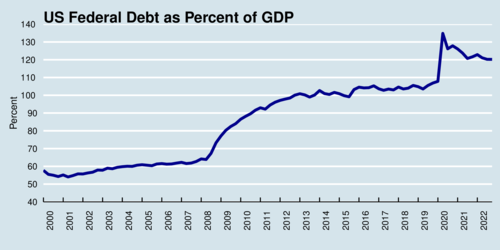

The United States has a mild economic debt problem and a serious political debt trap. The economic debt problem is shown in the graph below. Like many other countries, the US has spent heavily during the Covid-19 pandemic and has increased its debt load significantly. The country's debt-to-GDP (gross domestic product) ratio hovered around 100% before the pandemic—high but not particularly unusual by international comparison. The debt level spiked in 2020 before starting to settle down to about 120% by the end of 2022. There is no question that this debt load is manageable and sustainable, even if it needs downward correction.

click on image for high-resolution PDF version

Enter the political debt trap, a restriction imposed by Congress on the amount of outstanding national debt that the federal government can carry. If this debt ceiling is breached, the US Treasury is no longer able to issue new debt, and thus it loses the ability to pay its bills—to its workers, to social programs, to its military, and to US bond holders. Such a payment default would cause unprecedented economic harm to the US economy and around the world. So why would anyone in their right mind want to walk the US to the brink of disaster? To some it is just a game of political poker, and who blinks first loses. But the stakes are incredibly high, and political recklessness can easily lead to economic disaster—one where the economy tanks and jobs are lost.

‘Forced to choose between violating the budget law or the debt ceiling, economic reasoning suggests to take the option that causes the least economic harm.’

US law has created a paradox. First, Congress issues a law that approves a certain amount of spending. Overall spending exceeds revenue, and thus debt is building up. Then, Congress does not permit the debt to rise. This in turn means the US Treasury would have to default on its payments if it stopped taking on new debt. The legal paradox arises out of two mutually incompatible, but valid laws: one authorizing spending, and another preventing financing of that spending. There are only three ways out of this dilemma. First, Republicans and Demcocrats in Congress can negotiate an agreement. This is what is currently taking place, but with rather uncertain outcome. Second, obey the spending law and ignore the debt ceiling law. Or third, ignore the spending law, obey the debt ceiling law, and stop paying bills partially. If negotiations fail, which of the latter options should the US government choose? Both would violate valid law, and thus both would end up being litigated. To economists, the answer to the question follows from a related question: which of the two options causes the least economic harm? And the answer to that question is: ignore the debt ceiling and continue paying all legal obligations.

If the US Treasury were to obey the debt ceiling, it would avoid a default but instead would be forced into something called payment prioritization, which means paying some recipients all that is owed, paying some recipients less than they are owed, and perhaps paying some recipients nothing at all. Presumably, the government would continue paying bond holders all that is owed, because not doing so would undermine confidence in US bonds, and thus the long-term viability of issuing US bonds into international markets. Even if bond holders are paid on time, international markets would likely attach a higher credit risk to US bonds, making borrowing more expensive in the long term. Payment prioritization could create enormous domestic hardship, no matter which priority order would be chosen.

There are other options available to the government. Many of them are problematic from a legal point of view and would likely be challenged in Court. One such option was explained by my economist colleague Paul Krugman in The New York Times in October 2021: Biden Should Ignore the Debt Limit and Mint a $1 Trillion Coin. The Treasury has the right to issue commemorative coins, and in principle it could issue a one-trillion dollar coin, deposit it with the Federal Reserve, and have more money to spend. This is a book-keeping trick that essentially increases the money supply. It has also been suggested that President Biden invoke the 14th Amendment Section 4, which holds that "the validity of the public debt of the United States, authorized by law, ..., shall not be questioned." Whether the (conservative) US Supreme Court would back up invoking the 14th Amendment would remain to be seen, and many observers think it unlikely that the Supreme Court would overturn the debt ceiling by way of the 14th Amendment.

‘Issuing consols instead of bonds would prevent the debt ceiling from rising while continuing to raise funds to pay the government's bills.’

I have argued above a point of view that largely follows the analysis of Cornell Law professor Michael Dorn. He argued that in the dire circumstances faced by President Biden, the least bad option is to violate the debt ceiling by continuing to borrow money, because this is not completely inventing new legislative policy. And within that context, there is actually one financial instrument that would be legal to use and which solves the financing problem without raising the nominal debt level. It involves issuing a type of perpetual bond known as a consol, which pays interest but never matures. Technically, issuing such a bond would not add to the federal debt level because these types of bonds have no redeemable face value, so there is no liability in the future. The continuous interest payments are a budget expense just like any other spending program obligation and interest payments. This approach is a backdoor, but it appears to be perfectly legal, and would allow the United States to meet all its obligations.

When financial sanity returns to Washington, DC, a future government could even decide to buy back consols, or replace them with conventional bonds. This is in fact what Great Britain did in 2015: UK bonds that financed first world war to be redeemed 100 years later.

The debt ceiling is nonsensical. Legislatures that authorize spending cannot then prevent financing of this spending. The debt ceiling should be abolished, although this is unlikely going to happen in the current political landscape in the United States. Fiscal restraint must come from the will of elected leaders to balance their budgets, and ultimately voters have to hold their elected leaders accountable for either excessive profligacy or excessive austerity.

There is ample room to fix the United States' mild economic debt problem. The US tax-to-GDP ratio is well below the OECD average. The United States does not have a value-added tax (VAT), unlike all other OECD countries. Dealing with a country's debt problem involves looking carefully at both revenues and expenditures. Brinkmanship that walks the United States dangerously close to the "fiscal cliff" appears inexcusably reckless and puerile. Fiscal compromises are possible, but for these to happen, an attitude change is required that embraces negotiation, give-and-take, and common cause—something that is increasingly difficult to find among politicians in today's hyper-partisan US Congress.

Update May 28, 2023

It appears that the two parties managed to squeeze out a last-minute deal to avoid Amargeddon, as The Economist put it. It still has to pass through Congress. Stock markets had largely anticipated such an outcome, as prices had barely moved in response to the looming disaster. Yet, relief is only temporary as the deal only has a two-year time window. The debt ceiling will be back on the agenda soon enough, and that remains a worry for the United States, its neighbours, and the world economy. The debt ceiling will remain a ticking time bomb until is is defused permanently. While today compromise is to be welcomed, compromise today is no guarantee that in the future brinkmanship will push the United States over the edge of the cliff. Better, then, to fix the problem of the debt trap once and for all.

- Alan Rappeport: Everything You Need to Know About the Debt Ceiling, May 2, 2023.

- Neil H. Buchanan and Michael C. Dorf: How to Choose the Least Unconstitutional Option: Lessons for the President (and Others) from the Debt Ceiling Standoff, 2012. Cornell Law Faculty Publications. Paper 591.

- Wendy Edelberg and Louise Sheiner: How worried should we be if the debt ceiling isn't lifted?, Brookings Institutin, April 24, 2023.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)