Numerous governments around the world have adopted targets to phase out motor vehicle sales with internal combustion engines (ICE). Canada's policy introduced mandatory sales targets for new light-duty vehicles. The minimum share of zero-emission vehicles (ZEVs) is 20 percent starting in 2026, rising annually to a least 60 percent by 2030 and 100 percent by 2035.

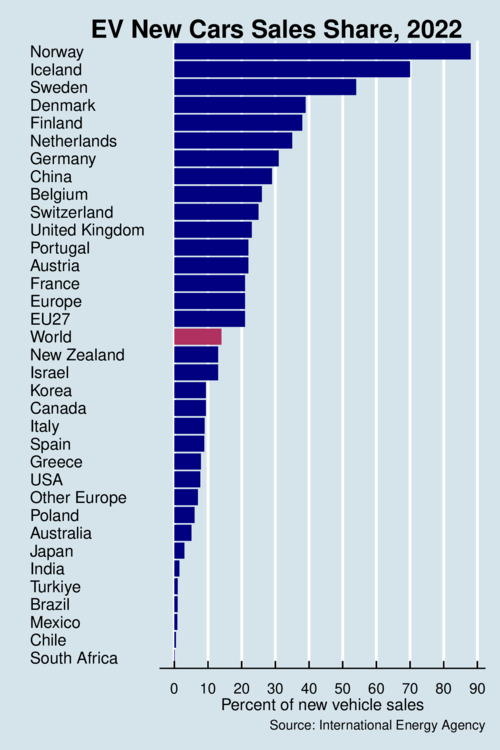

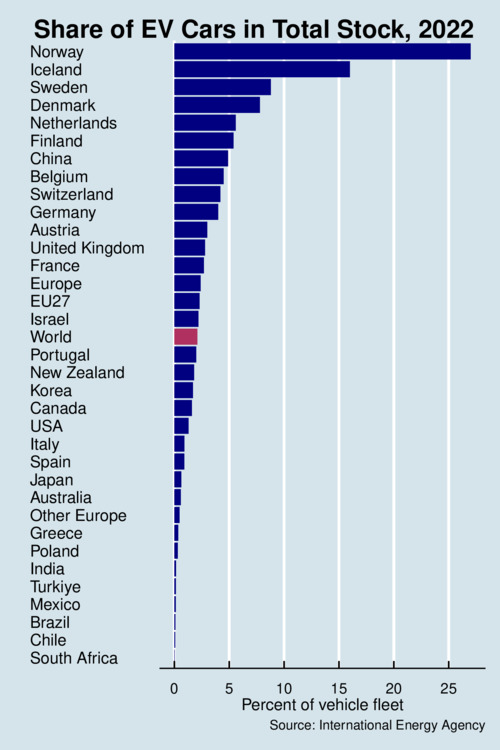

So what is the state of EV deployment around the world? The International Energy Agency reports statistics by country in its Global EV Outlook 2023. I have distilled the data into two diagram that rank EV adoption by sales share and stock share in descending order.

click on image for high-resolution PDF version

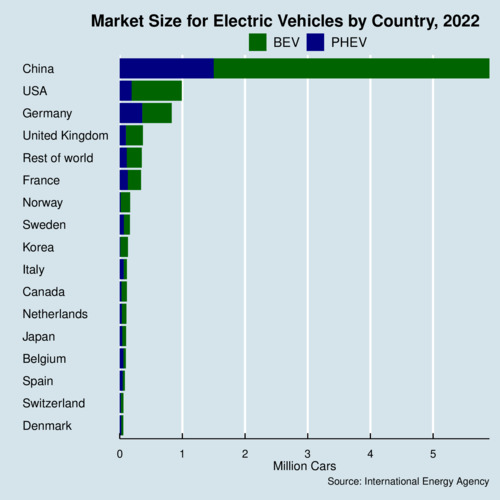

Worldwide, in 2022 every seventh car that was sold was electric. China is by far the largest market in volume, and this means about half of the total stock of EVs is in China. However, other countries have higher adoption rates. The leaders are the Nordic countries: Norway, Iceland, Sweden, Denmark, and Finland, followed by the Netherlands and Germany. Canada and the United States are laggards with adoption rates below 10%. In Norway, the adoption rate is approaching 90% already, and every fourth car in the overall fleet there is electric. In Canada, the EV share in new car sales was 9.4%, and the stock share 1.6%.

click on image for high-resolution PDF version

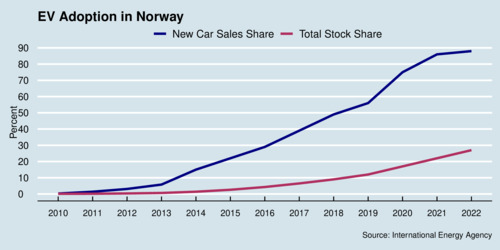

Norway is the world leader in EV adoption. The diagram below shows the path of their EV adoption in terms of new sales share and total stock share. Norway has transitioned almost completely to new EVs within a dozen years. It will take another decade for the stock share to catch up as the vehicle fleet turns over slowly.

click on image for high-resolution PDF version

‘Norway's rapid adoption of EVs is spurred by subsidies and pervasive charging infrastructure.’

