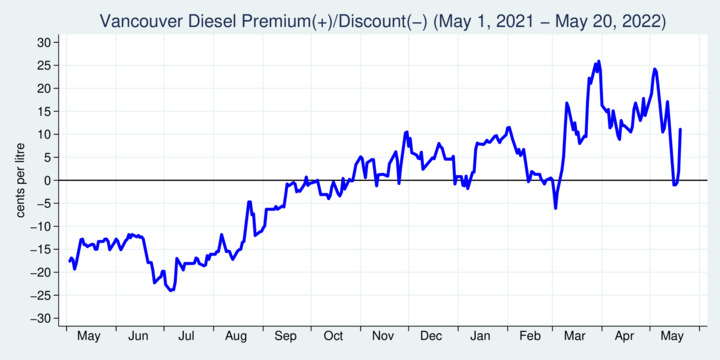

While gasoline prices have hit record highs over the last week, the increase in diesel prices has been even steeper. The chart below shows that diesel fuel was selling in Vancouver at a 25-cent discount in July last year and moved up to a 25-cent premium in late March and then again in early May of this year. What is behind this diesel premium? The answer involves both market conditions and technological constraints.

click on image for high-resolution PDF version

It is useful to understand how a refinery operates. Crude oil is processed by heating it and extracting different types of fuel from a distillation stack at different temperatures. The heaviest fuel types (fuel oil, diesel) require the highest temperatures, and the lightest fuel types (butane, propane, petrol) require the lowest temperatures. How much of each product is extracted depends on the refinery configuration and the type of crude that is processed.

To understand refineries, it is necessary to understand the different types of crude oil that are processed there. Crudes that contain little sulfur are sweet, and crudes with more sulfur are considered sour. The light/heavy distinction refers to the API gravity of oil, a measure of density, which is measured relative to water. The higher the API gravity, the lighter the oil, and anything above 10 is lighter than water. The most favourable types of crude oil are light-sweet, and the most difficult types of oil to refine are heavy-sour.

Broadly, there are three different types of refineries that process different types of crude oil. The simplest type is known as a "topping refinery" and only processed crude oils that are light and sweet. The next type is known as a "cracking refinery" that takes the gas oil from the crude distillation unit and breaks it further into gasoline and other distillates using various processes. The third and most involved type is the "coking refinery" where residual fuels are broken up into lighter products in a coker (or hydrocracker). Canada's refineries are predominantly of the cracking type that run on a mix of light and heavy crude oils to meet the product slate favoured in our fuel markets.

Which type of products are produced in each refinery is also very much determined by demand. Essentially, there are trade-offs determined by market forces. Refineries are configured to yield the most value based on the retail prices for the different types of products. However, once a refiner start producing more of one type, it must necessarily produce less of another type. If there are significant changes in the composition of demand, refineries are slow to adjust.

‘The diesel shortage in Europe is also having an effect on diesel prices in Canada, with limits on adjusting our refineries output.’

Now enter a situation where stocks of diesel fuel were low coming into the year 2022. Refining capacity is quite limited and decreasing in North America and Europe, and most of the spare capacity is in Asia and the Middle East. Some refined diesel is actually exported from Russia, not just crude oil, and Europe has relied a fair bit on Russian diesel. With this supply subject to trade sanctions and Russian exports falling, European firms have been turning towards supplies from elsewhere, pushing up demand globally for diesel. The diesel shortage in Europe is now spilling over to North American markets as well.

There is also a complicating factor because the supply of crude oil is moving more and more from light sweet crudes to heavy sour crudes, which require "coking" types of refineries. We don't have enough of those in North America for historic reasons.

Yet another problem is that refineries need natural gas in order to make hydrogen (used in the refining process), and that has become more expensive too. Hydrogen is used to lower the sulfur content of diesel fuels, and diesel fuels are required to be increasingly "low sulfur" in North American and Europe (as mandated). Hydrogen is nowadays often supplied by industrial plants, not just refineries. But hydrogen prices follow natural gas prices.

The bottom line is that the market for diesel fuel is complex, and follows its own market dynamic that is not the same as for gasoline. Mostly, the extra demand from Europe is spilling over to North American markets. If refineries rush to make more diesel, this will lower output of gasoline. In this case prices for diesel will fall, but rise for gasoline.

How long we will see elevated diesel prices depends much on what is happening globally. For better or worse, we are in a global market for energy, and everything that happens around the world also has an impact on the prices at the pumps in Canada.

Further readings and information sources:

- Natural Resources Canada: Refinery Economics

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)