Russia's invasion of Ukraine that started in February 2022 is now in its 68th week. Ukraine is fighting to liberate its lands from Russia's illegal occupation. Meanwhile, the list of war crimes committed by Russia is getting longer and longer. Russia's illegal war, and the atrocities committed against Ukrainians by Russia's military and mercenaries, fully justify the continued application of severe trade sanctions against Russia. It is necessary to deprive Russia of the means to continue its war effort in any way the civilized world can accomplish. On the financial side, depriving Russia of oil and gas revenue is paramount. Sanctions that were imposed against Russia's crude oil exports, its major source of export revenue, are showing some results, but with some indication that sanctions are being increasingly circumvented. Export revenues are the product of quantity and price, and thus we need to look at both to determine the effect of sanctions.

First, the bad news. Over the last year, Russia's total volume of oil exports seems to have barely buckled despite the sanctions. The International Energy Agency reports that the volume of Russian total oil exports between January 2022 and Januarty 2023 has remained virtually unchanged at 8 million barrels per day (mb/d). Nearly half of that went to Europe in early 2022, and this volume had dropped to 1.3 mb/d by early 2023. India, China, and Turkey have all increased their imports of Russian oil: India from 0.1 to 1.6 mb/d, China from 1.7 to 2.3 mb/d, and Turkey from 0.2 to 0.5 mb/d. These three countries are profiting from Ukraine's misery. Over the last year, sanctions seem to have merely reshuffled Russia's exports: from countries opposed to Russia's war to countries that are indifferent or apathetic about it. Motives range from opportunistic profiteering (Turkey), to worries about energy affordability (India), and to tepid support of Russia (China).

Before the war, Russia's oil production averaged about 11 mb/d; since 2011 it varied between 10.5 and 11.6 mb/d, and ended in 10.9 mb/d in 2021, according to the BP Statistical Review of World Energy. With 8 mb/d at the beginning of 2023, that is roughly a quarter less. Sanctions are having an effect, but not as strongly as needed to deprive Russia's war machine of foreign cash. Even at 8 mb/d and about 50 USD/bbl, Russia has gross oil revenues of about 150 billion USD per year.

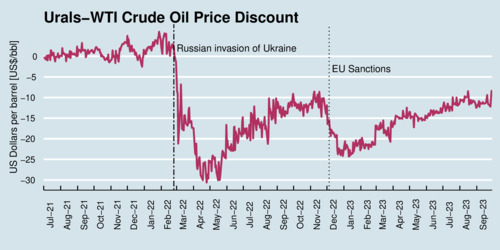

Second, the better news. Crude oil prices have fallen to pre-war levels of around 70 USD/bbl, down from peak prices that reached 120 USD/bbl. Prices for the crude oil that Russia sells, known as the Urals Blend, have consistently traded at a discount, as is shown in the chart below. Urals blends light oil from Western Siberia with heavy sour oil that originates in the Volga and Urals regions of Russia. It is generally regarded as the key benchmark price for Russian oil, and before the war traded at a slight premium to Brent and West Texas Intermediate. Russia also sends other grades of crude in the Far East and the Arctic, known as Sokol, Arco, Novy Port and ESPO blends.

click on image for high-resolution PDF version

The second chart takes a closer look at the size of the Urals Blend discount. Right after the invasion that started on February 24, 2022, Urals traded at a 20 USD/bbl discount that fell to 30 USD/bbl by May 2022. The discount then started to recover to just over 10 USD/bbl as oil sanctions (other than natural gas sanctions) took longer to put into effect. With new EU sanctions coming into effect in December 2022 and taking fuller effect in February 2023, the discount widened again to about 25 USD/bbl. Since April 2023 it has hovered at around 15 USD/bbl, but shows signs of further weakening. A discount of 15 USD/bbl deprives Russia of about 44 billion US dollars of oil revenue. Roughly put, Russia gets paid only about three-quarters than international oil prices.

click on image for high-resolution PDF version

‘The civilized world must redouble its efforts to further degrade Russia's oil revenue and hamper continuation of its neoimperialist war against Ukraine.’

Third, the bad news. Considering quantity and price effects together, the drop in production combined with the drop in prices has shrunk Russia's oil revenue significantly, from about 275 billion US Dollars to about 150 billion US Dollars, according to my estimates. That's about 50-60% of the pre-war level. The bad news is that this is not nearly enough to seriously degrade Russia's imports of goods in support of its war efforts. The civilized world must redouble its efforts to further degrade Russia's oil revenue and curtail Russia's ability to continue its brazen neoimperialist war against Ukraine. By flouting international law, Putin's Russia has become a pariah state. The numerous atrocities committed by Russian soldiers or mercenaries against Ukrainians, and other war crimes that have targeted civilian infrastructure (such as electricity grids, and likely including the destruction of the Nova Kakhovka dam), justify taking further actions to isolate, retard, and punish the Putin regime in Moscow.

It has been widely reported that Russia is relying on subterfuge to avoid Western oil sanctions. Russia's ghost fleet of oil tankers are also posing an environmental hazard to the world's oceans. Russia employs a flotilla of old ships, some of them rented cheaply from third countries, that do not meet global standards for safety or avoid safety inspections and insurance. This includes ships such as the Turba, registered in Cameroon or the Cathay Phoenix registered in Liberia. Some of these ships turn off their transponders that broadcast their GPS positions, and others broadcast signals with fake locations. Russia relies heavily on these types of deception. The European Union is working on penalizing such ships. Their 11th package of EU sanctions is focusing on circumvention.

Not all Russian oil is transported by sea. Some is flowing across the Eastern Siberia-Pacific Ocean pipeline known as ESPO, owned by Russian company Transneft, whose two pipes (ESPO 1 and ESPO 2) together can carry up to about 2.5 mb/d—roughly a quarter of Russia's oil production if it was fully utilized. Financially, ESPO 1 and 2 are of much greater significance to Russia than the Nordstream 1 and 2 natural gas pipelines (which were sabotaged in September 2022) ever were.

Closing the loopholes will take some effort. Third countries such as India cannot become a backdoor for Russian oil. Russian oil refined in India has reportedly reached European markets. Several European countries, as well as Canada, are seeking closer international trade ties with India. These would be very worthwhile. However, India's casual attitude about Russian oil has already gate-crashed a recent EU-India summit. India's growing economy needs more energy, but this should not come at the cost of greater energy dependence, particularly dependence on Russia. European Union countries learned a hard lesson in that regard, with too much dependence on Russian natural gas. Hopefully, India will avoid falling into the same trap.

One thing is clear: Russia's heinous war against Ukraine has reshuffled global energy markets along with geopolitics. In the wake of global events, I have previously argued for careful reglobalization. In the context of energy markets this means improving energy independence, greater reliance on trusted neighbours and allies, and otherwise strive for greater diversification and risk dilution. Some call it de-risking, but as the effect is on trade routes, the word reglobalization is perhaps a more apt paradigm: gain most of the benefits from liberalized trade without compromising security.

- U.S. Department of the Treasury: The Price Cap on Russian Oil: A Progress Report, May 18, 2023.

- Why the West's oil sanctions on Russia are proving to be underwhelming, The Economist, February 1, 2023.

- How Russia dodges oil sanctions on an industrial scale, The Economist, January 29, 2023.

- Christiaan Triebert, Blacki Migliozzi, Alexander Cardia, Muyi Xiao and David Botti: Fake Signals and American Insurance: How a Dark Fleet Moves Russian Oil, The New York Times, May 30, 2023.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)