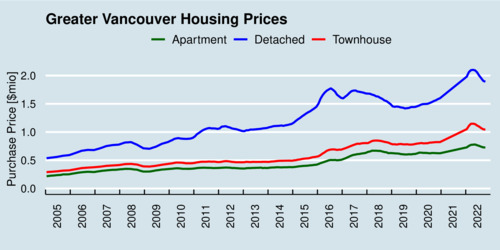

If you need evidence that monetary policy is doing its job in Canada, look no further than Vancouver's housing market. The Bank of Canada's interest rate stood at 0.25 percent at the beginning of the year, and now has climbed to 3.75 percent by late November, with more hikes expected. Rates for uninsured mortgages have climbed to about 5.75 percent at major financial institutions. As the chart below shows, the housing market in the Greater Vancouver region is showing first signs of easing.

click on image for high-resolution PDF version

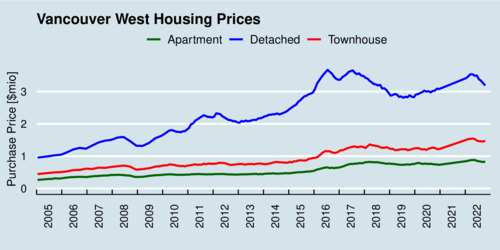

This region average hides significant heterogeneity. Housing on Vancouver's west side remains a luxury, with prices for detached homes in excess of 3 million dollars.

click on image for high-resolution PDF version

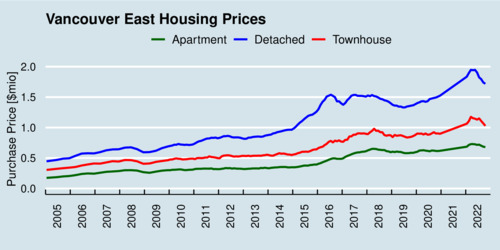

Even on Vancouver's East side, housing prices are not exactly affordable. The benchmark price for detached homes was flirting with two million dollars, and had increased significantly since 2019.

click on image for high-resolution PDF version

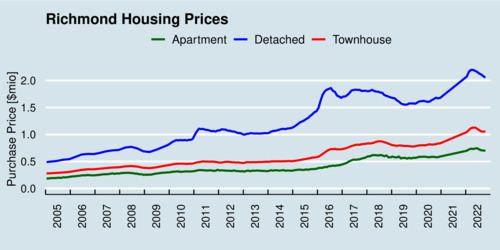

Housing prices in Richmond, just south of Vancouver, followed a similar trend as Vancouver's East Side, with prices just slightly higher and topping two million dollars for detached homes at the beginning of the year.

click on image for high-resolution PDF version

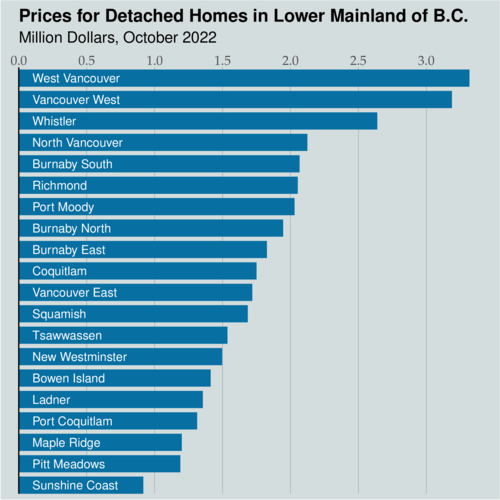

Next, a look at the heterogeneity of prices across the region, all based on the latest October 2022 data. The fist bar diagram shows the prices for detached homes. Unsurprisingly, West Vancouver on the North Shore tops the list, followed closely by Vancouver's Westside. The most affordable location was the Sunshine Coast, but is separated from the Mainland by a ferry ride. More affordable detached homes Within commuting distance to Vancouver could be found in Pitt Meadows, Maple Ridge, Port Coquitlam, and Ladner.

click on image for high-resolution PDF version

Townhouses are roughly half the price of a detached home, as the next chart shows.

