Lithium-ion batteries have been at the forefront of battery technology for the last decades and can be found in smartphones, electric vehicles (EVs), and many other applications. Their success lies in their relatively high energy density (measured by volume or weight) compared to other types of batteries. But lithium-ion batteries come with a notable problem: their ingredients are scarce, and as demand for EV batteries starts to soar, their prices may go up despite significant innovation. Enter a new competitor: the sodium-ion battery.

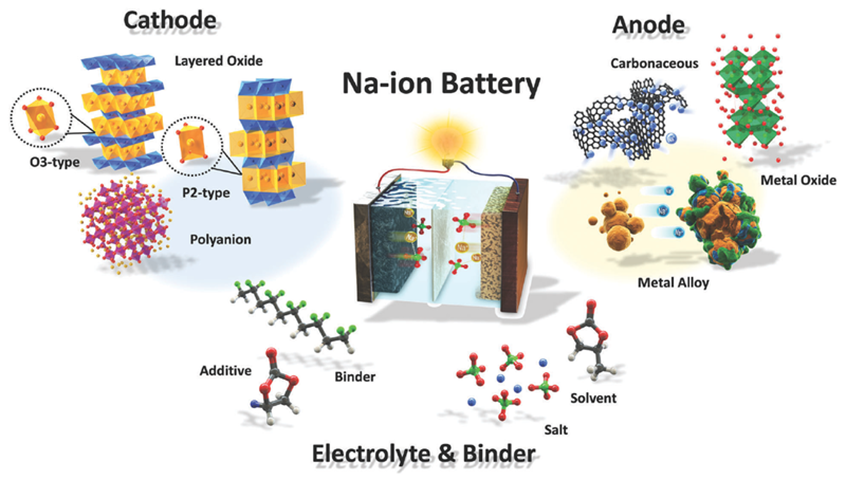

Sodium-ion batteries work quite similar to lithium-ion batteries, but their lesser performance compared to lithium-ion batteries made them commercially unattractive. This may start to change. Sodium is highly abundant and thus cheaper, compared to lithium. The materials required for the anode and cathode of a sodium-ion battery all appear to be significantly cheaper than for lithium-ion. Will cost advantages give this technology a new market?

Image credit: Jang-Yeon Hwang, Seung-Taek Myung, Yang-Kook Sun (CC BY 3.0)

Recent technological advances by a team of researchers lead by Jiguang Zhang at the US Department of Energy's Pacific Northwest National Laboratory seem to provide a new way to deal with an inherent problem with sodium-ion batteries. The solid-electrolyte interphase that forms during repeated cycling of sodium-ion batteries is notoriously unstable, which ultimately leads to continuous side reactions, electrolyte depletion and irreversible capacity loss. Sodium-ion batteries are less stable than lithium-ion batteries. New electrolyte chemistry promise much better capacity retention.

‘Cost advantages of sodium-ion batteries could make them very suitable for grid-scale electricity storage despite their lesser power density relative to lithium-ion systems.’

Batteries are needed for two different types of applications: mobile and stationary. For electric vehicles power density matters, as extra weight reduces efficiency. But power density does not matter as much for stationary applications such as Battery Energy Storage Systems (BESS) that are used to store electricity for commercial applications, including grid-scale electricity storage. Eventually, sodium-ion batteries may also find use in some mobile applications. But if space and weight do not pose significant constraints, which is the case for stationary applications, sodium-ion batteries may succeed because of their potential cost advantage.

If sodium-ion batteries take off on a large scale, they could lessen the expanding demand on critical minerals. The International Energy Agency estimated that a concerted effort to reach the goals of the Paris Agreement would entail a quadrupling of mineral requirements for clean energy technologies by 2040. To reach a net-zero target globally by 2050, six time more mineral inputs would be needed by 2040. Considering the enormous scale of the increase in mineral supplies (for lithium specifically an increase 42 times the level in 2020, graphite 25 times, cobalt 21 times, and nickel 19 times), alternative chemistry such as sodium-ion could become a game changer to keep the energy transition environmentally sustainable. Already, lithium-ion batteries based on lithium-ferrophosphate (LFP) chemistry offer cost advantages and environmental advantages of the more common nickel-manganese-cobalt (NMC) chemistry despite slightly lower energy density. The energy density of sodium-ion batteries today is roughly at the level that lithium-ion batteries were a decade ago, somewhere in the range of 110-140 Watthours per kilogram (Wh/kg). Today's lithium-ion NMC batteries have reached well over 200 Wh/kg, while lithium-ion LFP batteries have reached around 160 Wh/kg. Bloomberg New Energy Finance (BNEF) has projections that sodium-ion batteries may reach 150 Wh/kg by 2024.

Even if sodium-ion does not attain greater energy density, any significant cost advantage could help enable grid-scale energy storage of electricity. This is what could help propel the adoption of renewable energy from intermittent sources (solar & wind power). While the market for sodium-ion batteries remains at an early stage today, the rapid growth of lithium-ion technology has made it easier for sodium-ion technology to take root because manufacturing platforms are similar. Today's cost of sodium-ion batteries is thought to be around $87/kWh. If sodium-ion battery storage can be pushed down towards $50/kWh, less than half of the cost of lithium-ion systems, the cost advantage will see the technology take off fast, first and foremost for stationary applications.

There are first signs of a scaling-up of sodium-ion battery production. China's state-owned Three Gorges Corporation started a GWh-scale production line in Fuyang, in Anhui province, in late 2022. Batteries manufactured there are reported to have a 145 Wh/kg density and can be cycled 4,500 times. Contemporary Amperex Technologies (CATL), one of the world's battery producer giants based in China, unveiled a sodium-ion system in 2021 that claimed 160 Wh/kg.

Of course, there are some caveats. One is the infrastructure for recycling. High-value materials contained in lithium-ion NMC batteries could make recycling more attractive economically, while lower-value materials contained in sodium-ion batteries may impede recycling. But this may be an economically worth-while trade-off. Sodium, after all, is super-abundant.

One conclusion is certain: we can expect rapid innovation in the field of batteries, whether it is from sodium-ion technology or new lithium-based solid state battery technology, or new technologies still in the laboratory stage.

Sources and References:

- Casey Crownhart: How sodium could change the game for batteries. Cheaper batteries might be on the horizon., MIT Technology Review, 11 May 2023.

- The Role of Critical Minerals in Clean Energy Transitions, International Energy Agency, May 2021.

- Wesley Cole, A. Will Frazier, and Chad Augustine: Cost Projections for Utility-Scale Battery Storage: 2021 Update, National Renewable Energy Laboratory, Technical Report NREL/TP-6A20-79236, June 2021.

- Yan Jin, Gao, Xu, et al.: Low-solvation electrolytes for high-voltage sodium-ion batteries, Nature Energy 7, 718-725, 2022.

- Daniel Muteti: Carmakers race to develop solid-state batteries for EVs, DW, 15 August 2023.

- Esteban Pardo: What you need to know about solid-state batteries, DW, 9 September 2023.

- Jang-Yeon Hwang, Seung-Taek Myung, and Yang-Kook Sun: Sodium-ion batteries: present and future, Chemical Society Reviews 12, March 2017.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)