How has Norway accomplished this remarkable feat? Simply put: through large incentives. ZEVs are exempted from the registration tax, the value added tax, motor fuel taxes, and also receive a reduction in half for road taxes, ferry fares, and parking fees. As EV adoption has been skyrocketing, Norway's government is looking to find ways to wean off its citizens from these incentives. The Norwegian incentive programs on toll roads and ferries have already been phased out, while VAT exaemptions continue only non-luxury vehicles (below $62,500). Norway was also early to introduce a right to charge similar to what BC just adopted earlier this year (see my blog BC has made it easier for stratas to install EV chargers). Norway also invested heavily in public charging stations. Today, Norway has one of the densest charging station networks with over 7,000 public fast chargers and over 15,000 standar chargers. Norway shows that rapid EV adoption is possible. While Norway, as one of the most affluent countries in the world, could afford to expedite EV adoption, what will be necessary elsewhere is a reduction in the cost of batteries that have kept the upfront purchase price relatively high. As battery production ramps up worldwide and car manufacturers are investing heavily in developing new and better EVs, we can expect prices to come down.

How is British Columbia managing the transition to EVs?

British Columbia is a step ahead of Canada's federal government with respect to the transition to electric vehicles. Already in May 2019 the Government of British Columbia adopted the Zero-Emission Vehicles Act with an accompanying ZEV Regulation. BC's 2019 law requires 100% ZEVs by 2040 and recognizes three types of ZEVs, mostly defined by battery range. A battery-electric vehicle (BEV) in class A must have a minimum range of 80.47 kilometers (50 miles), and a plug-in hybrid-electric vehicle (PHEV) in class must have a minimum range of 16 km. Car manufacturers must earn credits for each sale of an EV, which are converted into a compliance ratio that manufacturers must meet and increases each year. A ZEV credit for class A is the EPA range [in kilometers] times 0.006214, plus 0.5, and a maximum of 4. For example, a BEV with a range of 250 kilometers earns 2.0535 credits. A ZEV credit for class B is the EPA range times 0.006214 plus 0.3, with a maximum of 1.1 (or 1.3 if the vehicle meets the strict US06 test procedure for low emissions). For example, a PHEV with a range of 50 kilometers earns 0.6107 credits. Suppliers must earn ZEV-A and ZEV-B credits (positive ZEV units) for a model year that are equal to or greater than the ZEV units that will be deducted, which is the product of the compliance ratio times the total new vehicles (ZEV+ICE) sold. Suppliers that are in non-compliance must pay a penalty rate (currently set at $5,000) times the deficit of ZEV credits. Note that compliance ratios will eventually exceed 100% because ZEVs can earn more than one credit.

BC's ZEV Act and Regulation have a few more subtle twists. Suppliers that are in overcompliance (have earned more credits than needed for compliance) can bank their credits (indefinitely) and apply them towards any future undercompliance. They can also transfer their credits to another supplier, which means in practice that they can sell them for a price less than the penalty for non-compliance. There are some further twists. The Class-A and Class-B credit system only applies to large volume suppliers (more than 5,000 car sales per year), while medium volume suppliers (between 1000-4999 car sales per year) can use a combination of both classes. Essentially, the BC ZEV Act allows a trading system to develop that allows overcompliant firms to sell credits to undercompliant firms, ensuring that the overall target is met.

Eventually, we can expect that this ZEV credit system will replace the current BC passenger vehicle rebates for individuals that offer up to $4,000 for BEVs and long-range PHEVs. As EV purchases are increasing, the subsidies will no longer remain fiscally sustainable.

‘BC's revised ZEV mandate will put a $20,000 penalty on excess ICE vehicles.’

BC's ZEV Act and Regulation is currently being reviewed and a recent policy review document recommends changing the credit penalty from $5,000 to $20,000 while shifting to a simpler one-credit-per-BEV system. The existing credit system (and compliance ratios) would be converted 1:4 for class-A and 1:1.3 for class B. This proposed shift would align BC's system with California's and Quebec's credit system after 2025, and would also align with the proposed federal system. The revised system would also move up the 100% compliance target from 2040 to 2035.

One of the (perhaps unintended) consequences of these active ZEV policies in BC and Quebec is that car makers have been prioritizing selling ZEVs in these two provinces, where uptake is notably higher than in other provinces. The new federal mandate may change this, as it would equalize the ZEV policy across the country.