click on image for high-resolution PDF version

Apartments, with the exception of West Vancouver, are generally selling for between $500,000 and $800,000.

click on image for high-resolution PDF version

The median total (pre-tax) income in British Columbia in 2020 was $96,220, according to Statistic Canada table 11-10-0009-01. Buying a home is still out of reach in many places in the Lower Mainland. The rule of thumb is that mortgage costs should not exceed 32% of total household income. At current rates, the median-income household can perhaps afford a a half-million dollar purchase of a home with a $150,000 downpayment and about $2,300 in monthly mortgage costs. A detached home is pretty much out of reach for a typical household. Apartments in part of the Lower Mainland remain within reach, but certainly not everywhere. Even renting isn't cheap. According to Vancouver-based rental listings site liv.rent, the average rent for an unfurnished one-bedroom place in Metro Vancouver topped $2,000 for the first time in May 2022, and has been rising further.

Housing affordability will remain a major problem in the Vancouver region. As any economist will tell you, this problem has both supply-side and demand-side problems. On the demand side, there is primarily population growth. Add additional factors that include interest rates, taxation rates, and overseas investors. On the supply side, we have geographic constraints (mountains in the north, ocean in the west, border in the south, valley ending in the east) as well as zoning constraints (determining density). Add additional factors such as construction costs including labour and materials. From the above it is clear that the solution to Vancouver's affordability crisis is not simple. We need interventions on the supply and demand side, but ultimately the supply side is the binding constraint. Simply put, we need more construction, and when land is scarce, the only way to provide more housing is to go up and to go denser. Higher density, combined with more public transit, is the main key to solving the affordability problem.

