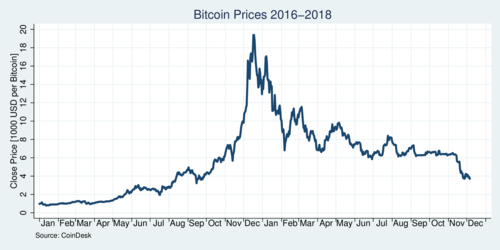

Roughly a year ago I wrote that the bitcoin bubble will burst, and that was an easy prediction to come true only a month later. Bitcoin prices have dropped off their lofty heights and continue to drop (see chart below). But while bitcoins provide little commercial value, they have become a great concern for the environment. Bitcoin mining and transaction verification (through a "proof of work" calculation) require ever more electricity.

click on image for high-resolution PDF version

A web site that has tracked the energy consumption of bitcoins, Digiconomist.net, has estimated that bitcoin calculations requires more than 60 Terawatthours (TWh) of electricity per year. That almost matches the total electricity consumption of British Columbia (which uses about 75 TWh). Because of the profuse amount of electricity that is needed to power bitcoin operations, the bitcoin servers are increasingly searching for cheap sources of electricity, whether in low-cost Iceland or low-cost hydropower jurisdictions such as Quebec, Manitoba, or British Columbia. While hydropower is relatively clean, much of the bitcoin mining takes place in jurisdictions where electricity is far from clean. Making bitcoins gets more and more expensive over time, and this provides an upper limit on the electricity use of bitcoin mining.

What makes bitcoins so energy hungry other than creating bitcoins? Each transaction needs to be verified, and that can take several hours as the block chain gets longer and longer over time. A report by de Vries (2018) has tried to estimate the cost of these transactions, which comes to about 215 kWh per transaction. If you apply a cost of 10 cents per kWh, each transaction costs over $21. One of the claims of bitcoin operators is that digital currencies would make transactions easier and cheaper. That can't be true if processing and verifying a transaction takes hours and costs more than $20. All that electricity isn't just using clean electricity. If we use an average GHG intensity of 158 tonnes of carbon dioxide per GWh for Canada or 488 t/GWh for the United States, then 60 TWh amount to about 10-29 Megatonnes of extra CO2.

‘Cryptocurrency mining creates few jobs and little benefit to the economy overall.’

Cryptocurrency mining is an economically unproductive activity; it creates virtually no new jobs and precious little "value added" in our economy. It creates no real goods and services, and even the promise of cheaper or quicker financial transactions is a fantasy. Bitcoins only exist to enrich the bitcoin miners—and help criminals launder money or facilitate scams and cryptographic ransom attacks. Quite frankly, it appears that bitcoins and similar digital currencies have a net negative welfare effect in our economy. A study by Chiu and Koeppl (2017) finds that Bitcoins are "not only extremely expensive in terms of its mining costs, but also inefficient in its long-run design."

Canadian utilities receive an increasing number of requests for power from bitcoin operations. The magnitude of these requests is staggering. However, our publicly-owned utilities should not engage in any sort of subsidization of such operations. In British Columbia, BC Hydro is moving towards offering a "load attraction rate" to new businesses that would offer a 20% discount on electricity rates for the first three years. That could become a costly error, as bitcoin operations are footloose: they could easily pack up their servers and move to a warehouse somewhere else. Considering that bitcoin operations do not contribute nearly nothing to value creation in British Columbia, a subsidy is simply money in the pocket for the operators. There are more worthwhile causes in British Columbia for expanding electricity use as the provincial government is aiming to expand electric mobility and to electrify the oil and gas mining industry. Hydro Quebec realized the error of rolling out the welcome mat for bitcoin miners; the provincial utility moved to raise the cost of electricity to 15 cents per kWh for new digital currency operators. BC Hydro should take notice.

As Canadian provinces will need more electricity to meet the demand of a growing population that will also transition increasingly from fossil fuels to clean (hydro and wind) electricity, there is really no compelling public reason to facilitate expanding bitcoin mining anywhere in Canada. There is no compelling economic rationale why public utilities should subsidize cryptocurrency firms.

Further readings and sources:

- Alex de Vries: Bitcoin's Growing Energy Problem, Joule 2(5), 16 May 2018, pp. 801-805.

- Timoth B. Lee: New study quantifies bitcoin's ludicrous energy consumption Bitcoin could consume 7.7 gigawatts by the end of 2018, ArsTechnica, May 17, 2018

- Bethany Lindsay: BC Hydro puts out welcome mat for bitcoin miners, but experts urge caution, CBC News, 3 December 2018.

- Jonathan Chiu and Thorsten V. Koeppl: The Economics of Cryptocurrencies – Bitcoin and Beyond, Queen's University Working Paper, April 2017.

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)