Something peculiar happened during 2023: British Columbia has set a new record for electricity imports. Usually the province, having an abundance of hydroelectricity, has been a net exporter, but this year conditions worsened to the point that the province had to import one-sixth of its electricity from its neighbours. BC's electric load typically varies between about 5 and 12 Gigawatts [GW]. BC is able to export and import roughly 4 GW under ideal conditions, roughly half of its average load across the year. What is driving this change, and do we need to worry about it?

Let us start with a look at the transmission capacity. British Columbia can trade electricity with its neighbours in Oregon and in Alberta. BC Hydro (BCH) maintains several interties (transmission lines) with Oregon's Bonneville Power Administration (BPA): two 500 kV lines in the Lower Mainland, and two 230 kV lines in the Boundary region. The line ratings also depend on operational conditions. Generally, the available transfer capability (ATC) of a powerline is determined by subtracting a transmission reliability margin (TRM) from the total transfer capability (TTC). ATC can vary during the course of the day. According to the posted technical data for path ratings, for exports (north to south) the maximum capacity is rated 3,150 MW on all lines combined, and for imports (south to north) the maximum capacity is 2,000 MW combined. Availability of these capacities is lower during heavier load conditions. BCH also has two interties with Alberta: one 500 kV line from Cranbrook to Langdon and two 138 kV lines from Natal to Altalink lines in Alberta. The approved rating for this link is 1,200 MW for exports to Alberta and 1,000 MW for imports from Alberta. However, operational limitations reduce the usage of these lines.

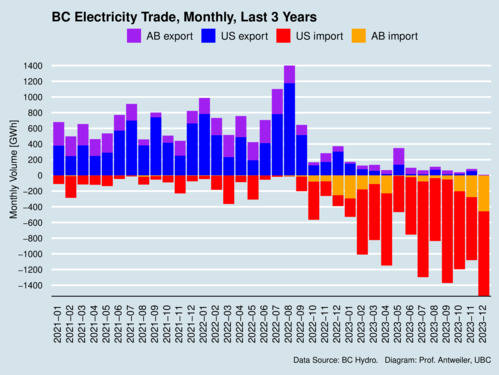

The first chart below shows the exports to and imports from the United States and Alberta. In any given month, we usually observe both imports and exports as the direction of trade changes with load conditions in BC and its neighbours. Since October 2022 there has been a notable reversal of the overall direction. BC has quickly become a net importer, with a peak reached in December 2023 with 1,452 Gigawatthours [GWh] of net electricity purchases. December also experienced the largest monthly import of electricity from Alberta yet: 457 GWh.

click on image for high-resolution PDF version

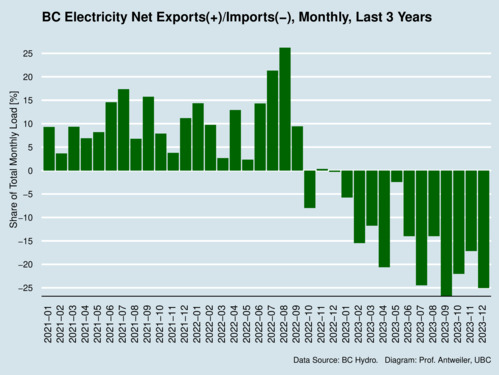

The next chart summarizes exports and imports into net exports (positive) or net imports (negative), and expresses these net exports and imports as a percentage of the load provided in the province. September and December 2023 marked the peaks with just over a quarter of BC's electricity arriving from the United States and Alberta.

click on image for high-resolution PDF version

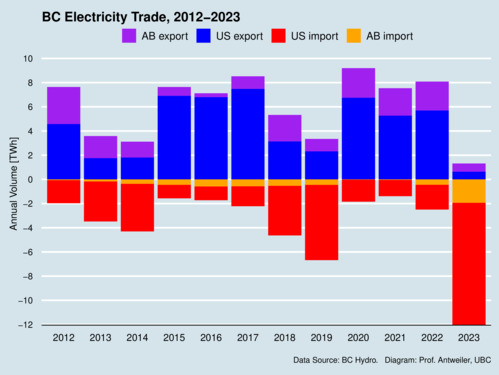

Exactly how unusual 2023 has been can be seen by looking at the next two charts, which show the annual exports and imports of electricity. The first chart breaks down trade by origin and destination and shows annual trade in Terawatthours [TWh]. My blog BC's electricity load reached a new peak during 2022 provides some reference values for the overall electricity load. Annual output is around 65 TWh.