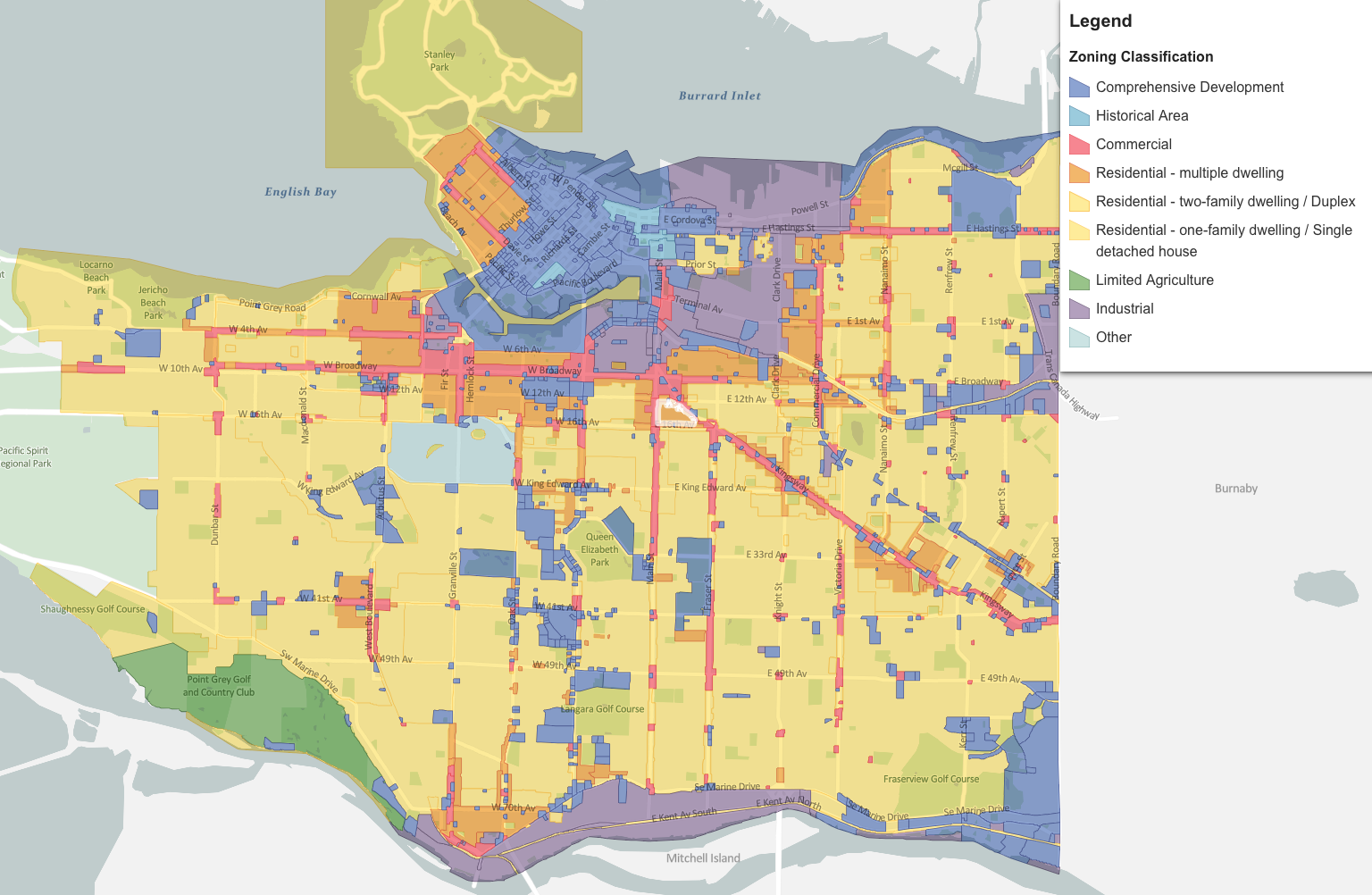

Jake Wegmann, a professorial colleague at the University of Texas at Austin's School of Architecture, wrote an article in 2020 in the Journal of the American Planning Association that stood out by its argumentative title: Death to Single-Family Zoning ... and New Life to the Missing Middle. He argues that planners in the United States and Canada should stop defending single-family zoning, which he described as "the single most harmful widely used practice in planning". Wegman disputes many of the common arguments in favour of single-family zoning, namely that it reflects consumer preferences or is the most appropriate housing form for raising children. In fact, over the past century Vancouver only allowed single detached homes to be built around residential lands. The last city administration introduced The Vancouver Plan in April 2022. The core idea in the plan is to scrap existing zoning restraints and permit modest density everywhere, what Wegman called the "missing middle". This involves primarily multiplexes, buildings which include three or more units.

The province's new premier, David Eby, sworn in only last Friday (Nov. 18) in a ceremony involving the Musqueam community, has some big plans to nudge cities in the direction of allowing more density. This includes removing rental restrictions in strata bylaws, legalizing secondary suites, and more importantly, changing zoning baselines in major cities from single-unit to three-unit dwellings (small multiplexes). Cities can, and should, go further in particular areas. As the zoning map of Vancouver below shows, the colour yellow (single-detached homes) dominates. We need to see a lot more orange on this map if housing prices have any chance of just easing a little. No doubt, opposition to zoning changes will be fierce. It's a battle between the current generation of home owners, eager to protect the inflated value of their homes, and the next generation of home owners, frozen out of an unaffordable housing market. The lucky ones inherit from their parents, but the newcomers will be mostly out of luck. Is housing affordability becoming a generational battle?

click on image for full resolution version

The battle for higher density in Vancouver has more than one focal point. Rezoning around the new Broadway subway expansion is one. Another one is the redevelopment of the Jericho Lands, which are currently co-owned by the Musqueam, Squamish and Tsleil-Waututh First Nations and the Canada Lands Company (a federal Crown corporation). Higher density will be coming to these areas, and the Jericho Lands development is likely going to be connected to the UBC extension of the Millennium Line with a separate station, should this project receive approval and financing. Of course, there is fierce opposition to the land development from nearby owners. The question will be about what potnetial limits will be put on high-rises. This discussion shines light on an implicit trade-off: if we don't allow more medium-density housing (4-6 storey buildings) broadly, we will see more tall high-rises in the few narrow areas where such developments will be permitted. High-rises are popular with developers because of the spectacular views than sell. However, what we need is a lot more affordable housing capacity, not high-priced condos with a view. For that, zoning rules across the Lower Mainland need to accommodate population growth.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)