active research program, and two charts from this research project illustrate nicely where things stand with public EV charging. As I am driving electric, I also have first-hand experience with using them.

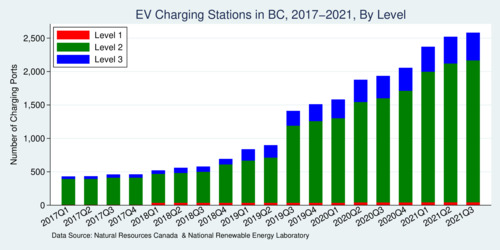

The first chart shows the growth of EV charging stations by quarter. There are three different types of charging stations. Level 1 chargers are essentially just standard 110V outlets. They only provide slow charging and thus this segment is not expected to grow much. Level 2 chargers operate at 208V and typically provide between 3 and 20 kilowatt (kW) power, with most in the 6-7 kW range. At 6 kW power, a car that consumes about 24 kWh per 100 km can charge enough to drive about 25 km in one hour. Level 3 chargers operate on direct current (DC) and provide 25-50 kW, with most of them at the higher level. With 50 kW power, the same 24kWh/100km car as before can charge up for about 200km of driving in one hour.

As the chart shows, there are now over 2,500 public electric vehicle charging stations (EVCS) in British Columbia. However, there are about 50,000 electric vehicles traveling on BC's roads. This means there is one public charger for every 20 EVs. This means that arriving at a popular destination can be a frustrating experience for EV drivers looking for charging opportunities when they find that all charging spots are already in use. The density of the public charging network is still in its infancy. A key economic question is thus: what is the optimal ratio of public EVCS to EVs? The 20:1 ratio is unsatisfying for EV drivers, but the cost of EVCS is not trivial especially for Level 3.

click on image for high-resolution PDF version

Level 2 and Level 3 chargers can have different types of plugs. The most common Level-2 charging plug is the J1772, also known as the "J plug". This is by far the dominant standard today. Some Level-2 charging spots simply offer an electric outlet, which in turn requires a portable charging cable that fits the outlet. These outlets can come in different types such as NEMA 14-50 or NEMA 14-30 or NEMA 6-50, which may also require a suitable adapter. Tesla owners have yet another type of plug that is unique to their vehicles. Tesla Level 2 chargers are mostly operated as "destination chargers" by hotels and other commercial entities.

For level 3 charging there are three major standards: CHAdeMO, Combo-CCS, and Tesla. The "Tesla Superchargers" currently only works for Teslas, although the company has announced that it will allow other users on their network later in 2021. For the other two standards there is a standards battle among car manufacturers. CCS is currently endorsed by BMW, Daimler, Ford, General Motors, Honda, Kia, Hyundai, Mazda, Renault, and VW. CHAdeMO is supported primarily by Japanese car makers: Nissan, Mitsubishi, Subaru, and Toyota. As a result of the standards battle, many Level 3 chargers (e.g., those provided by BC Hydro) have two plugs. I expect that ultimately one standard will out, and CCS has the greater momentum. Which standard is ultimately superior is a matter for debate among engineers; for example, CHAdeMO offers bidirectional charging, but CCS is evolving too. Standards battles are typically decided by network size, and Combo-CCS is in the clear lead.

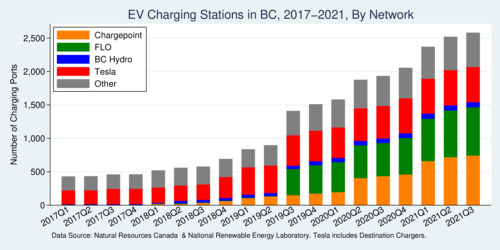

The second chart shows which companies are involved in providing public EV charging in British Columbia. Two networks dominate: Chargepoint and Flo.

click on image for high-resolution PDF version

Chargepoint is based in Texas and has expanded significantly in the United States and Canada in the last few years. FLO is a subsidiary of Quebec-based AddÉnergie. Other significant players are BC Hydro (exclusively for Level 3 charging stations), Tesla (both with their own Level-3 superchargers and with their partners' destination chargers). Newcomers to BC are "Electrify Canada" (owned by Volkswagen).

For anyone using EVCS in BC, encountering different charging networks is a logistics problem: one needs to be a member of each one that provides compatible charging. My own car can only be charged with a Level-2 J-plug, and thus I am mostly using Chargepoint and Flo (as well as a smaller network ELMEC/EVduty). Having an App for each on your smartphone makes it relatively easy to use the different networks. Some charging networks offer "roaming" on partner networks, but this does not always work as advertised. Various adapters can also come in handy, for Teslas as well as J-plug equipped vehicles.

So what is necessary to make EV charging easier in the future? There are three items on my wish list as an EV owner:

- Greater Density: BC needs many more public charging stations so that arriving at a parkade somewhere makes it extremely likely to find an available charging port.

- Standardization: Car makers need to converge on a single Level-2 and Level-3 standard (J-plug and CCS-plug, respectively).

- Seamless Roaming: The different charging networks need to cooperate on effective roaming arrangements.

I expect significant consolidation of charging networks over time. Larger networks are more beneficial, and without seamless roaming the smaller networks will stagnate and wither. There is ample opportunity for mergers, and I expect car makers to play a major role in owning EV charging networks—or at least partnering with EV charging networks.

Making EV charging a profitable business model is not easy. Each EVCS has a significant upfront fixed cost, while the revenue stream from charging trickles in over very long times. If an EVCS charges $1 per hour and generates about $6 per day of use on average, it takes several years to amortize a $5,000 installation expense. Thus, the EV charging networks can't put up the fixed cost of owning stations. Instead, they rely on partners (e.g., municipalities) to own the stations while the charging networks offer the management and use services. Essentially, EV charging networks operate on a service model to become profitable. This in turn means that other parties have to take on the ownership cost. This in turn is one of the most significant challenges to expanding charging networks.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)