Critics of ZEV mandates point to the possibility that the new rules enforce a ZEV:ICE sales ratio, which in turn could lead to fewer car sales overall if ZEVs remain more expensive to buy than ICE vehicles. Car makers are obviously rather concerned about this. And fewer new (cleaner) cars may meen more older (dirtier) used cars on the road. But this worry would be misplaced if ZEVs become cheaper than ICEs.

The life-cycle cost of ZEVs is becoming increasingly more competitive compared to ICEs, and in many instances electric vehicles are already approaching price parity. However, many buyers may remain put off by higher upfront sticker prices even though they will benefit from lower operating costs for owning a ZEV. A recent article in the New York Times pointed to vehicles approaching price parity in the United States once subsidies were taken into account, along with falling prices for batteries. But keep in mind that life-cycle cost parity arrives much earlier than price parity because in most jurisdictions electricity is much cheaper than gasoline per kilometre driven.

What are the economic implications of the ZEV policies?

Canada's and BC's ZEV policies can achieve a transition to electric mobility; the stiff penalty on selling ICE vehicles will make sure of this, and Norway shows that a rapid transition is indeed feasible—at some cost. ZEV policies are, however, not what environmental economists consider a first-best policy for climate change. The main first-best instrument is the price on carbon emissions at a level that matches the social cost of carbon (SCC). ZEV policies are a second-best instrument and can only be justified when the current carbon price is well below the SCC. This said, even a $250/tonne carbon price would only amount to an increase in the price of gasoline of 55.5 cents per litre. While this gives a large incentive to switch to driving with electricity, there may be other market imperfections that prevent a rapid transition to EVs. Foremost among them are obstacles to EV charging, and the related range anxiety of motorists. These remain important hurdles that need to be addressed perhaps more urgently than boosting EV sales. To boost demand for EVs, boost EV charging infrastructure first.

click on image for high-resolution PDF version

Canada's and BC's ZEV policies will also affect car manufacturing in North America and beyond. Who will satisfy the prescribed increase in supply for ZEVs? Domestic car manufacturers are lagging behind in terms of innovation, model varieties, and cost. Foreign producers such as China's BYD, now the world's largest manufacturer of EVs (BEVs and PHEVs combined), are eager to enter North American and European markets. China is also the largest EV market by sales volume (see chart above). The threat to established car makers is significant. The European Commission launched an investigation on alleged subsidies for electric cars in China, as the share of Chinese EVs sold in Europe rose to 8% and could reach 15% in 2025. Prices for Chinese-made EVs are typically 20% below those of European competitors. China is now the largest market for EVs, and this size advantage promotes rapid learning-by-doing and economies of scale in production. The United States places steep import tariff on Chinese cars. The Biden Administration continued the previous administration's 25% extra tariff on top of the regular 2.5% umport tariff. However, it is possible that Chinese manufacturers may set up assembly plants in Mexico and enter the CUSMA market through there.

‘Car makers in North America and Europe face an existential threat in the transition to electric mobility.’

Well-intentioned policies—with the ZEV policy among them—can sometimes have unintended consequences. The electrification of mobility is transformative for the auto industry. It could also reshuffle the auto industry in terms of brand preferences and comparative advantages across countries, with a significant risk to Canada remaining a viable production location for car manufacturers. Norway does not have that problem: the country does not have a significant auto industry. Established car makers in North America (and Europe) will either learn to catch up quickly or face the risk of their demise. But the great electrric car race is just beginning.

Looking to dive deeper into the topic?

For a more detailed analysis of the uptake of EV vehicles around the world and the possible paths for further EV adoption, read Joel Jaeger's informative article at the World Resources Institute.

Further readings and sources:

- International Energy Agency: Global EV Outlook 2023, 2023.

- OECD: Norway's evolving incentives for zero-emission vehicles, 7 November 2022.

- Joel Jaeger: These Countries Are Adopting Electric Vehicles the Fastest, World Resources Institute, 14 September 2023.

- Márton Békés et al.: What Norway's experience reveals about the EV charging market, McKinsey, 8 May 2023.

- Government of BC: B.C. Zero-Emission Vehicles Act & Regulation Guidance Document, 1 June 2021.

- David Adams: Sand in the gears: How government plans risk making EVs less appealing, The Globe and Mail, October 13, 2022.

- Jason Tchir: Do more EVs go to Quebec and B.C. than other provinces?, The Globe And Mail, 1 January 2023.

- Jack Ewing: Electric Vehicles Could Match Gasoline Cars on Price This Year, The New York Times, 10 February 2023.

- Jack Ewing: In Norway, the Electric Vehicle Future Has Already Arrived, The New York Times, 8 May 2023.

- Charles Riley: The great electric car race is just beginning, CNN Business, August 2019.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)