click on image for high-resolution PDF version

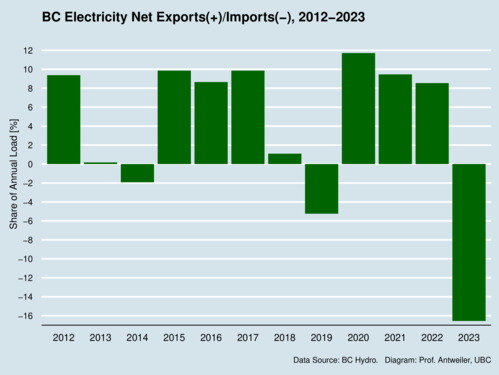

It is again useful to express net exports as a percentage of total load to gauge the magnitude of trade. During 2023 BC had net imports of 16.6% of its total load—a number far higher than the previous eleven years for which I have data.

click on image for high-resolution PDF version

So what is causing all this, and do we need to worry? Essentially, BC's reservoirs are running low on water. While BC received a near-normal amount of snow pack last winter, it seems to have melted faster than usual and this in turn has failed to refill reservoirs. BC's River Forecast Centre wrote in its snow survey and water supply bulletin for June of this year that we have had "exceptionally rapid and early snow melt, particularly for higher elevations, due to extreme spring heat." The situation could worsen as we are entering into a new El Niño cycle—the warm phase of the El Niño/Southern Oscillation (ENSO). Some relief will for BC Hydro will come from the planned filling of the new Site-C Dam reservoir in 2024, with the dams' turbines coming online in 2025. Chances are that BC is looking at another year of electricity net imports rather than earning revenue through net exports.

The effects of these imports can be glanced from BC Hydro's latest quarterly (September 30) financial statement. For the six months ending September 30 (the first half of the fiscal year 2023/24), trade revenues were $381mio, down from $1,991mio the previous year; a 81% decrease. The good news is that even after taking into account trade energy costs and netting out the entire trade operation, the balance is still positive. Note that certain trade energy costs are reclassified to trade revenue and netted against revenues, and this makes reading the numbers a little bit more challenging. This said, the fiscal year is still incomplete and some of the purchases may well turn the balance negative by the end of the fiscal year.

The financial effects of drought conditions will likely remain transitory; BC Hydro's balance sheet is not in any immanent jeopardy. However, climate change seems to have a growing impact on the ability of reservoirs to be refilled from melting snow pack. Hydrologists have investigated what we can expect. A BC Hydro report from 2012 suggested that while climate change may increase overall rainfall, but that "it has not been determined how effectively reservoir storage will be able to buffer projected changes in seasonal runoff timing, such as lower summer inflows." More research is needed as critical uncertainties remain.

What would happen if climate conditions worsen to the extent that it reduces availability of hydro power? First, with Site-C dam coming online in 2025, there is no prospect of critical conditions for the next number of years. But as electricity demand increases gradually due to the electrification of mobility, BC Hydro may need new generation resources sooner than it had envisioned in its 2021 Integrated Resource Plan. In its 2023 update, BC Hydro suggested that it is planning to "acquire new energy resources starting with 810 GWh in fiscal 2031, then shifting to primarily capacity resources starting with 160 MW in fiscal 2038." This seems like a prudent course of action, and as circumstances change, there is still plenty of potential for new clean electricity generation in BC: in addition to hydro, the province also has significant potential for more wind farms (onshore and possibly offshore) as well as geothermal energy, some small-scale run-of-river projects, and even a bit of solar power.

On January 17, 2024, BC Hydro and the province of BC announced new capital spending to address the growing power needs. In addition to completing Site C, BC Hydro announced that it will launch a "call for power" this spring—the first such call in over 15 years—and will ask for 3,000 GWh of clean electricity bids. This will be the first in a series. Expect more wind, water, and solar capacity to start appearing in British Columbia.

Sources and further readings:

- Justine Hunter: Drought conditions force BC Hydro to rely on power purchases, The Globe and Mail, 18 December 2023.

- BC Hydro: Historical Flow Data.

- Bonneville Power Administration: Flow Data History.

- Georg Jost and Frank Weber: Potential impacts of climage change on BC Hydro's water resources, BC Hydro, 2013.

- Justine Hunter: After year of record-breaking imports, BC Hydro rolls out new spending plan, The Globe And Mail, January 17, 2024.

- BC Hydro: Power Pathway: Building B.C.'s energy future, January 2024.

Updated on Wednesday, January 10, 2024

![[Sauder School of Business]](logo-ubc-sauder-2016.png)

![[The University of British Columbia]](logo-ubc-2016.png)